On Monday, March 9th, Gold staged a dramatic rally in what may prove to be a major reversal off of key support. Tuesday’s price action in the metal cemented those gains.

Is this a watershed event? A close above resistance at $1750 will go a long way towards restoring confidence in the sector.

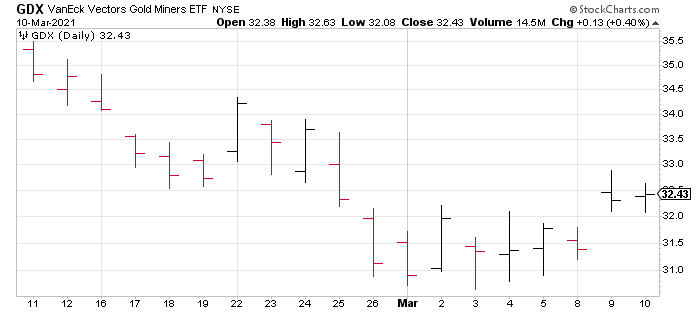

Looking at the senior stocks, as per the GDX, their reluctance to break down and follow the metal to a lower low (on Mar 8th and 9th) adds validity to the notion that a bottom is in…

Tomorrow’s weekly close on the charts, for both the metal and the senior stocks, will be a closely-watched event.

Moving along…

They say you should never fall in love with a stock. Wise counsel for sure, especially where junior exploration companies are concerned. But developing a fondness for certain stocks might be forgivable, especially if your due diligence reveals an asset that has been largely derisked… and the team running the show boasts all the necessary skillsets to build a mine and expand a resource base—the proof being a solid track record of creating shareholder value.

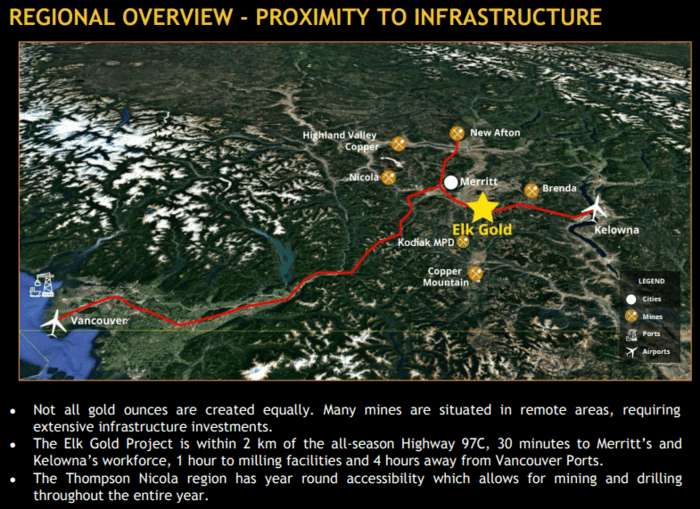

Gold Mountain’s (GMTN.V) flagship Elk Gold Project is a historically productive mine located roughly 57 kilometers from mining-friendly Merritt, BC.

The project has a 43-101 compliant resource—the pit constrained ounce-count currently stands at 454,000 ozs in the Measured and Indicated category plus an additional 95,000 ozs in the inferred category.

The grade is impressive for an open-pit scenario—5.33 AuEq ounces per tonne for the Measured and Indicated rock.

The beauty of this play is that it’s been largely derisked and is on the fast track to production.

The economics look compelling.

A 2020 Preliminary Economic Study (PEA)—factoring in a US$1,600 Au price:

- A Post-Tax NPV of $191M;

- A low OPEX – AISC of US$735 per oz;

- A low start-up CAPEX at CA$6.9M;

- An expansion CAPEX of CA$26M once the Company decides to scale the project;

- A 50,000 ounce per year mine plan by Year 4;

- A payback period of 6 months, from the start of production.

The low AISC—a metric that estimates all direct and recurring costs—is the upshot of mining shallow high-grade rock in an easily accessed setting surrounded by key infrastructure.

You might be scratching your head over the extremely low (initial) Capex of $6.9M. But this is where the concept of toll milling comes into play (toll milling eliminates the need to build a mill on-site).

The Company is ideally positioned to take advantage of this option (note Elk’s proximity to the New Afton mine on the above map).

Momentum

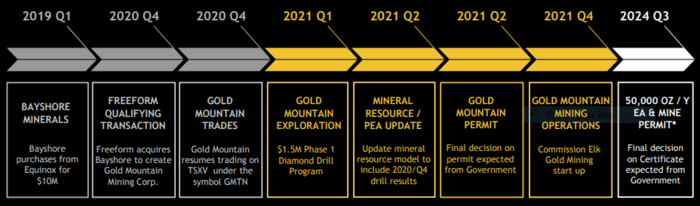

The Company is firing on all cylinders, pushing the project forward on multiple fronts.

On January 9th of this year, the Company signed a mining contract with Nhwelmen-Lake LP.

A few weeks later, the Company engaged a world-class toll milling partner—New Gold—to push the above-noted ounce count closer to production.

If the Company’s current resource—549k ounces (measured, indicated, and inferred)—represented the final chapter for the Elk project, my enthusiasm here would be somewhat muted.

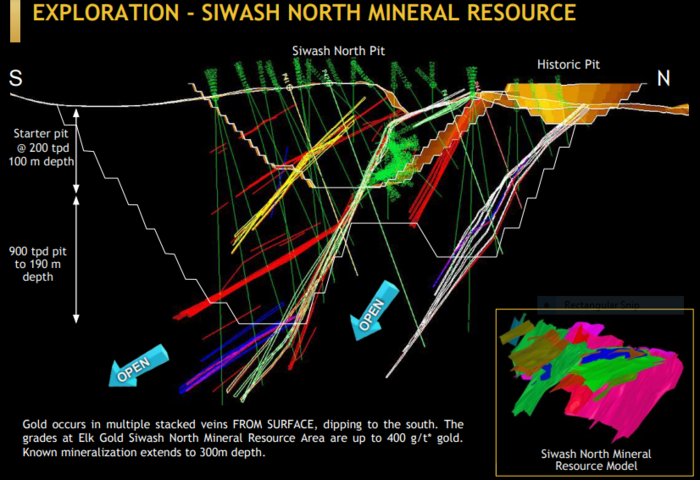

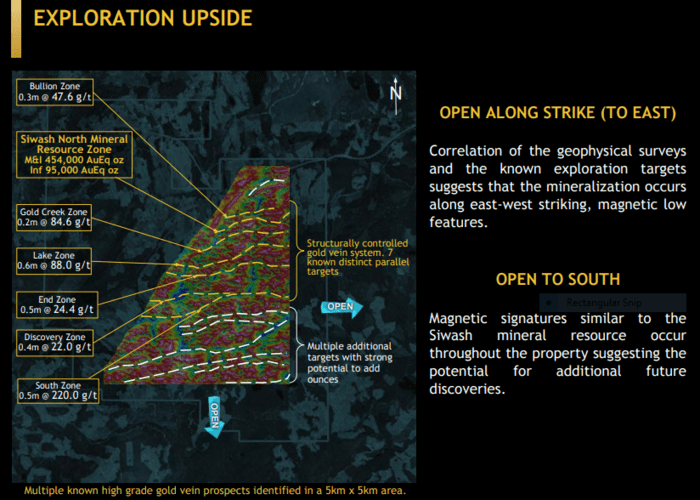

The exploration upside at Elk is excellent.

The Siwash North zone holds the current resource and is open along strike and at depth (nice images folks).

Elk is a mesothermal, intrusive related, gold vein system. The gold occurs in pyritic quartz veins accompanied by minor base metal values. These quartz veins occur in fractures and shears within a granitic intrusion.

There are multiple (known) mineralized zones outside the main resource base with similar grades and structure (the property is 16,716 hectares in size (41,306 acres)).

Earlier this year, the Company launched an aggressive Phase-1 drilling campaign, one designed to bulk-up the Siwash North resource, as well as define additional mineral inventory along the highly prospective zones highlighted on the above slide.

Today (March 11), we got our first look at what-else lies in these subsurface layers.

Gold Mountain Provides Exploration Update and Appoints Dr. Quinton Hennigh to Advisory Board

Here, the Company tabled initial results from its Phase 1 exploration campaign at Elk—results that incrementally expand the strike of known mineralized zones beyond the current resource model.

Highlights from infill and step-out drilling include:

- SND20-004 intercepted 1.5 meters averaging 7.3 g/t Au (including 0.30m averaging 21.7 g/t Au);

- SND20-001 intercepted 1.3 meters averaging 7.2 g/t Au (including 0.30m averaging 30.5 g/t Au);

- SND20-020 intercepted 1.3 meters averaging 5.1 g/t Au (including 0.30m averaging 22.1 g/t Au).

The Company has recently completed approximately 4,250m of core drilling in 26 holes. Phase 1 drilling is planned to encompass a total of 7,100m. Initial holes completed as part of the Phase 1 program were designed to incrementally step out and infill along near surface extensions of known mineralized zones. Initial assay results confirm the Company’s exploration model with the 2600 and 2700 veins intercepted on approximately 75 meter centres over a strike length of 300 meters and 175 meters down dip. This results in a demonstration of connection between the Yellow Brick Road Zone and the Siwash North Zone.

A re-logging and sampling program also uncovered a new vein in a historic hole which yielded 1.2 meters averaging 52.3 g/t Au (including 0.30m averaging 216 g/t Au).

Not bad for historic drill core—that’s some über-rich rock.

Phase 1 also includes a campaign to re-log and sample historical drill core using latest exploration technology resulting in enhanced ability to discover additional veins. As an example, a new vein intercept was recognized in historic hole SND11-132, yielding 1.2m averaging 52.3 g/t Au (including 0.30m averaging 216 g/t Au.) The Company plans to further implement its follow up re-logging and sampling program upon completion of Phase 1 drilling.

There’s a good breakdown of these results in the body of this press release. You can also find the breakdown here.

In testing the potential depth extensions down dip of the main resource block, the drill bit tagged some visually compelling rock—rock that could host significant mineralization.

Phase 1 drilling includes nine (9) holes totalling approximately 2,850m targeting down dip high-grade extensions of the 1300 and 2500 veins below the current lower extent of the resource model in areas that display robust gold grades. Visual observations thus far indicate strong sulphide vein intercepts in these holes. The Company anticipates that upcoming assay results from the 1300 and 2500 veins will help JDS Mining better determine the feasibility of underground mining.

Kevin Smith, Gold Mountain’s CEO :

“Management has a goal of driving this resource to a million ounces and beyond. We plan to accelerate our relogging program, given the newly discovered 216 g/t intercept, and commence Phase 2 of our drill program as soon as Phase 1 is complete. Initial drill results are validating our thesis that gold mineralization can be predictably expanded at the Elk Gold Project. Having built a detailed geologic model utilizing over 127,000m of historic drillhole data, we are able to focus our drilling to add ounces in a cost-effective manner. The drill is now targeting high-grade zones below the current resource, and we’re encouraged by visual indications to date.”

The Company also announced the appointment of Dr. Quinton Hennigh—an industry expert with previous experience in high-grade vein systems—to its advisory board.

Dr. Hennigh is an economic geologist with 25 years of exploration experience, and is a founder and current Chairman and President of Novo Resources Corp., which is exploring and developing gold projects in the Pilbara region of Western Australia, including its Beatons Creek, Karratha and Egina gold projects, the latter of which is under a joint venture with Japan’s Sumitomo Corporation.

Early in his career, Dr. Hennigh explored for major mining firms including Homestake Mining Company, Newcrest Mining Ltd and Newmont Mining Corporation. He then joined the junior mining sector in 2007 and has been involved with a number of Canadian listed gold companies, including Gold Canyon Resources Inc., where he led exploration at the Springpole alkaline gold project near Red Lake Ontario, a 5 million ounce gold asset that was sold in 2015 to First Mining Gold Corp. Dr. Hennigh was also instrumental in Kirkland Lake Gold’s acquisition of the Fosterville gold mine, which is located in Australia and was previously owned by Newmarket Gold Inc. Dr. Hennigh obtained a Ph.D. in Geology/Geochemistry from the Colorado School of Mines in 1996.

Dr. Quinton Hennigh, technical advisor:

“A few years ago, I undertook a detailed review of the Elk high grade gold project. “The vein system not only displays remarkable gold grades but strong persistence along strike and at depth. Geophysical data, particularly magnetic, indicates excellent potential to extend known veins along strike as well as target new veins. It is unusual to find an advanced project already on a fast track toward production that also displays strong exploration upside. I look forward to working with Gold Mountain’s team to expand this remarkable high grade vein deposit.”

Final thoughts

Expect robust newsflow, much of which will be assay-related, over the next few months. We’ll also see an updated resource estimate, permitting news, and progress updates on the development front.

The team behind this near-term production play is simply top shelf. Expect this crew to run a tight show and to be highly protective of its share structure—insiders own 25% of the outstanding common.

Lastly, if the bottom is in for this corrective phase in Gold, and if the metal catches a tailwind—pushing to higher ground taking out last summer’s highs—I suspect these near-term production plays will capture a lot of attention from the market.

END

—Greg Nolan

Full disclosure: Gold Mountain is an Equity Guru marketing client.

Leave a Reply