Defense Metals (DEFN.V) is doing everything right, and at a hurried pace, in advancing its 1,708-hectare Wicheeda Rare Earth Element (REE) Project further along the curve.

In previous write-ups, we suggested that the market might acquire a real taste for this rich, highly strategic REE deposit as 2020 progressed.

The stock did make a very decent recovery after the markets were dealt What-For in mid-March…

… but the momentum has faded in recent sessions. It would appear that gold and silver stocks are hogging all of the attention.

This current detached sentiment may represent an opportunity.

I jotted this down a few months back—it holds even more true today:

… in the event you’ve just landed on our pale blue planet and are still scoping things out, REEs—often referred to as the ‘Vitamins of Chemistry’—are everywhere.

Exhibiting an extraordinary range of electronic, optical and magnetic properties, REEs are in the satellites orbiting our planet, the nuclear reactors animating our abodes, the electric vehicles (EVs) whipping past us in the Andretti lane… the palm of our hands when liaising with Chuck E. Cheese.

The fact is, there’s no replacing REEs. Their properties are so unique—so unequaled—we’d be right-screwed if there was a sudden break in the supply chain. And with China in control of the REE refining market, the potential for a break is very real.

The West is currently scrambling to secure REE supply in its own own back yard—it’s a matter of (tech) survival.

U.S. Falters in Bid to Replace Chinese Rare Earths

Rising tensions with China and the race to repatriate supply chains in the wake of the COVID-19 pandemic have given fresh impetus to U.S. efforts to launch a renaissance in rare earths, the critical minerals at the heart of high technology, clean energy, and especially high-end U.S. defense platforms.

But it’s not going well, despite a slew of new bills and government initiatives aimed at rebuilding a soup-to-nuts rare-earth supply chain in the United States that would, after decades of growing reliance on China and other foreign suppliers, restore U.S. self-reliance in a vital sector.

As stated in the headline, this high-grade REE deposit is located in mining-friendly British Columbia. It’s road accessible with ample infrastructure through and through.

Wicheeda holds the following in its subsurface layers:

- An Indicated Mineral Resource of 4,890,000 tonnes averaging 3.02% LREO (Light Rare Earth Elements);

- An Inferred Mineral Resource of 12,100,000 tonnes averaging 2.52% LREE;

- All reported at a cut-off grade of 1.5% LREE (sum of cerium (Ce), lanthanum (La), neodymium (Nd), praseodymium (Pr), and samarium (Sm); in addition to niobium (Nb) percentages).

This resource, a significant increase versus an earlier estimate, is the upshot of a successful 2019 drilling campaign, one that tagged some truly exceptional values (all 13 drill holes + assays are plotted on the following map):

Note how the deposit remains open for expansion to the North, the Southwest, the East, and at depth.

Metallurgy – the mother of all concerns re REE deposits

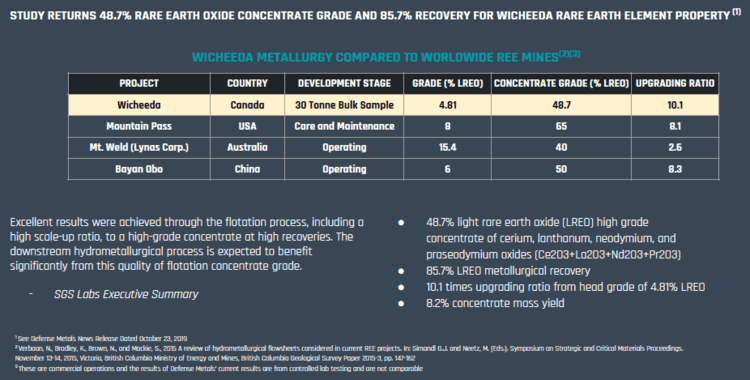

On October 23, 2019, the company dropped news that substantially de-risked Wicheeda. In terms of metallurgy, it’s currently ranked among the very best REE deposits in the world.

- a TREO metallurgical recovery rate of 85.7%;

- a 48.7% TREO high-grade concentrate of cerium, lanthanum neodymium, and praseodymium oxides (Ce2O3+La2O3+Nd2O3+ Pr2O3)

Funds from a recent raise are currently being used to construct an REE flotation pilot plant, a phase-2 proposal recommended by SGS Canada Inc.

Completion of the pilot plant is expected by the end of this month. Initial results are expected in August.

The objectives of this phase-2 testing:

- Confirm metallurgy in a pilot plant environment;

- Generate data to support engineering;

- Produce a large amount of concentrate for downstream hydrometallurgy testing.

This is a big ass’d leap along the development curve. The market should be paying more attention.

Last month we got our first peek at what SGS Canada—the world’s leading inspection, verification, testing, and certification company—has going on behind the curtain.

Hot off the press

The company dropped the following headline earlier today (July 8):

These baselines studies are a critical step in paving the path to production. Here, they’re initiating surface water assessment studies comprised of field-based hydrology and water quality data collection.

Highlights:

• Defense Metals has engaged Prince George based EDI (Environmental Dynamics Inc.) to initiate baseline surface water quality assessment at the Wicheeda REE Project;

• Completed Stream and lake water quality samples collected at total of seven unique sites in the vicinity of the of the Wicheeda REE Deposit and analytical results are pending;

• Completed Spring freshet manual stream flow measurements collected at five unique sites;

• Completed assessment of eight stream sites in anticipation of the installation of continuous water level logging hydrometric stations for long term monitoring.

Craig Taylor, Defense Metals CEO:

“Defense Metals has reviewed a proposal from EDI comprising surface water, groundwater, meteorological and wildlife baseline assessments to support a potential future Wicheeda REE Deposit BC mines permit application. With the initiation of this multi-year program of baseline surface water hydrology and water quality assessment we continue to be forward-looking with respect to advancement of the Wicheeda REE Project.”

In order to evaluate potential mine effects on surface water, a total of eight hydrology stations will be established within the deposit area. Discharge data from these stations will be collected over a two-year period to determine baseline conditions.

“Hydrometric station installs and subsequent site visits will follow BC hydrometric standards for Grade A provincial standards, in accordance with BC Ministry of Environment and Climate Change Strategy’s “Water and Air Baseline Monitoring Guidance Document for Mine Proponents and Operators”. Following Grade A standards ensures the highest level of data quality is collected and allows the credibility of data for any potential future project applications including: major mine permit applications proceeding through the BC Environmental Assessment Act, or regional mine permit applications via the Mines Act.”

Further to this press release:

The collection of in situ water quality measurements and sampling will be completed at each proposed hydrometric station. In situ water quality measurements will include specific conductance (SPC), dissolved oxygen (% and milligrams per litre [mg/L]), pH, turbidity and temperature (°C). All water quality samples will be analyzed by a certified laboratory for a full suite of parameters including:

• total and dissolved metals, including mercury;

• physical parameters: chlorophyll a (lake samples only), hardness, pH, total suspended solids, total dissolved solids (calculated);

• major ions: alkalinity (total);

• bicarbonate, calcium, carbonate, chloride, magnesium, potassium, sodium, sulfate;

• carbon: total and dissolved organic carbon; and

• nutrients: ammonia (total as N), nitrate (as N), nitrite (as N), Kjeldahl nitrogen (total and dissolved), nitrogen (total), phosphorus (total).

Very technical. Very necessary. And once again, an important step in the company’s relentless push along the development curve.

Final thought

Compare Defense with its current $6.85 market cap to your garden variety gold or silver junior with a cap two to three times this modest valuation. I see a disparity here, but that’s only my opinion. Do your own due diligence.

Here… right HERE is a good place to start.

END

—Greg Nolan

Full disclosure: Defense Metals is an Equity Guru marketing client. We own shares.

Leave a Reply