You’d be hard pressed to find someone who hasn’t been touched by depression or anxiety. Biochemically, they’re considered co-morbid, which means they often happen at the same time and feed off of one another. Depression and anxiety often overlap in terms of neurotransmitters and therefore, they’re often lumped together and treated the same way.

And if you look at the numbers of those infected with these twin diseases, considered the common cold of mental illness, you realize that this isn’t exactly a battle we’re winning. The normal course of treatment for depression and anxiety is psychotherapy, medications like antidepressants, or both. Let’s also factor in lifestyle changes, improved sleep habits, better social support, stress-reduction techniques and exercise—but what if none of that works?

Ask yourself – why is the 2020 Global Anxiety Disorder & Depression Treatment Market about USD $16 billion and forecasted to reach USD $19.81 Billion by 2028, registering a CAGR of 2.4% over the forecast period? Have we tried everything?

No, as it turns out. We haven’t.

Filament Health (FH.NEO) represents another significant option—as yet untried because of pearl-clutching governments past—and now it might be a solution whose time as come.

What is Filament Health?

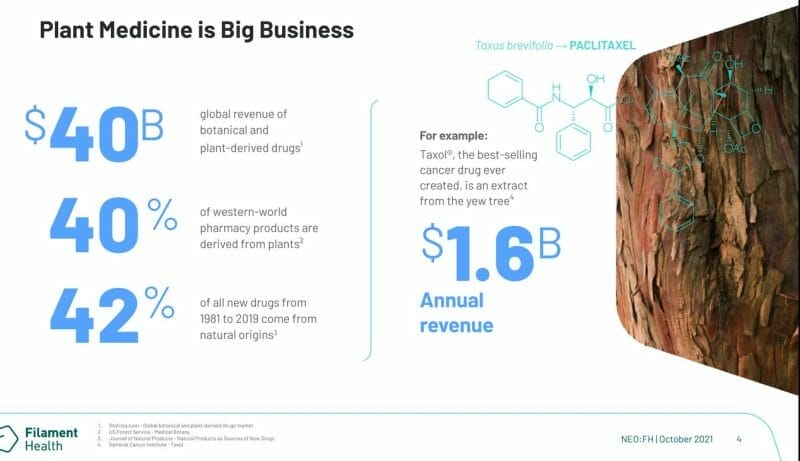

Filament Health is a psychedelic drug discovery and extractions tech company. Their mission statement is to get safe, approved and natural psychedelics for everyone who needs it as soon as possible on the belief that measurable and useful medicines will help resolve many of the world’s mental health problems. Including depression and anxiety. Filament makes their money by leveraging the commercialization of their extraction tech, and uses its intellectual property portfolio, as well as its in-house GMP facility, and Health Canada issued Dealer’s License for all natural psychedelics.

The operative word in that paragraph is ‘natural.’ There’s no synthesis is psilocybin or any other psychedelic compound. You’ll never read a press release about them picking up a device or company wherein they gather IP required to combine molecules requires to make artificial psychedelics. It’s not in their company DNA.

“We believe very strongly that it’s important to bring a natural option for these various psychedelic compounds to the market for a couple of reasons: first and foremost, it’s no secret that general everyday consumers prefer natural products when they can get them. You probably didn’t take a synthetic caffeine pill this morning, you probably took a cup of tea or coffee—that’s a natural extract. We think this consumer megatrend will continue into psychedelics, and consumers on the fence about whether or not to try psychedelics, may be more comfortable trying it if the product is natural,” said Ben Lightburn, CEO of Filament Health in an interview with Equity Guru’s own Maddy Grace.

The Opportunity

One of the biggest stumbling blocks for the nascent psychedelics industry, much like the cannabis industry before it, is how to ensure a stable, repeatable experience. You’ll find a McDonalds anywhere you go in North America and the Big Mac you buy will taste the exact same whether it’s in Albuquerque, New Mexico or in North Vancouver, British Columbia. They use the same ingredients, the sauces are mixed the same way, and it’s served the same way. That’s by design. It means customers know what they’re getting whenever they crack open one of those paper boxes they come in, and there’s no surprises.

Cannabis is much the same—this time owing more to regulations than market sentiment.

Filament has developed tech capable of extracting and standardizing a stable dose of natural psilocybin to overcome issues with crop-to-crop and flush-to-flush variability. You can rest assured when you pick up one of Filament’s products from your pharmacy in the future that you’re getting the correct dosage, and there will be no surprises. You don’t want surprises in your depression and anxiety medicine.

Before Filament’s tech, previous methods of natural extraction produced challenges including poor yields, instability, and repeatability. Your experience would literally not be the same each trip and that’s no good for anyone. It’s definitely one of the things Health Canada will be looking for when regulations come.

M&A and Intellectual Property

In March of this year the company picked up Psilo Scientific, a drug discovery and extraction tech company for a little over $11 million in a mix of $200,000 in cash and 37,156,469 shares. The acquisition included a change of control with Psilo becoming a subsidiary of the company.

The company has only been in existence since June 22 when it completed a reverse takeover wherein Filament Ventures and a numbered company based in BC rolled into one another to form the company as we now know it.

Filament Health is the first public company to get a patent from the Canadian Intellectual Property Office (CIPO) for natural psilocybin extraction and standardization and associated psychoactive compounds. They received the patent on August 3, 2021, for transforming psychedelic raw materials into pharma-grade standardized extracts.

Their latest patent, and their 20th application, supports the company’s research phase programs, including three international Patient Cooperation Treaty (PCT) applications. The company intends to use their Canadian success by using the Patent Prosecution Highway (PPH) in the United States and internationally.

The PPH allows a company to speed up the patent application process, and can be used if the application has a corresponding patent allowable by one of the PPH partners. The CIPO has PPH partnerships with 26 intellectual property offices throughout a global PPH pilot program, with four IP offices through bilateral PPH pilot programs.

“This milestone sets us ahead of industry peers and demonstrates the strength of our IP strategy. Many naturally occurring compounds have great potential to alleviate suffering, and our patent filings cover a range of innovative technologies necessary for transforming the healing power of those compounds into pharmaceutical standardized form,” said Lightburn.

The Numbers

A few things before we get started:

Eagle eyed viewers have probably noticed that everything before The Numbers section is word for word the same as a story originally written November 2. Yeah. That’s by design. That’s the nature of a reprint and since there’s been no significant change to this company’s business plan, product or opportunity, and there’s no need to reinvent the wheel.

That ends here. The company released financials and they’re worth talking about. But as with the original article, if technical analysis is more your style, then I invite you to check out Equity Guru’s own chart wizard Vishal Toora, and don’t forget our investor round table wherein we all discuss this company and the opportunity behind it.

Now that that’s covered. Let’s go deep with the update.

The company dropped their financials a few days after the original story was published, making them roughly a month old now. That’s still quite fresh and we can assume that the $6,444,291 they’re sporting in the cash column is still valid. That represents a significant amount of runway before this company is going to have to think about raising money. We can only speculate on why they have been so quiet on the news front and maybe December has a bit to play in that, but we shouldn’t count out that the FDA authorized the company’s first clinical trial using naturally sourced psychedelic substances.

Those things take time if you’re going to do them right.

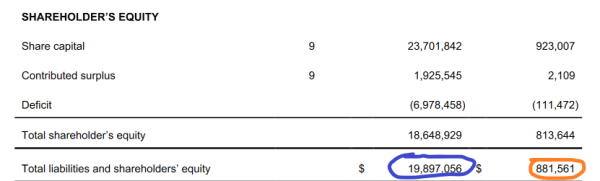

As for the pertinent financial data, consider the following cutout:

With a company as nascent as Filament, where you don’t have a lot of the standard metrics for growth readily available (PE ratio, profit margins, etc) we have to measure growth in other ways. We have the cash column above, but that measures how much available cash a company has until they have to go beg for more (therefore, potentially incurring debt), but another good one is determining the health of a company through its shareholder equity.

Shareholder equity is found by a simple metric – total assets minus total liabilities, and the number as you can see above, displays a significant amount of growth in this category since December 31, 2020. (The indicator of comparison is missing, but that’s what it is.)

If the number is positive then it means the company can cover its liabilities. If the number on the left is significantly more than its counterpart, it suggests growth. For most companies, higher shareholder equity indicates more stable finances and more flexibility in the case of an economic or financial downturn, so that should curb your anxiety. If it doesn’t, there’s always Filament Health.

—Joseph Morton

Full disclosure: Filament Health is an equity.guru marketing client.

Leave a Reply