On October 5, 2020 Fremont Gold (FRE.V) announced that the company has “received nearly all the remaining assay results from the recently completed phase 1 drill program at the past producing Griffon gold project, located at the southern end of the Cortez Trend, Nevada”.

Note: Fremont will be hosting a webinar on Thursday, October 8, at 11am EDT to discuss both the Griffon drill results and its plans to drill North Carlin.

Register for the webinar here:

Vancouver Area Warning: 11 a.m. EDT is 8:00 a.m. our time.

That’s 70 minutes after sunrise.

“Vancouver people have such a laid-back lifestyle,” one Chinese executive complained to the Globe & Mail, “They never work in a hurry.”

Come guys, let’s show them we can do it.

“In Nevada, Carlin-type gold deposits have a combined mineral endowment of more than 250 million ounces, all concentrated along four main trends: Carlin, Cortez (Battle Mountain-Eureka), Getchell, and Jerritt Canyon,” stated Equity Guru’s Greg Nolan on August 6, 2020.

“This was the first drill program to be completed at Griffon since it was in production in the late 1990s,” stated Blaine Monaghan, CEO of Fremont. “A lot more work needs to be done and now that we have the results, we can begin planning the next phase of exploration.”

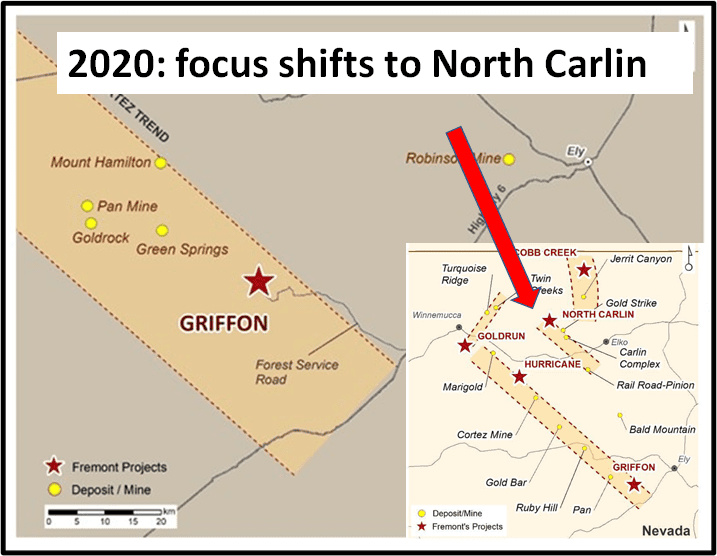

“In the meantime, while that planning is underway, Fremont is readying to launch a fall drill program at its 100% owned North Carlin gold project,” continued Monaghan, “which is located at the northern end of the prolific Carlin Trend in Nevada.”

The market reaction to this news was negative.

By mid-morning trading, FRE was down 26% to .07 on 2 million shares traded.

A few hours later, COVID-19 infected President Donald Trump tweeted opposition to the House Democrats’ $2.4 trillion virus relief proposal, the Dow quickly fell 350 points and gold fell $30 to USD $1,889.

By market close, FRE was down 31% to .065 on 2.8 million shares traded.

“The gold values in the newly reported holes really are very low and clearly uneconomic,” stated one investor on CEO.ca, “The market says -30% on 3x average volume, which we might translate as ‘the early Griffon intersect may become a story much later, but this is going to be dead money for quite a while, and we’re shifting to other bets’”.

The public commentary on CEO.ca is generally at a higher calibre than the typical “Your-Mother-blows-donkeys” variety on other investor bull-boards.

For the next 12 months, eyeballs will shift to the North Carlin gold project, although history suggests the Griffon project may still hold riches.

Case in point, in May of 1996 Arequipa Resources plunged sickeningly from $36 to $18, on the back of some weak drill results.

Platoons of indignant investors fired up their megaphones and shouted “Pump & Dump!”

A few months later, Barrick Gold (ABX.T) bought out Arequipa for a $1 billion.

“In the summer of 1996, Barrick made a cash-only, $969-million bid for the shares of Arequipa on the basis that the project had 5 million oz. in the ground,” stated The Northern Miner.

Arequipa played it cool, holding out for an improved deal, until Barrick announced a revised bid valued at more than $1 billion.”

In 2000, the Arequipa Peru gold asset produced 821,614 ounces of gold at a total cash cost of US$43 per ounce.

The Griffon project may or may not experience an Arequipa-style turn-around, but one thing’s for damn sure: with a micro market cap of $5.7 million, Fremont Gold still has unlocked value.

“Fremont is pleased to announce its plans to drill the North Carlin project, which is located on the northern end of the prolific Carlin Trend,” stated FRE.

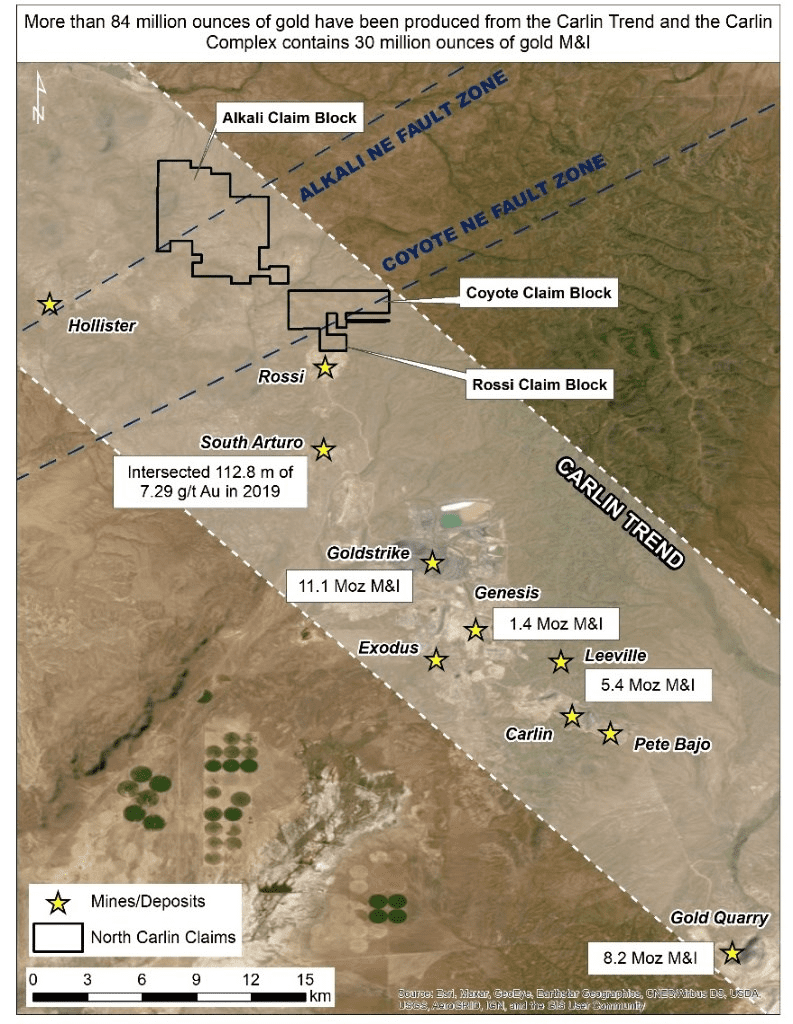

The Carlin Trend is one of the richest gold mining districts in the world having produced over 84 million ounces of gold since the early 1960s.

Strategically located at the northern end of the Carlin Trend, North Carlin is over 42 km2 in size and is approximately 6 km north of and on-strike of Nevada Gold Mines/Premier Gold Mines’ South Arturo mine, where recent drilling intersected 39.6 metres of 17.11 grams per tonne gold, and 12 km northwest of Nevada Gold Mines’ Goldstrike mine, which hosts 11.1 million ounces gold in the measured and indicated category.

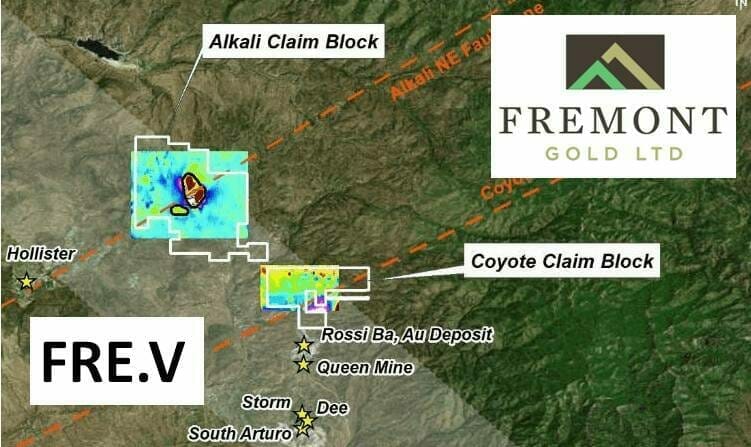

Situated in the right geological setting for the discovery of a major gold deposit, Fremont staked the claims comprising North Carlin (the Alkali, Coyote and Rossi claims) in 2017.

Since then, FRE has developed several never before drilled targets based on soil geochemistry, gravity and geomagnetic surveys, and the projection of faults that control gold mineralization in the Carlin Trend.

At Griffon, gold is tightly controlled by numerous faults. Fremont’s first phase of drilling tested targets across the length of the project area, targeting soil geochemical anomalies and mapped faults.

Drilling the projected faults that control gold mineralization in the Hammer Ridge pit will be a top priority in the next phase of exploration at Griffon.

To reiterate: Fremont will be hosting a webinar on Thursday, October 8, at 8:00 a.m. Vancouver time to discuss both the Griffon drill results and its plans to drill North Carlin.

Register for the webinar here:

- Lukas Kane

Full Disclosure: Fremont Gold is an Equity Guru marketing client.

Leave a Reply