Awalé Resources (ARIC.V) is a West African ExplorerCo focused on the largely untapped greenstone belts of Cote d’Ivoire.

According to the Company’s home page…

“West Africa is now accepted as one of the world’s great gold provinces, and is the largest Paleoproterozoic gold producing region, with a near 10,000 tonne gold endowment. Cote d’Ivoire contains 33% of the prospective Birimian greenstone belts in west Africa, but less than 10% of total gold resources, making it an ideal location for new gold discoveries.”

Awalé is all about Cote d’Ivoire’s untapped discovery potential, and based on recent newsflow, they appear to be onto something significant.

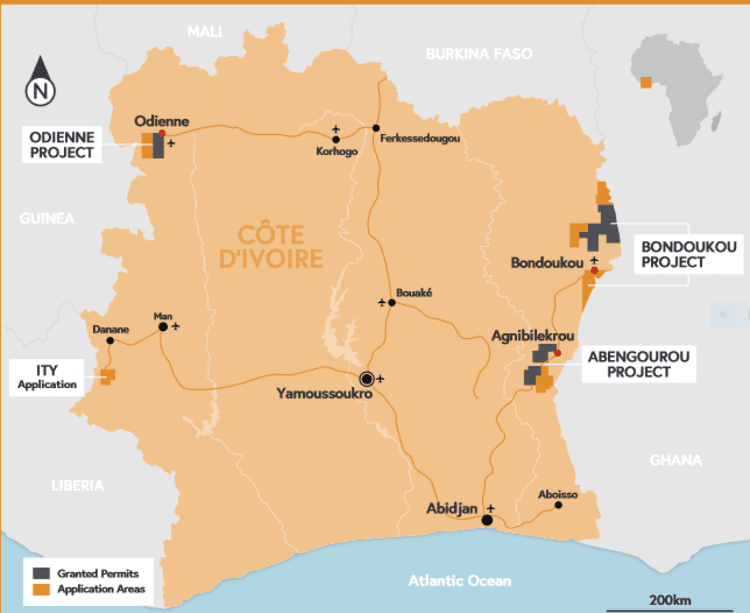

The Company holds three key properties in its project pipeline.

Odienné 90% owned (397km2)

Awalé’s joint venture partner at Odienné is ANGET-CI – a local company who have a 10% stake in the project.

Geologically, the project area lies on a splay of the regional scale Sassandra fault which forms the partition between the Archean Kenema Man domain and the Proterozoic Baoule-Mossi Domain. Rocks in the project area consist of a felsic/acid volcanic to mafic greenstone belt intruded by a series of later plutons of varying size and orientation. The intrusions range from intermediate to mafic in composition.

Within the greenstone’s ductile deformation is common and artisanal mining in the area is often associated with brittle ductile contrasts, where the sheared greenstones come into contact with the intrusives. Mineralisation and alteration around these workings showed gold hosted in quartz with generally biotite schist variably in contact with volcanics, volcaniclastics and intrsuives. Silica alteration is dominant with weaker chlorite and sericite, with a sulphide association (pyrite dominant, + chalcopyrite and arsenopyrite). The Danane permit lies on the same trend as the Endeavour Ity Mine (7.5 Moz) which lies on a Birimian inlier associated with a regional scale structure that passes through Liberia and Côte d’Ivoire.

Bondoukou 100% owned (1,192km2)

The Bondoukou project lies at the southern extents and confluence of the Boromo greenstone belt from Burkina Faso and the Bolgatanga and Wa Lawra belts from Ghana. To the south of the project area is the western extension of the Bui belt from Ghana.

The Bui Belt is noted for the occurrence of Tarkwaian sediments which host the Damang and Tarkwa deposits. These greenstone belts have proven gold mineralisation; the Boromo Belt in Burkina Faso hosts the Centamin Konkera resource (3.3 Moz a 1.7 g/t) and the Cluff Resources Poura mine (1.5 Moz of historic production at 13.5 g/t Au). The Wa Lawra Belt hosts Azumah Resources Kunche and Bepkong deposits (1 Moz at 1.5 g/t Au), while the Bolgatanga Belt hosts the Youga and Namdini deposits held by MNG Gold and Castle Resources.

Abengourou 100% owned (718km2)

The project is located to the north of the interpreted structural extension of the Sefwi greenstone belt and Sunyani Basin from Ghana. The Sefwi Belt hosts Newmonts Ahafo Mine (23 MOz) and, as well as the Bibiani (7 MOz, Resolute Mining) and Chirano (5 Moz, Kinross) deposits. The Amelekia permit area was formerly held by Golden Star Resources who completed initial exploration over the project area. Work completed included significant amounts of geochemistry, consisting of stream sediment sampling, soil sampling and hand Auger sampling, this work was completed in conjunction with geological and regolith mapping. The project area is predominantly underlain by a sequence of folded metasedimentary rocks consisting of siltstones and arenites, higher plateau in the area are predominantly in-situ laterites. Shearing and gold mineralisation appears to be associated with fold parallel shear zones which trend northeast/southwest throughout the project area.

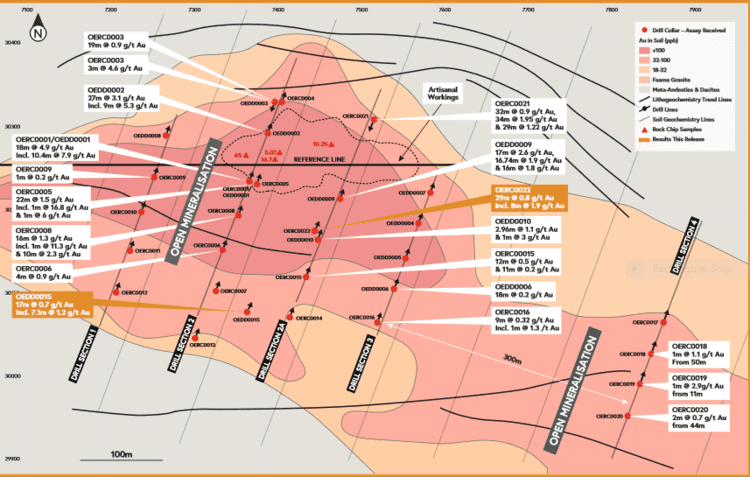

A late 2019 discovery at the Company’s Odienné Gold Project—the Empire prospect—has been generating significant assay-related newsflow over the past 12 months.

2 discovery holes were tagged during this Phase-1 program…

- OEDD0001 – The discovery Hole

- 18.15 meters at 4.9 grams g/t Au from 40 meters downhole,

- including 10.4 meters at 7.9 g/t Au from 40 meters downhole

- 18.15 meters at 4.9 grams g/t Au from 40 meters downhole,

- OEDD0002 – A Scissor of OEDD0001

- 27 meters at 3.1 g/t Au from 43.2 meters downhole,

- including 9 meters at 5.3 g/t Au from 43.2 meters downhole.

- 27 meters at 3.1 g/t Au from 43.2 meters downhole,

Hole OEDD0009, a 100 meter stepout tagged three broad zones of strong mineralization (with visible gold) along strike to the east…

- OEDD0009

- 17 meters at 2.6 g/t Au from 40 meters downhole,

- including 2.65 meters at 15.4 g/t Au from 40 meters,

- 16.74 meters at 1.9 g/t Au from 74.26 meters downhole,

- including 9.28 meters at 2.7g/t Au from 80.72 meters,

- 16 meters at 1.8 g/t Au from 98 meters downhole,

- including 3 meters at 7.6 g/t Au from 111 meters downhole.

- 17 meters at 2.6 g/t Au from 40 meters downhole,

Another highlight from this Phase-1 campaign…

- OERC0021

- 2 meters at 4.8 g/t Au from 53 meters downhole,

- 18 meters at 3 g/t Au from 97 meters downhole (including 2 meters at 15.5 g/t Au from 111 meters downhole),

- 29 meters at 1.2 g/t Au from 134 meters downhole,

- including 11meters at 2.5 g/t Au from 140 meters downhole and 2 meters at 5.6 g/t Au from 140 meters downhole.

True width = approximately 75 to 90% of the reported interval.

A complete list of all drill results from this Phase-1 program can be perused via this February 26th press release:

Awalé Resources – Final Results and Completion of Phase 1 Drill Program for the Empire Discovery

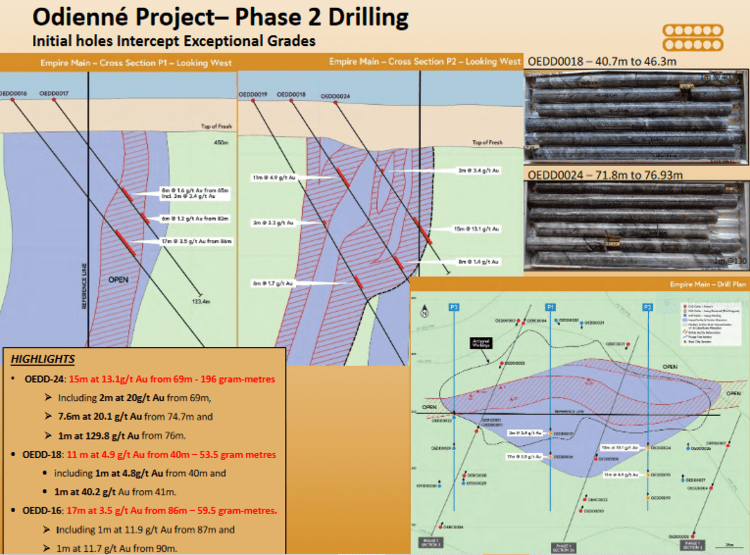

Earlier this summer, the Company announced a Phase-2 drilling campaign—a 5,000 meter 50 hole program (combination RC and DD)—a program designed, in part, to chase the potential down-plunge extensions of the mineralization tagged in discovery holes OEDD0001 and OEDD0002.

An October 7th press release—Further High Grade Intercepts from the Empire Gold Discovery, Odienné, Côte d’Ivoire—delivered fresh assays from the Phase-2 program.

HIGHLIGHTS

- OEDD-16: 17 meters at 3.5 g/t Au from 86 meters downhole (including 1 meter at 11.9 g/t and 1 meter at 11.7 g/t from 87 and 90 meters respectively);

- OEDD-17: 8 meters at 1.6 g/t Au from 65 meters (including 3 meters at 3.4 g/t Au from 66 meters and 6 meters at 1.2 g/t from 82 meters).

This next batch of holes, furnished via an October 28th press release—Awalé Resources Intersects 13.1 grams per tonne Gold over 15 meters at the Empire Discovery, Odienné, Côte d’Ivoire—represent 30 meter stepouts to the east.

HIGHLIGHTS

- OEDD-24: 15 meters at 13.1 g/t Au from 69 meters (including 2 meters at 20 g/t Au from 69 meters, 7.6 meters at 20.1 g/t Au from 74.7 meters, and 1 meter at 129.8 g/t Au from 76 meters);

- OEDD-18: 11 meters at 4.9 g/t Au from 40 meters downhole (including 1 meter at 4.8 g/t Au and 1 meter at 40.2 g/t Au from 40 and 41 meters, respectively;

- OEDD-19: 2 meters at 3.2 g/t Au from 70 meters, and 6 meters at 1.7 g/t Au from 103 meters.

Hole OEDD-24 is a fat hit. The sub-interval—1 meter at 129.8 g/t Au—opens up the potential for additional bonanza grades at Odienné.

Glen Parsons, Awalé’s CEO:

“The postulated high-grade plunge is proving correct with the spectacular intercept of 15m at 13.1 grams gold from OEDD0024, which is a step east of known mineralisation. Furthermore, OEDD0018 has reported 11m at 4.5 grams gold which represents a potential second zone of mineralisation that was also seen in OEDD0009 from the discovery program.

Turning the rig to drill from south to north on this program has proven successful, as our knowledge continues to grow on optimal orientation. This orientation has further revealed a new NNE-NE gold mineralised vein orientation. The final 2 holes of the diamond program (OEDD0031 and 32) are drilled from north to south and to the southeast to test this new orientation. More visible gold has been seen in these 2 holes than any of the previous drilling with much of the gold being hosted in the new vein orientations. This new orientation opens interpretation to steep plunging lodes as well as the current shallower plunge tested in this program.”

Phase-2 drilling at Empire Main is now complete with 13 holes drilled for 1695 meters.

Assays are pending for an additional 8 stepout holes.

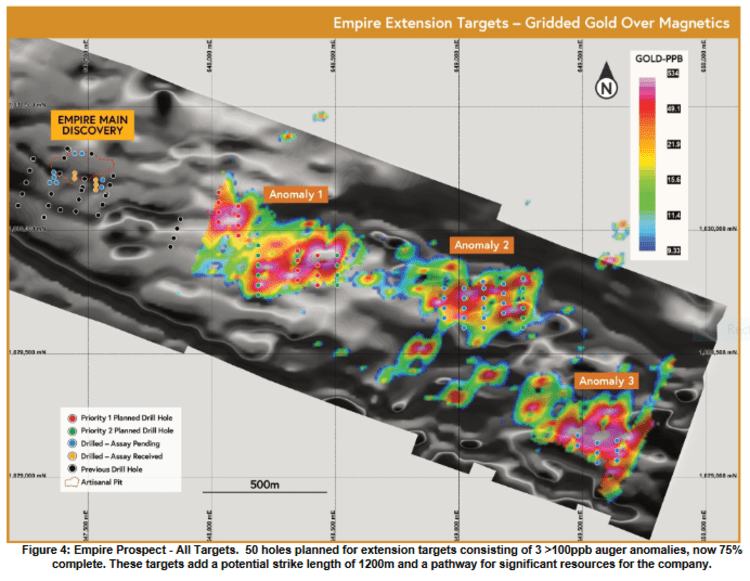

The exploration upside (this is where it gets interesting)…

The surface footprint at the Empire Main discovery zone may appear limited, but as noted above, there’s potential at depth and to the northeast (assays are pending for holes 31 and 32).

Earlier this year, auger results, anchored by a large gold-in-soil anomaly, defined three high priority targets—a significant stretch of mineralized strike.

These anomalies display a similar gold and pathfinder geochemistry to the discovery zone and hold the potential to add a further 1.2 strike kilometers of mineralization.

These anomalies were never given a proper probe with the drill bit. Note the scale on the map below.

Regarding the drilling recently conducted on these anomalies during this Phase-2 campaign, CEO Parsons stated:

“Encouragingly, target Geology has been intercepted by RC and Diamond drilling at both these anomalies with similar alteration, sulphide species, and host rock geology as at Empire Main. Visible gold bearing brittle ductile zones were logged in hole OEDD0020 at Anomaly 2.

We are excited by the continuation of geology and alteration seen in drill chips and DD core from the extension drilling and look forward to receiving results from these anomalies and potentially moving toward discovering more high-grade mineralization at the current known 3km mineralized Empire target area. These 3 targets have potential to build significant resources at the Odienné project.”

The Company is targeting a global resource of 1 million-plus ounces for the Empire Main discovery zone and the anomalies defined to date.

It’s important to note that the Company has tested only 3 kilometers of strike along a 20-plus kilometer structure.

The exploration upside at Odienné has to be considered excellent.

Final thoughts

The Awalé team is solid. Super solid. Several of the names here were behind Mariana Resources, a company that was taken out by Sandstorm Gold (SSL.T) for its uber high-grade Hod Maden project in northeastern Turkey. Extorre Gold, acquired by Yamana Gold (YRI.T) during the previous bull cycle, is another company that stands out among management’s resumes (Extorre was a spinout of Exeter).

The Company has 124.07 million shares outstanding and a market cap of $14.89M based on its recent $0.12 close.

Management and directors own ~28% of the Company, Sandstorm Gold holds 17.21%, Capital DI holds 12.18%.

Regarding newsflow going forward, in the October 28th press release, CEO Parsons stated…

“The pipeline of assays from completed holes is now in motion and we look forward to reporting results as and when they are received.”

The following link offers a very insightful interview with Awalé CEO Parsons…

Awale Resources – Following up on the best drill results to date at the Empire Discovery

END

—Greg Nolan

Full disclosure: We do not have a marketing relationship with Awalé.

Leave a Reply