Adopting a sin as an acceptable, taxable business is slow going. From the moment our government overlords decide to un-ban a thing, it takes often years, even decades, to move through the many stages of evolution before it can become fully embraced by society.

Take booze as an example. In the 1930’s, coming out of prohibition, you couldn’t pour liquor in a bar in Vancouver unless you also had ‘entertainment’ on the premises. Quickly, bar owners figured out ‘entertainment’ wasn’t defined in the law, so they put pig pens in their establishments and would advertise to drinkers to ‘come see the pig.’

It took a long time to get private liquor stores in Canada, longer still for booze permitted for sale on a Sunday, and outdoor patios, and longer again for late night closings, bring-your-own, craft breweries, and booze in cinemas. We still aren’t allowed to take wine across provincial lines and we’re still arguing, in Vancouver anyway, about whether drinking at the beach should be a thing, even as cannabis sales have emerged and taken the consenting adult market by storm.

Cannabis had its own slow going. Banned for decades, it was the rationale for millions unjustly imprisoned until a citizen went to court and suggested he should be able to get access to what he deemed medicine. From the moment the judge agreed, supposedly unlocking medical cannabis to thousands of Canadians, it still took several years for the government to find the keys, even as California and Colorado had shown it was a cash bonanza to do so.

During those years, every weed company, of which there were suddenly hundreds, repeated the same mantra – “We’re here for patients, not for people who want to get high,” because medical weed was legally defensible. A year or so later, it was a different story, and getting high was all of a sudden , even as restrictions on certain products still applied. Though the Canadian government has inserted itself into the distribution piece of the industry, that same government still wrings its hands for months before it allows any sort of new innovation or growth.

Psychedelics are going through that same process right now. Decriminalized in a lot of places, with hundreds of new players jumping in, the ‘we’re doing it for medical reasons’ drumbeat carries on as everyone waits for regulators to catch up to the public demand. Ketamine is medically legal, so they’ve all got a ketamine play, but eventually we’ll be drinking Golden Teacher milkshakes and buying Penis Envy chocolates from the government store. Just not yet.

In gambling, the transition from the underground, where betting could only happen on reserves or in Vegas, to something where consenting adults can roll the dice at home, however they want, wherever they want, has also taken decades. I grew up hearing about the ‘football pools results’ every weekend, where lotto numbers were picked based on which UK football games ended in draws. From those simpler times, we eventually moved to the Bodog years, where regulators chased early online poker companies to the islands. More recently, some US states opened up to single event sports gambling (IE: Oakland to beat the Angels), and more recently to in-game betting (IE: Oakland’s next hitter to strike out), and daily fantasy sports, which brought a multi-hundred million dollar war for market share between Draft Kings and Fan Duel.

Eventually, the people get what they want, how they want it, but not before the pearl clutchers yell at their representatives to stop it from happening because, think of the children or God or morals or.. something.

That’s where we’re at in North America right now and, by virtue of that, the world, with the outraged objectors looking finally beaten down and the markets opening up to what people want.

Online slots, sportsbooks, gaming, daily fantasy sports, poker, accumulators, let’s gooooo.

As we’ve seen in every other sin industry, when the door cracks open, it takes time to fully let us all in, but the stock market doesn’t wait. It blows up, raises millions on rumour, and begins financing the companies it deems to be the likely winners when the liberalization of laws finally happens.

The genie is out of the bottle. Now it’s a land grab for market share.

Some of the biggest stock runners of the past few months have been fighting for the same patch of ground, and they’re all finding fresh fuel from a host of different places.

- The rise of cryptocurrency makes it easier to move dollars across border

- The pandemic saw more people stuck at home looking for action online

- The rise of the millennial investor saw the sports betting crowd spilling into the markets, where they spent billions investing in things almost more for a laugh than a profit

- Governments have realized they make more taxable revenue when players can make micro-bets every few minutes, instead of a bet on eight games played next Saturday

Yes, you can wring your hands and say gambling is bad, and it is, but so is smoking, eating too much sugar, driving too fast, reading political conspiracy forums, swiping right on everyone, buying a motorcycle, wearing Crocs, tattooing your balls, buying terrible plant based food stocks, drinking Jagermeister, traveling to Florida, living in Abbotsford, voting Conservative, and reversing into parallel parking spots – yet we let people do those without punishment.

Online gaming and gambling is here, whether or not the government is fast or slow in permitting it, and whether the government tries to force people into doing the government approved version of it (Powerball and Keno) or we do it on some janky Putin-backed mega-casino-site run out of Novosibirsk that doesn’t honour withdrawal requests.

So if the door is now open, and it is – the Canadian government is at the second reading stage of allowing single event sports betting in the country – let’s call this the ‘medical gambling’ stage in the same way we started with medical weed – the work begins on doing due diligence on the gaming stocks available to us.

On the already inflated side of things, Draftkings (DRFT.Q), Penn National Gaming (PENN.Q) and Flutter Entertainment (PLYPF.OTC) (home of FanDuel, Betfair, PokerStars and more) have blasted off into the multi-billion dollar range long ago. Locally, TheScore (SCR.T) finally figured out a business model that people were interested in when it shifted into sports betting recently, after faffing about as a cable channel, then an app, for years.

But I’m a value investor. Not interested in billion dollar companies nearly as much as I am the little guys, where a small uptick can be a multiple return on my investment.

THE BIG OPPORTUNITIES IN LITTLE PLAYERS

We’ve talked a lot about FansUnite (FANS.C), which has had a mighty run lately on the back of a Scottish sportsbook acquisition, and a merger with Askott Entertainment that brings the ability to white label sports odds, e-sports betting, and online casino games. We like FANS a lot, they’re a client, and we hold the stock.

We’ve also talked about Luckbox AKA Real Luck Group (LUCK.V) which ran hard to $1.80 over a couple of days, until it popped out a $1.20 financing, which saw folks sell their stake down to $1.20 to buy into the raise and helped bring some stability to the company. Not a client, but we bought in at several financing rounds because we believe in the space.

Then there’s Interactive Games Technologies (BETS.C), which has been around for a bit but as been a little more under the radar than the other crews.

Until a month ago, when it ran from under $0.20 to over $0.80.

300% up in a month. Tell grampa to take his retirement money out of Bombardier already and get in on this gambling kick.

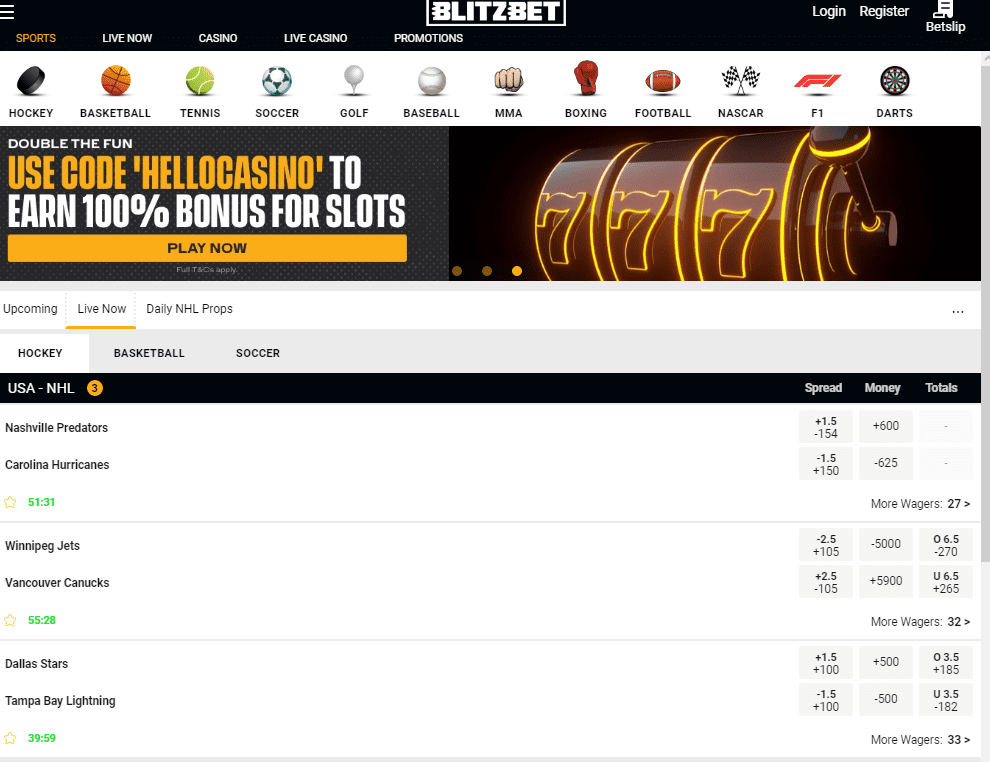

Mid-pandemic, BETS came out with a wet sail, having launched BlitzBet, an online gaming brand billed as “the first of many anticipated brands that the company intends to operate to provide customized on-line sports betting, casino and poker platform, each with specific target audiences and players.”

It then launched LineMovement, billed as “a new sports content platform focused on solidifying the company’s position within the greater on-line gaming marketplace and leveraging the company’s social media presence to drive massive traffic to the company’s affiliates and partners.”

They even managed to get Canadian hockey icon Nick Kypreos to sign on.

This was an auspicious start, but having done a lot of research on online gambling regulations, I knew there’d need to be a lot of work behind the scenes on things other than just branding to make this work. Things like licensing and compliance in the gambling business are a full time job, especially for a startup.

IG certainly had the big things down; Bulk online content and big time branding? Why, that was the 2000’s era strategy that built Bodog into a one time giant.

The other part of that Bodog strategy? Having a big dog to be the face of it all.

IG also went there but, in doing so, veered off reservation.

One of the reasons I didn’t pay much attention to IG (then named i3 Interactive) early was the guy they were blitzing with; Dan Bilzerian, the much maligned CEO of Ignite International (BILZ.C), actual international fugitive, and social media shitstorm.

Bilzerian’s bio stated he was “an internationally recognized and social media celebrity, and [..] part owner of i3 Interactive.”

Mr. Bilzerian has over 50 million followers across five of the most prominent social media platforms, making him one of the largest social media followings of any celebrity and ranks one of the highest for social media engagement with followers. Mr. Bilzerian became one of the world’s most successful professional poker players, earning upward of $50-million (U.S.) per year.

Ignite lost $50 million on marketing back then, much of which was said to be related to Bilzerian’s living expenses. Interesting that he claimed to have earned that same amount playing poker, but surely that’s just a coincidence.

Listen, I’m no stranger to hating the guy I’m invested in. Lord help me, if I restricted myself to only stocks run by people who passed the ideological purity test, I’d be all in on Ben and Jerry’s ice cream with a side bet on Sarah Mclachlan’s Music School for Kids.

And Bilzerian did, reportedly, deliver 100,000 entrants to a Blitzbet online blackjack tourney, which is huge, and would take millions in marketing and several years of work to recreate organically. Lord help them, crazy people are great at drawing attention, even as they’re setting fire to their own face.

But the folks at Interactive Games aren’t idiots.

There are no shortage of folks who’ll shoot some paper to a guy with 50 million Instagram followers if he’ll agree to bring eyeballs to the party (lest we forget Gene Simmons robbing cannabis company Invictus MD blind while telling people drugs are bad), but the devil is quickly found in the details of these celebrity deals.

And the international warrants.

The company has been unable to overcome irreconcilable differences with Dan Bilzerian relating to the Bilzerian agreements (as defined in the company’s listing statement dated June 28, 2020), resulting in the company severing its partnership with Mr. Bilzerian. As a result, the company has cancelled the 20,157,713 shares issued to Mr. Bilzerian.

Realistically, IG got exactly what they needed to out of Bilzerian before cutting him loose right at the time it became REALLY IMPORTANT not to have crazy people in the C-suite.

[Interactive Games]. commends the Canadian federal government for the initiative put forth to legalize single event sports wagering in Canada. The company is eager for this proposal to move forward to enable the company to provide Canadians with its enhanced products and services in the Canadian marketplace.

Federal Justice Minister David Lametti is expected to introduce legislation as soon as Thursday to legalize single-event sports betting in Canada — ending a decades-old prohibition on gambling. This would allow the Canadian federal government to collect billions of dollars in taxes in the years to come. An estimated $14-billion in annual sports betting — $10-billion through the black market through bookies and $4-billion more through offshore on-line outlets, according to figures from the Canadian Gaming Association — is wagered by Canadians through illegal channels beyond the regulatory control of the government.

From here on, compliance is the only important thing at Interactive Games. When the regulators make their rules, you don’t want to have been found on the wrong side of things. At FANS, they bought existing licensed operators. At LUCK, they spent years working on their compliance at the expense of revenues.

On that front, to date, IG has partnered with Amelco UK, which delivers a full suite of gaming and gambling products for international users.

That gets them in the gate in Canada and elsewhere, but it might not be Canada where IG has the biggest potential..

GAMBLING GLOBALLY

In August 2020, IG announced it had acquired an Indian online poker brand with 75k Monthly Active Users and 1 million-plus registrations. That company, FTR Poker, was soon rebranded to BlitzPoker, and the Bilzerian factor ramped up users stupid fast.

Since the proposed acquisition of FTR Poker has been announced, Blitzpoker has increased registrations by nearly 170 per cent, first-time depositors by 127 per cent, active players by 117 per cent and gross revenue by five times.

In December, the India push continued as Interactive Games bought out LivePools India, which boasted 1.5 million users in the rummy, fantasy sports, and online gambling areas. Now rebranded as Blitzpools, that deal is also picking up steam on the user acquisition front.

The billions of people potentially lined up to be customers in India alone could propel Interactive Games beyond the crowded and competitive US and European markets, but there will likely be push back from the traditionally conservative government over there, the same way there has been anywhere online gambling has taken root.

If you like FANS and LUCK for their North American and European exposure and room to grow, BETS is a great geopolitical hedge to benefit elsewhere should those more developed markets take longer than expected to make their deregulation evolution.

To be clear, the Indian market will be smaller on a revenue-per-user basis, but on a potential-number-of-userss side of the equation, it will be important to watch.

— Chris Parry

FULL DISCLOSURE: Interactive Games is an Equity.Guru marketing client, as is FansUnite.

Leave a Reply