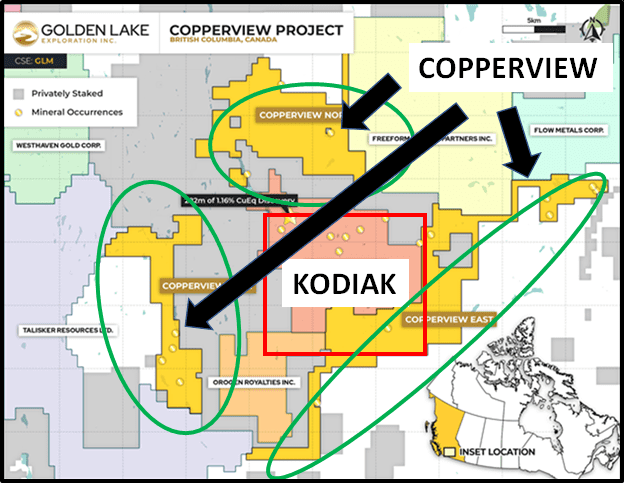

On September 8, 2020 Golden Lake Exploration (GLM.C) announced that it has bought the Copperview Project – expansive group of claims – located in south-central British Columbia.

“Mining Journal’s 2017 World Risk Report ranked BC as the least risky jurisdiction in the world for resource investment, largely on the back of its world-leading mining code,” states The BC Regional Mining Alliance (BC RMA), “Industry, Aboriginal groups and all levels of government are working together to encourage responsible resource development”.

The Copperview project, acquired from Donald Rippon of Mineworks Ventures, surrounds the MPD Property owned by Kodiak Copper (KDK.V).

The verb “surround” is used literally here.

If the MPD Property was an armed fugitive, and the GLM’s trio of claims were FBI agents, we would strongly advise the MPD property to come out with its hands up.

Kodiak Copper is a $60 million dollar company that controls the MPD copper-gold porphyry project in the prolific Quesnel Trough in BC, as well as the Mohave copper-molybdenum-silver porphyry project in Arizona, USA.

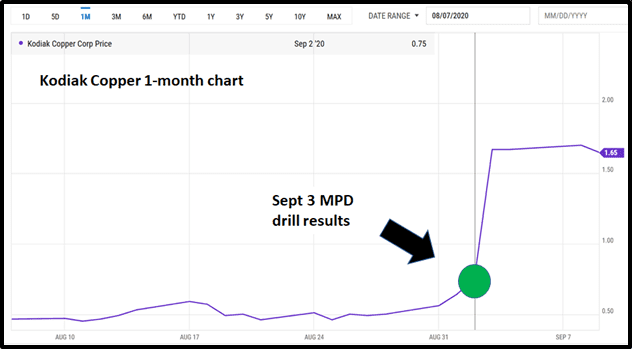

Six days ago, Kodiak reported the discovery of a significant high-grade copper-gold extension of the recently discovered Gate Zone at MPD.

A 282 metre section of strongly mineralized and altered drill core from drill hole MPD-20-004 (drilled to 785 metres and partially reported herein) was prioritised and rushed through assay, returning 0.70% copper, 0.49 g/t gold and 2.64 g/t silver (1.16% CuEq*) over 282 metres from 263 to 545 metres

“We view this new discovery as transformative for the project, and by extension for Kodiak,” stated Claudia Tornquist, President and CEO of Kodiak who believes the new high gold values would be considered “a successful stand-alone gold discovery in the absence of any copper.”

“Given our 100% ownership of MPD, and its position adjacent to highways with year-round accessibility, we anticipate a very active remainder of 2020,” added Tornquist.

The “collective wisdom of the market” deemed the drill results significant.

The Copperview project comprises 17 claim blocks totaling over 204 square kilometers (20,437 hectares).

That’s about 40 times the size of Stanley Park.

Infrastructure Highlights:

- Southern extent traversed by the Peachland-Summerland Hwy

- Hwy parallels the railroad tracks.

- The northern portion of the project area is just south of Hwy 97C

- Western claim groups are traversed by Hwy 5A.

- Extensive network of logging and ranching roads allows year-round access to most target areas over the project area.

The Copperview project covers, or is adjacent to, nine known mineral showings and three historical small placer gold operations.

The southeast and east portions of the Copperview project are contiguous to Kodiak’s MPD Property.

Most of the Copperview project has seen only limited exploration activity and only a few shallow drill holes.

Historic exploration focused largely on exposed surface mineral showings.

Several large untested copper-in-soil and gold-in-soil anomalies can be quickly advanced to new near-term drill targets.

“With some exploration activity dating to the 1960-1970s, many historical copper intervals were not assayed for gold, representing underexplored gold potential,” states GLM.

Key Acquisition Deal Points to take 100% ownership:

- GLM to pay $200,000 cash

- GLM to issue two million shares

- GLM to spend $1 million in a 3-year time frame.

- A 2.5% Net Smelter Royalty (NSR) will be granted to the vendor

- 1.5% of the NSR can be re-purchased GLM for $1.5 million.

“The acquisition terms are favorable, and the ready access and setting allow for immediate field investigation of known showings and targets by our exploration team,” stated Mike England, President of Golden Lake, “The ability to work the project on a year-round basis complements nicely with our exploration activities on the Jewel Ridge gold project in Nevada.”

The flagship asset

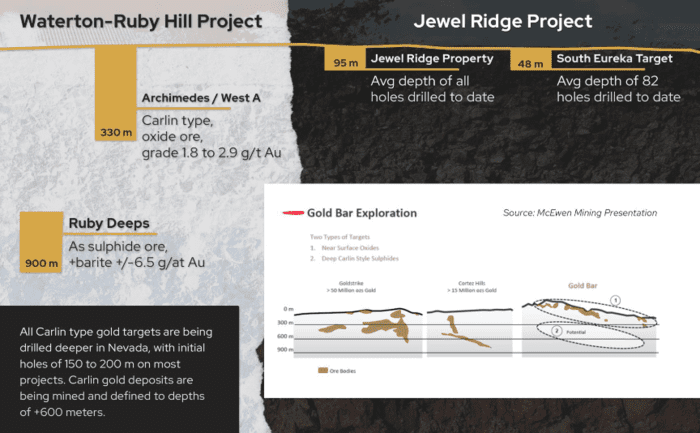

“Golden Lake is currently drilling its highly prospective Jewel Ridge Project located at the south end of Nevada’s prolific Battle Mountain—Eureka trend,” wrote Equity Guru’s Greg Nolan on August 21, 2020.

The deposit types of interest at Jewel Ridge are Carlin-type, sedimentary rock-hosted, gold deposits and carbonate replacement deposits.

Jewel Ridge is located adjacent to, and south of, the former Ruby Hill gold property produced about 680,000 ounces of gold from the Archimedes open pit.

From 1976–2012, the Eureka district produced about 1.38 million ounces of gold.

Importantly, according to Nolan, in a press release dated August 20th – Golden Lake Exploration inc. provides drilling update on Jewel Ridge Property– intersects significant oxide mineralization at depth at south Eureka Target – the second hole drilled at the South Eureka Tunnel target intersected a significant width of oxide mineralization at depths that have never been probed historically.

Quoting Nolan’s article:

“This oxide material was encountered at 183 meters but the hole was lost at 206 meters, bottoming out in mineralization.

Deeper we go…

The occurrence of alteration and strong oxidization at these depths on the South Eureka Tunnel target represents a new target that will require additional drilling. The deepest previous hole on this target was drilled in the 1980s to a depth of 340 ft (104 m). The Company is proposing to deepen two of its planned holes of this Phase 1 program to test the deep oxide target.

The Company is negotiating with the drill contractor for a return to the Jewel Ridge property for a Phase 2 drill program. As part of this planned program, the Company will make necessary site preparations to allow the drilling of deeper holes (230 to 275 meters depth) to test the new deep oxide target.

This is the kind of development that could really move the needle for Golden Lake.

A potential analog…

The Ruby Hill mine further to the north has a deep sulphide zone—the Ruby Deeps—with grades in the range of 6.5 g/t Au.

Back to this recent acquisition

GLM will publish exploration plans on the Copperview project following a detailed review of existing geological data and a site visit to the BC property.

- Lukas Kane

Full Disclosure: Golden Lake Exploration is an Equity Guru marketing client. We own shares.

Leave a Reply