In early 2018, Equity Guru had 30 cannabis clients.

At the time, it was our specialty, our niche.

Equity Guru owner Chris Parry was the one of the first journalists to take the sector seriously.

Later, we signed a bioscience accelerator (XPhyto Therapeutics (XPHY.C), a concealed weapon detector co. (Patriot One (PAT.T) and a grocery store chain Organic Garage (OG.V).

We also hired renowned mining writer Greg Nolan to scour the planet for good resource companies.

But four years ago cannabis was our main jam.

In that moment, telling investors to sell their cannabis stocks was counter-intuitive.

Yet, that’s exactly what happened.

“I could sit here and cheerlead this stuff and make money doing it,” wrote Chris Parry in his infamous January 20, 2018 Time for a Dad Talk article, “Everyone wants to be told the fun will never end.”

“I’m begging you, Sparky,” continued Parry, “Sell half of what you hold, take a little out of the market, secure your future, and reinvest the rest in things you believe will double not in a month, but in a year. Real companies that do more than just grow in stock price.”

According to the New Cannabis Ventures Global Cannabis Stock Index, cannabis stocks peaked two days later on January 22, 2018 at $174, and have since bumped all the way down to $34.

In 2021, cannabis stocks have been mutilated across the board.

If I had a billion dollars, I’d buy shares in the following three cannabis companies because they have growing revenues, strong war chests, zero or shrinking debt, smart management and coherent strategies for future growth.

HEXO Corp (HEXO.T) is a $377 million cannabis company that has slumped 97% (from $41 to $1.06) since March, 2019.

HEXO services the Canadian recreational market with a brand portfolio including HEXO, Redecan, UP Cannabis, Namaste Original Stash, 48North, Trail Mix, Bake Sale, REUP and Latitude brands, and the medical market in Canada, Israel and Malta.

HEXO also services the Colorado market through a joint venture with Molson-Coors.

On December 14, 2021 HEXO reported its Q1, 2022 financial results for the fiscal quarter ended October 31, 2021 “The Path Forward”, a new strategic plan to solidify itself as Canada’s leading cannabis company and position it to capitalize on international opportunities.

Q1 2022 Fiscal Highlights

- Total net revenue increased 29% to $50.2 million from $38.7 million in Q4’21, and up 70% from the comparative quarter of fiscal 2021.

- Closed acquisitions of Redecan and 48North which contributed net revenues of $13.5 Million and $1.1 Million respectively during the two months ended October 31, 2022.

- The Company’s total non-beverage gross margin before adjustments increased to 28% from 25% in the previous quarter.

- Revising expected synergies from acquisitions to over $50M from previously reported $35M.

- Forecasting positive cash flow within the next four quarters based on incremental cash flow of $37.5 million in fiscal 2022 and an additional $135 million in 2023 for a total of $175 million over the two years.

“We are taking immediate steps through our new strategic plan, The Path Forward, to strengthen our capital position, improve operations, accelerate organic growth and complete our transformation to be cash flow positive from operations within the next four quarters,” stated Scott Cooper, President & CEO, HEXO.

“Having visited all our core sites, and in meeting with our employees and customers, I am more confident than ever in HEXO’s future and our ability to accelerate the creation of short and long-term value for shareholders,” added Cooper.

The company has a large debt, which it is managing aggressively.

As of December 14, 2021, USD$118 million and USD$375 thousand of principal on the Convertible Note has been redeemed and converted, leaving USD$241.625 million of principal outstanding.

The Path Forward is made up of five priorities:

- Reduce manufacturing and production costs;

- Streamline and simplify the organizational structure;

- Realize cost synergies from acquisitions and recent plant closures;

- Focus on revenue management, including more disciplined pricing; and

- Accelerate growth through organic market share gains and capture missed revenue opportunities, including improving our ability to align cultivation planning with market demand, reintroduce a focus on medical and strengthen our commercial capabilities and innovation pipeline.

These initiatives are expected to generate incremental cash flow of $37.5 million in fiscal 2022 and an additional $135 million in 2023 for a total of $175 million over the two years, split almost evenly between cost reductions within HEXO’s control and revenue opportunities.

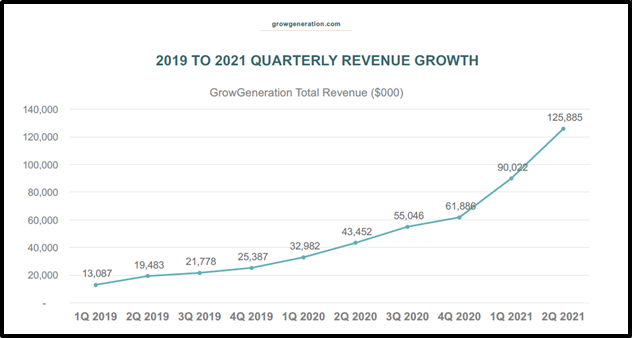

GrowGeneration (GRWG.NASDAQ) is a $785 million picks & shovels cannabis company that has slumped 80% (from $58 to $13.14) since February, 2021.

GrowGen owns and operates a network of specialty retail hydroponic and organic gardening stores.

Its 62 stores, include 23 locations in California, 8 locations in Colorado, 7 locations in Michigan, 5 locations in Maine, 5 locations in Oklahoma, 4 locations in Oregon, 3 locations in Washington, 2 locations in Nevada, 1 location in Arizona, 1 location in Rhode Island, 1 location in Florida, 1 location in Massachusetts and 1 location in New Mexico.

GrowGen also operates an online superstore for cultivators at growgeneration.com and B2B e-commerce platform, agron.io. and distribution centers.

The product line includes organic nutrients and soils, advanced lighting technology and state of the art hydroponic equipment to be used indoors and outdoors by commercial and home growers.

On November 11, 2021 GrowGen reported Q3, 2021 GAAP net income of approximately $4.0 million compared to net income of $3.3 million in the same period last year. Diluted earnings per share was $0.07 compared to a $0.06 in the same period last year.

“The GrowGen team delivered a strong third quarter, with revenues up 111%, compared to the same period last year in a difficult macro environment,” stated Darren Lampert, GrowGen’s Co-Founder and CEO.

“Same-store sales at 25 locations increased 15.7% from the prior year. At present, we have 62 retail locations in operation. Our online marketplace, including Agron, is on pace to reach $35 million of revenue for 2021. We opened two locations in the Los Angeles metro area, and for next year, we are looking to open 15 to 20 locations.”

Financial Highlights for Q3, 2021 Compared to Q3, 2020

- Revenues rose 111% to $116.0 million for third quarter 2021, versus $55.0 million for the same period last year.

- Same-store sales at 25 locations open for the same period in 2020 and 2021 were $59.2 million in third quarter 2021, versus $51.2 million for third quarter 2020, a 15.7% increase year over year.

- Gross profit margin for third quarter 2021 was 29.4%, compared to 26.5% in the same quarter last year, an increase of 290 basis points.

- GAAP net income before tax was $5.1 million for the third quarter 2021, versus $5.1 million for the same period last year.

- Net income was $4.0 million, or $0.07 per share based on a basic share count of 58.5 million.

- Adjusted EBITDA was $10.8 million for third quarter 2021, versus $6.6 million for the same period last year.

- Private label sales, inclusive of Power Si and Char Coir, were 8.7% of revenue, compared to 2.1% for the same period last year.

- E-commerce revenue, inclusive of Agron revenue, was $10.5 million, compared to $3.9 million for the same period last year.

- Cash and short-term securities as of September 30, 2021 was $93.0 million.

GrowGen made the following acquisitions in 2021:

- In July 2021, the Company acquired the assets of Aqua Serene, Inc., an indoor/outdoor garden center with stores in Eugene and Ashland, Oregon.

- In July 2021, the Company purchased the assets of Mendocino Greenhouse & Garden Supply, Inc, a hydroponic garden center located in Mendocino, California.

- In August 2021, the Company purchased the assets of Commercial Grow Supply, Inc., consisting of a hydroponic and garden supply center serving the Santa Clarita, California area.

- In August 2021, the Company purchased the assets of Hoagtech Hydroponics, Inc., consisting of a hydroponic and garden supply center serving the Bellingham, Washington area.

“At present, we are on track for full year revenue of $435 to $440 million in 2021,” reported the CEO, Darren Lampert.

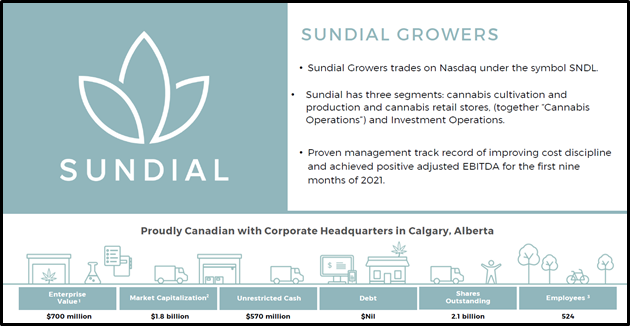

Sundial (SNDL.NASDAQ) is a is a $1.3 billion small batch cannabis company that has slumped 95% (from $11 to $.64) since July, 2019.

Headquartered in Calgary, Alberta, Sundial’s brand portfolio includes Top Leaf, Sundial Cannabis, Palmetto and Grasslands. Sundial also operates the Spiritleaf retail banner.

On November 11, 2021 — Sundial Growers reported its financial and operational results in Canadian dollars for Q3 ended September 30, 2021.

Highlights:

• Net earnings of $11.3 million for the third quarter of 2021 compared to $71.4 million loss in the third quarter of the prior year.

• Adjusted EBITDA of $10.5 million for the third quarter of 2021, compared to an adjusted EBITDA loss of $4.4 million in the third quarter of 2020.

• Net revenue from Cannabis segments of $14.4 million for the third quarter of 2021, an increase of 57% over the second quarter of 2021 and an increase of 12% over the third quarter of 2020.

• $1.1 billion of cash, marketable securities and long-term investments at September 30, 2021, and $1.2 billion at November 9, 2021, with $571 million of unrestricted cash and no outstanding debt.

• Acquired Inner Spirit on July 20, 2021 and entered into an agreement to acquire Alcanna, Canada’s largest private liquor retailer, operating 171 locations, for a total consideration of 387.3 million common shares of Sundial, with a value of approximately $346 million.

The acquisition provides Sundial with stable cash generation through a mature and proven business model with trailing twelve months free cash flow of $16.4 million on a built-out retail platform.

“Our third quarter results reflect the initial impact of the business transformation led by Sundial’s team over the last 10 months,” stated Zach George, CEO of Sundial. “Despite the ongoing challenges facing industry participants, our financial condition has never been stronger.”

$1.1 billion of cash, marketable securities and long-term investments at September 30, 2021, and $1.2 billion at November 9, 2021, with $571 million of unrestricted cash and no outstanding debt.

Selling cannabis stocks in January 2018 felt like the wrong thing to do, because the sector was bathed in euphoria.

But it was a good move.

Buying cannabis stocks in January 2022 feels like the wrong thing to do because the sector is wallowing in a cloud of gloom.

Your move.

Full Disclosure: Equity Guru has no financial relationship with the cannabis companies mentioned in this article.

Leave a Reply