In 2021, as trillions of dollars of dumb money flowed into virtual currencies, meme stocks, SPACs and Nonfungible Tokens (NFTs) – profitable legacy industries like Oil & Gas have been kicked to the curb.

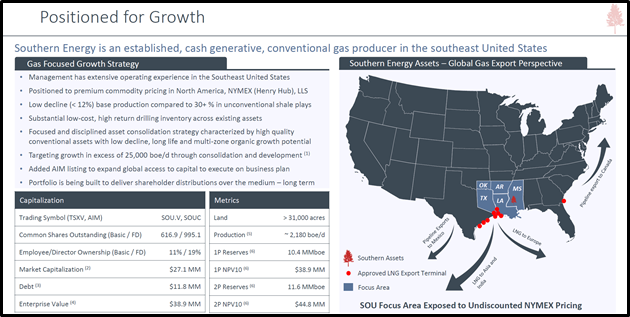

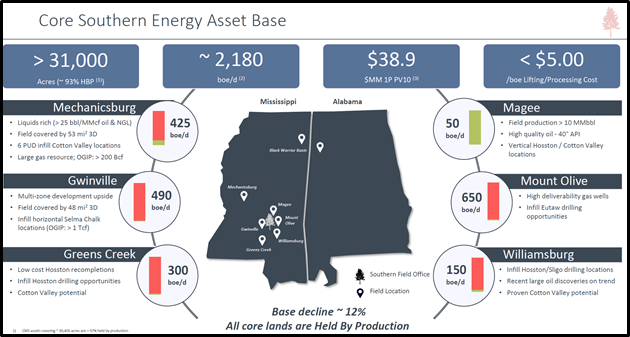

Southern Energy (SOU.V) is a $31 million energy producer with natural gas and light oil assets in Mississippi and Alabama featuring a stable, low-decline production base, a low-risk drilling inventory and strategic access to the best commodity pricing in North America.

Background: oil prices rose 50% in 2021. Lack of production capacity and weak capital investment in the sector is expected to push crude from $85 to $100/barrel in 2022.

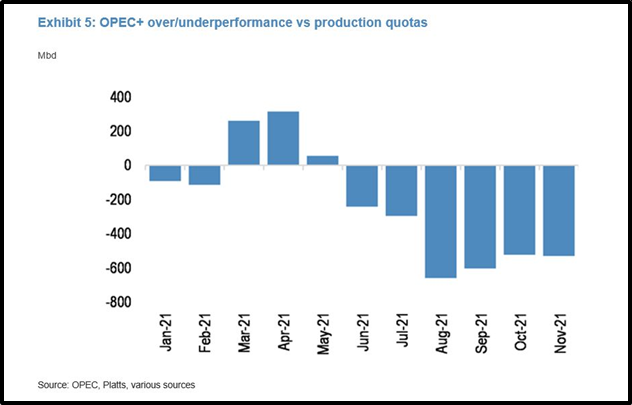

“Assuming China doesn’t suffer a sharp slowdown, that Omicron actually becomes Omi-gone, and with OPEC+’s ability to raise production clearly limited, I see no reason why Brent crude cannot move towards $100 in Q1, possibly sooner,” stated Jeffrey Halley, senior market analyst at OANDA.

OPEC and its allies are reducing output cuts implemented when demand collapsed in 2020. Smaller producers are unable to raise supply to meet current demand.

Natural gas prices posted a 47% gain in 2021.

After 12 days, natural gas is already up 30% in 2022.

On December 22, 2021 Southern Energy announced completion of an 8-1 share consolidation that resulted in reduction of outstanding shares from 617 million to 77.1 million.

A month earlier, Southern closed an equity financing, raising $12.7 million.

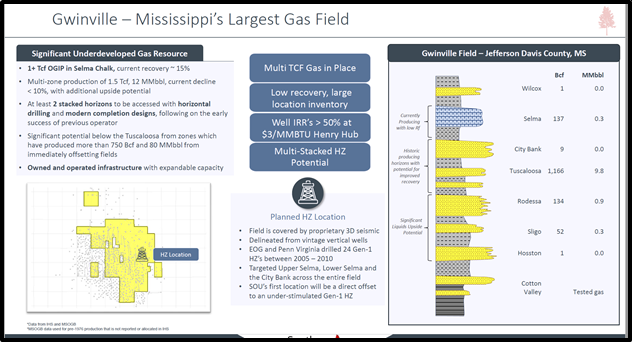

Southern intends to use the net proceeds of the Offering to drill up to three horizontal Selma Chalk wells in the Gwinville gas field and for working capital and general corporate purposes.

On November 29, 2021, Southern Energy announced its Q3, financial and operating results for the three and nine months ended September 30, 2021.

Q3 2021 Highlights in CND

- $1.7 million of adjusted funds flow from operations in Q3 2021, excluding $1.9 million of one-time expenses related to AIM listing, a 51% increase from the same period in 2020

- Average production of 12,237 Mcfe/d[2] (2,040 boe/d), 92% natural gas in Q3 2021, a 7% decrease from the same period in 2020

- Petroleum and natural gas sales of $6.6 million in Q3 2021, an increase of 85% from the same period in 2020

- As at September 30, 2021, Net Debt1 of $19.2 million, a reduction of $10.1 million or 35% from December 31, 2020

- Net earnings of $5.5 million in Q3 2021 ($0.02 per share – basic) compared to a net loss of $3.0 million in Q3 2020

- Average realized oil and natural gas prices for Q3 2021 of $85.50/bbl and $5.10/Mcf, respectively, reflecting the benefit of strategic access to premium-priced US sales hubs

- Completed a series of low-cost well recompletions and workovers beginning in Q3 and carrying into early Q4 2021

- Work program had an overall cost of approximately $1.0 million ($0.9 million in Q3 2021) and added approximately 1,250 Mcfe/d[3] (208 boe/d) of production (approximately 80% natural gas)

- At current strip pricing, the program is expected to payout in approximately 4 – 5 months and add more than $1.6 million of cash flow from operating activities in 2022 after payout

- In August 2021, successfully completed admission of its entire issued share capital to trading on the AIM market of the London Stock Exchange plc

“Following completion of our aforementioned fundraise, Southern intends to drill up to three horizontal Selma Chalk wells in the Gwinville gas field shortly,” stated SOU, “with first production anticipated in Q1 2022.”

The three wells will be drilled from a common padsite and then completed with multi-state stimulations.

On January 13, 2022 Equity Guru’s Jody Vance spoke with Southern Energy CEO Ian Atkinson about SOU’s current business objectives.

In this December 1, 2021 video, Atkinson spoke with Proactive about the group’s recent capital raise, and how the company intends to ‘more than double’ free cash flow and its total proven and probable reserves.

+

“We’ll be immediately deploying this capital into a three well program that one of our main natural gas assets in Mississippi called Greenville,” explained Atkinson, “The results are expected to more than double our corporate free cash flow as well as our two key reserves. This program is very quick to convert from capex to cash flow.”

“We’re a growth company that will offer equity appreciation through developing assets, building production, cash flow and reserves,” continued Atkinson, “We have a growth target of 25,000 barrels of oil equivalent per day, predominantly natural gas, which can be largely attained through organic growth opportunities and our existing assets”.

“We feel there are creative consolidation opportunities in our focus area. In addition to the low declined stable cash flow characteristics of our current asset base coupled with a similar type assets, we plan to acquire and consolidate.”

“Within our US Gulf Coast focus area, it’s a very transactable jurisdiction,” stated Atkinson, “We’re looking at assets ranging from 2,000 barrels of oil equivalent per day to over 15,000.”

“With a modest capital infusion from our recently closed equity financing, we’ll be able to deliver self funded organic growth, which we expect will again quickly translate into share price appreciation for investors,” concluded Atkinson.

Depleting crude inventories is bullish for near & medium-term oil & gas prices.

“JPMorgan analysts said in a note on Wednesday that they could see oil prices rising by up to $30 after the Energy Information Administration (EIA) and Bloomberg lowered OPEC capacity estimates for 2022 by 0.8 million barrels per day (bpd) and 1.2 million bpd respectively,” reports Reuters.

Morgan Stanley predicts that oil prices will “overshoot” to $125 a barrel this year, and $150 in 2023.

Throughout 2021, Southern had hedges on a total of 6,100 Mcf/d of natural gas production. That hedge drops to 4,000 Mcf/d for calendar 2022, as some of the older natural gas hedges expire.

U.S. natural gas futures rose more than 14% on Wednesday, January 12, 2022, as temperatures dropped across the mid-west.

“The perfect storm is hitting Nat gas futures as freezing temperatures are hitting the market as supply shortages still exist,” stated Jeff Kilburg of Sanctuary Wealth, “This is all being amplified as many short speculator traders were caught offside and are being forced to cover their positions.”

Higher oil & gas prices will catalyze Southern Energy’s 2022 revenue growth.

If Morgan Stanley’s predictions are correct, SOU’s current .41 share price will be a quaint dot in the rear-view mirror.

Full Disclosure: Southern Energy is an Equity Guru marketing client.

Leave a Reply