BREAKING: Boeing 737 Jet Crashes in Iran due to technical issues after takeoff. Source (ISNA)

Oil Stuff & The Middle East

At least two airbases housing US troops in Iraq have been hit by more than a dozen ballistic missiles. Iranian state TV says the attack is a direct retaliation to the US killing top commander Qasem Soleimani. Presently, it’s unclear whether there are any casualties.

As a result, we saw Oil surge to over $65 per barrel. Crude futures have jumped by over 7% since the US assassinated General Soleimani.

The oil market is currently pricing in risks associated with potential attacks in oil production facilities. Particularly, the concern is about the Strait of Hormuz, a narrow chokepoint for the region’s supplies that Iran has threatened to shut down if there is a war.

Brent crude surged as much as 5.1% to $71.75. Prices settled lower on Tuesday as the hostile rhetoric between Washington and Tehran ensued without any impact on supply.

Iran has also added that further attacks would stop IF the US does NOT engage in a retaliatory response.

S&P Futures fell sharply as markets anticipate rising tensions.

Gold

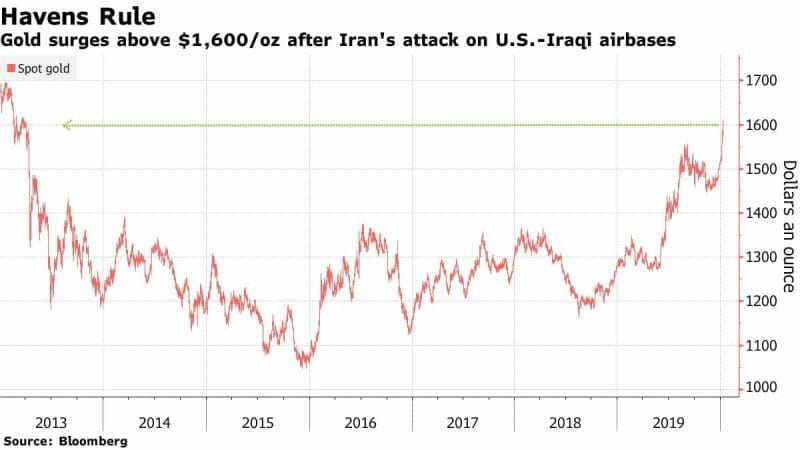

With escalating tensions, Gold surged to above $1600 an ounce for the first time in more than six years. The 2% surge in the gold price is a direct consequence of the attack on the US base.

Spot bullion climbed as much as 2.4% to $1,611.42 an ounce, the highest since 2013. Futures jumped as much as 2.5%. Silver also surged, while platinum advanced and palladium fell.

The decade for gold has seen its fair share of highs and lows, and the latter half of the decade has seen a bullish run fuelled by easier monetary conditions and rising risks on slower global growth. With lower government bond yields across the globe, investors get a better return on gold as a safe asset class than bonds.

To add, Fed minutes last week suggest that the committee is comfortable with a pause on low rates for a while. Couple this with the repo operations and the added liquidity has dampened the volatility in the market.

However, dampened volatility doesn’t necessarily mean that the risks have been eliminated. It’s just the case that the Fed has underwritten most of it.

The Dow dropped 119.70 points, or 0.4%, to 28583.68. The S&P fell 9.10 points, or 0.3%, to 3237.18.

On another note, this is peak America: Jeopardy’s leaked winner trending on Twitter when the country’s troops are in the midst of an escalating conflict in the middle east.

Student Debt

It’s a well-established fact by now that America has a student debt problem. While I don’t think that simply “writing off the debt” or “debt forgiveness” will work in theory, or in practice, as Bernie Sanders might suggest, it’s important to look at how its affecting bond yields for the underwritten debt.

For instance, here’s an interesting story where the borrower is likely to be 114 years old by the time the underlying bond matures.

What happens when a student borrows money from a bank? There are some credit checks, sure, but when the bank loans out money, it’s doing so in anticipation that it will collect some interest on it in the future.

When many students take out that loan, all of that money can be put together in the form of a bond that gives a certain yield that is a combination of the different amounts and interest rates that students have taken the loan out on.

If you’re a med student, for instance, with over $300K in debt and happen to own a house, then it’s possible that your loan is secured by the asset.

This bond is then traded freely on the market. However, when governments offer assistance programs that reduce students’ minimum monthly payments in proportion to their respective incomes, it can take longer to pay off your debt.

So what happens if theoretically, it takes longer to pay off your debt than it takes for the time the bond issued against it matures? Yields drop. What’s worse for the bond, is that it can get downgraded. The hit on the credit rating will make things worse for the bond as an asset class and will make it harder for investors to recover their money with an attractive yield.

But there’s a convenient “solution” for the issuer of the bond! They can simply increase the maturity date of the bond. By days, months, weeks, and in this instance, by decades.

For investors, these bonds can make for attractive investments, especially when they are backed by the government against the possibility of default. In essence, the government is subsidizing the education of a few at the expense of many taxpayers.

The US government itself has issued about $1.2 trillion in student debt, of which 10% ($120 billion) are in default.

The question to think about isn’t necessarily “why is there so much student debt?” but rather, “Why has the cost of education risen exponentially when inflation and asset prices have not?”.

I’d love to hear your thoughts on the matter! If you want to hear mine, send me an email and I can forward you a copy of the paper I wrote on the topic.

In essence, I think education today has taken the form of the atheist church that offers salvation in the promise of employment. Moreover, “elite” institutions command a higher price, not by virtue of a higher quality that they provide, but by the exclusivity of access – to alumni, prestige, and essentially all forms of socio-economic status.

Other Stuff

- Boeing Backs Simulator Training It Once Resisted for Max Pilots

- Apple Privacy Executive Defends Encryption After FBI Request

- Google Says Over 500 Million People Use Its Assistant Monthly

- Accenture to Buy Former Symantec Services Unit From Broadcom

- Ghosn’s side of the story: Press Conference on Wednesday

- Immigration Could Help Canada Top U.S. in Economic Growth This Year

Here’s what we are talking about:

- Cannabis companies take a leaf from the baseball playbook, but sacking CEOs at Supreme (FIRE.T) and Experion (EXP.V) won’t placate the masses

- Patriot One’s (PAT.T) CEO Martin Cronin stands and delivers

- 1933 Industries (TGIF.C) forges ahead in California despite slumping cannabis market

- Predictive tool Augur demonstrates the sometimes nonexistent wisdom of crowds

Leave a Reply