On a down day for the metals and the Dow 30 taking it squarely on the chin with an 800 point shellacking, East Asia (EAS.V) bucked the trend and put on a really big show (Ed Sullivan voice).

This impressive price trajectory—a 50% charge to higher ground—was accompanied by huge volume.

The reason for the price/volume strength? After halting the stock for a session and a bit, East Asia dropped the following headline during the mid-morning session today (September 3rd):

East Asia Minerals Receives AMDAL Environmental Permit Approval for Sangihe Gold Project

For East Asia faithful, this was a watershed event.

After a meeting between the North Sulawesi government and community representatives on September 2, East Asia received AMDAL environmental permit approval for its Sangihe development project.

“In furtherance of the issuance of the final permit, the Company is now attending to the preparation and submission of the necessary filings to complete the process. The Company expects the permit will be issued in the next few days. EAMC will immediately apply for an upgrade of the licence to 30-year operation production status.”

For those new to East Asia story

Those who were active in the junior exploration arena during the previous bull cycle in gold may remember East Asia having staged a rally of epic proportions, from penny-stock-status to a market cap north of $600M, before collapsing back in on itself.

East Asia is an Indonesian story.

As a mining destination, as measured by the esteemed Fraser Institute in their most recent “investment attractiveness” survey, Indonesia is climbing the charts, demonstrating an improving climate for mining executives and investors, attracting renewed exploration and investment activity from mining enthusiasts around the world.

Currently ranked 27th out of the 76 countries profiled, this densely populated nation beats out five Canadian provinces and a territory.

Of interest to speculators looking for opportunities in the junior arena, Indonesia boasts some truly spectacular Tier-1 deposits, Freeport-McMoRan’s Grasberg being the standout with over 67 million ounces in gold reserves. I believe that particular ounce-count, spread out across three operating mines—the Grasberg open pit, the Deep Ore Zone underground mine, and the Big Gossan underground mine—represents the largest inventory of gold ounces on the planet.

East Asia controls two highly prospective Indonesian based properties in its project portfolio—Sangihe and Miwah.

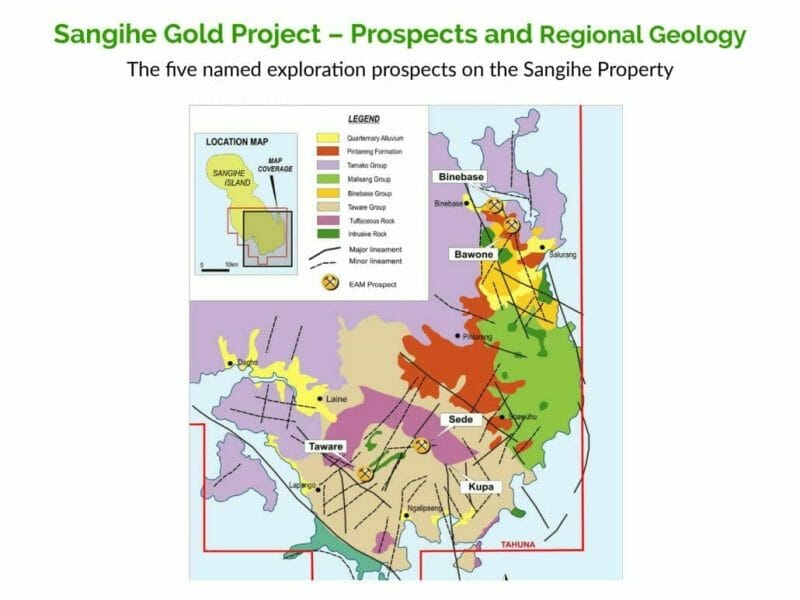

The Sangihe Gold Project—two blocks covering the Taluad and Sangihe Islands located between the northern tip of Sulawesi Island (Indonesia) and south tip of Mindanao (Philippines)—currently bears flagship status.

Sangihe is on a fast track to production.

This 42,000-hectare land package consists of three main areas of interest: the Bawone and Binebase prospects on the eastern side of the island, and the Taware prospect further to the south.

There is good infrastructure throughout the region.

The resources slated for extraction are as follows…

EAS management has its sights set on a modest heap leach production scenario, and today’s headline represents a major push along the development curve.

Stage One of the Sangihe mine plan will see the extraction of roughly 1,000 ounces of gold per month when the production facility is fully operational.

One thousand ounces per month may not sound like much, but this is only the first phase of many, and Sangihe’s economics are robust.

Estimated all-in costs = roughly $700 per ounce.

If you factor in current gold prices, we could see free cashflow of $1,250 per ounce or $1.25M per month.

This kind of cashflow would allow the company to self-fund exploration across its extensive land base, augmenting an already significant ounce count.

A closer look

What a lot of people may be missing here is the exploration and resource expansion upside in the vicinity of the above resource—the gold ounces slated for near-term production.

The above resource represents only a fraction of what lies in Sangihe’s subsurface layers.

The deposit itself—the ounces outlined in the 2017 resource summary— are located at Binebase (top right, map below).

Located between Binebase and Bawone (top right, above map) is an Inferred resource of 835,000 oz. of gold and 11,926,000 oz. of silver.

A planned phase one drilling campaign along the Binebase-Bawone Corridor will bring these additional ounces into play.

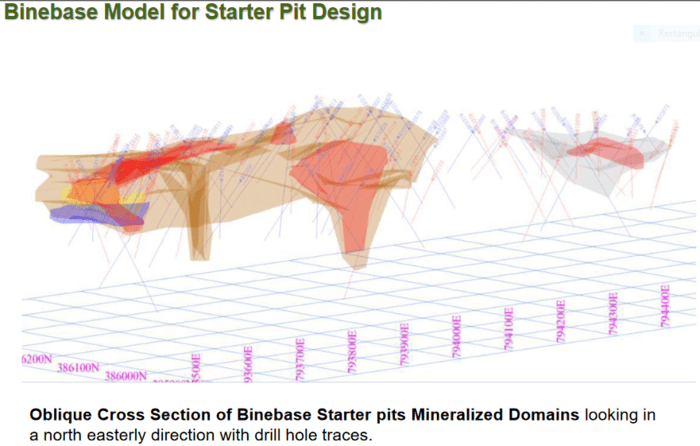

Binbase drilling (past and current) tagged the following values:

- BID-14 drilled 96.2 meters of 1.30 g/t gold, 48.25 g/t silver and 0.05% copper from surface (including 42.0 meters of 2.67 g/t gold, 86.38 g/t silver and 0.09% copper from 3.0 meters depth);

- BID-15 tagged three separate intervals: 62.0 meters of 2.00 g/t gold plus 45.5 meters of 1.98 g/t gold plus 8.5 meters of 2.28 g/t gold.

Those are some solid hits—super solid. They may be indicative of what else lurks along Sangihe’s untested subsurface layers.

This is one of several slides I plucked from the company’s recently updated corporate presentation—slides (#10 thru 14) that demonstrate Sangihe’s exploration upside:

All told, there are 25,000 hectares of prospective terrain that geologist Frank Rocca—a former Barrick man—estimates the potential for at least 2,000,000 ounces of Au.

What to expect over the balance of the year, and the first quarter of 2021

People might be wondering, “what can we expect over next the few months?” Good question. The following is my best guess as to how things will play out:

Now that the AMDAL is in hand, the company can apply for the production license—an upgrade to a 30-year operation license which can be further upgraded another 20-years (to 50).

Next, the company will deal with deadrent (deadrent is an annual mining license tax paid to the federal government based on a cost-per-hectare for the area that makes up the Sangihe gold project). East Asia will use funds from recently exercised warrants to pay down the US$400,000 it owes for past and current deadrent. Done deal.

After the production license is in hand—a mere formality now that the AMDAL is squared away—compensation will be dealt out to local land users. The process of conducting land inventory and surveys for crops, trees, and vegetation has already begun (East Asia press release dated August 20th). To ensure that any disputes that may arise from this compensation process are dealt with expeditiously, the company has contracted a legal team, one that specializes in these matters. This is a very heads up move on management’s part—it should ensure a seamless transition to the next phase at Sangihe—breaking ground.

Regarding this contract, East Asia CEO, Terry Filbert, stated the following:

“This contract provides us with complete support and guidance to ensure a smooth land acquisition process that will provide fair and accurate compensation to all landowners. The land acquisition will be a 20-year lease with government set compensation based on an analysis of the land, crops, trees and vegetation in accordance with the Martin Jati survey. This is a detailed process that is expected to take two to three months to complete.”

While all of this is going on, the company will secure project funding. Details on that front shouldn’t be too far off.

All the above should be completed within the next two months—let’s call it three (shit happens).

By December of 2020, the company will have broken ground at Sangihe.

And by March of 2021, we should see our first gold pour—that’s my best guess.

In chatting with CEO Filbert earlier today, I learned that his COO, Garry Kielenstyn, is planning a move from Jakarta to Sangihe within the next few weeks in order to hit the ground running as soon as he’s given the green light.

“Garry has a long and successful track record for bringing projects through construction to production in remote parts of Indonesia. He holds the position of Indonesian Registered Mine Manager (Kepala Teknik Tambang).”

CEO Filbert informs me that his team is mostly in place. He’s using the same crew he’s used in previous mining operations.

According to Filbert, the gold reef material they’ll be mining at Sangihe is the same material they’ve mined elsewhere in the region.

Very simply… they’ll be doing it again.

Getting back to today’s headline—the receipt of the AMDAL—CEO Filbert again:

“This is a milestone achievement for EAMC, and I am very proud of the team for meeting all of the necessary requirements to get the Sangihe project approved for the AMDAL licence. Since joining EAMC in 2017, this has been my primary focus despite challenging markets for venture mining.”

“The timing has been fortuitous and impeccable given the recent rising of gold prices. The Company was able to take advantage of the delays we experienced waiting for the AMDAL environmental meeting to be held to initiate many of the steps necessary to secure the production licence, and prepare for construction.”

The other highly prospective property in East Asia’s project portfolio—the 3.4 million ounce Miwah Gold Project—is a subject we’ll explore another day.

END

—Greg Nolan

Full disclosure: East Asia is an Equity Guru marketing client. We own shares.

Leave a Reply