Gold is currently trading around USD $1,945/ounce – up $200/ounce in the last year.

The current macro argument for high gold prices hinges on the accelerating degradation of fiat currency (paper), through money printing.

The same argument was in vogue in ten years ago. Many pundits predicted gold would spike to $5,000/ounce. That didn’t happen. Long term gold investors have shown patience.

Although the Fed is raising interest rates, with inflation running hot at 7.9% real rates are negative (investors buying bonds are guaranteed to lose purchasing power) – a positive environment for gold.

With $30 trillion of U.S. government debt, a single percentage point rise in interest rates adds $305 billion in debt servicing costs.

If investors flee to gold, aggressive little explorers like Falcon Gold (FG.V) will benefit from this mass migration of wealth.

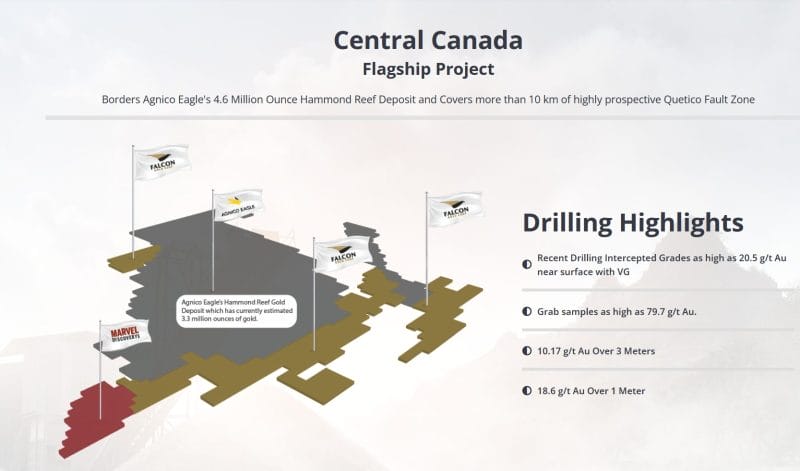

Falcon Gold’s flagship asset is its Central Canada Gold Project (CCGP), located 160 kilometers west of Thunder Bay Ontario (in proximity to Aginco Eagle’s Hammond Reef deposit).

Falcon’s Other Mineral Assets:

- The Esperanza Gold/Silver/Copper mineral concessions located in La Rioja Province, Argentina.

- The Springpole West Property in the world-renowned Red Lake mining camp

- a 49% interest in the Burton Gold property with Iamgold near Sudbury Ontario

- The Spitfire-Sunny Boy, Gaspard Gold claims in BC

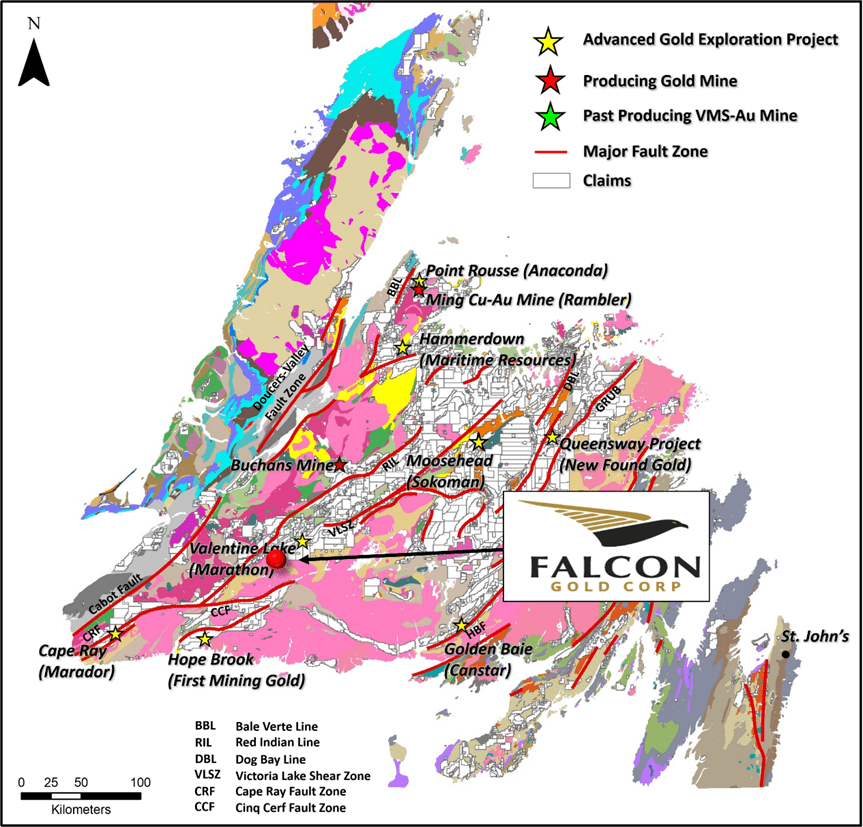

- The Great Burnt, Hope Brook, and Baie Verte acquisitions adjacent to First Mining, Matador Benton-Sokoman’s JV

- Marvel Discovery in Central Newfoundland

Central Canada Gold Mine History:

- 1901 to 1907 – Shaft constructed to a depth of 12m and 27 oz of gold from 18 tons using a stamp mill.

- 1930 to 1934 – Central Canada Mines Ltd. installed a 75 ton per day gold mill. Development work included 1,829 m of drilling and a vertical shaft to a depth of 45 m with about 42 m of crosscuts and drifts on the 100-foot level. In December, 1934 the mine had reportedly outlined approximately 230,000 ounces of gold with an average grade of 9.9 g/t Au.

- 1935 – With the on-going financial crisis of the Great Depression, the Central Canada Mines was unable to fund operations and the mine ceased operations.

- 1965 – Anjamin Mines completed diamond drilling and in hole S2 returned a 2 ft section of 37.0 g/t Au and hole S3 assayed 44.0 g/t Au across 7 ft.

- 1985 – Interquest Resources Corp. drilled 13 diamond holes totaling 1,840m in which a 3.8 ft intersection showed 30.0 g/t Au.

- 2010 to 2012 – TerraX Minerals Inc. conducted programs that included line cutting, geological surveys and 363 m of drilling.

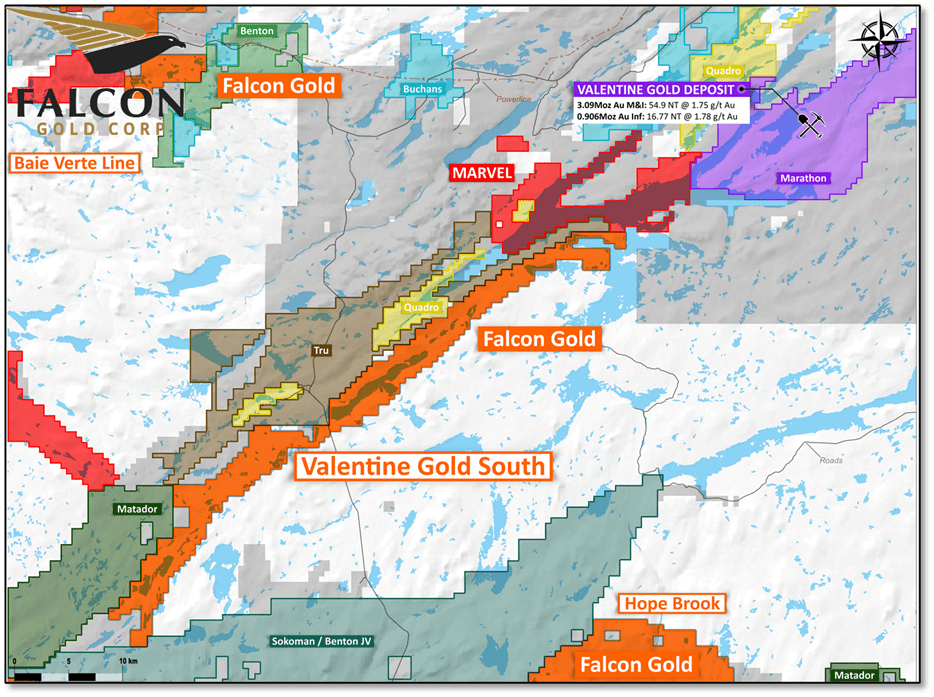

On March 10, 2022, Falcon Gold announced that it acquired, via staking, a very large and strategically located land position in the Valentine Lake South Area.

This new land position consisting of 605 claims (15,300 hectares) is contiguous to Marvel Discovery Corp, Matador Mining, and Tru Precious Metals Corp (TRU). The Property also lies along strike from the Valentine gold deposit which hosts 6.8 million ounces of gold (Moz. Au) (all categories) and is now under development.

Falcon has immediate plans to begin high resolution magnetic surveys upon approval of exploration permits.

During 2021, 22 holes were drilled by TRU on their Golden Rose Project, contiguous to the Valentine Gold South Project, and assay results are just now being released.

The first release of results includes 12 metres (m) grading 1.01 grams per tonne (g/t) Au from drill hole WL-21-12 and 7 meters grading 1.71 g/t Au from drill hole WL-21-06, including 2.39 g/t Au over 4 meters.

“Our in-house studies have concluded that these crustal scale deformation zones host Newfoundland’s larger gold deposits,” stated Falcon’s CEO Karim Rayani, “They commonly have second- to third-order structural components much like the gold deposits along the Cadillac-Larder Lake and Destor-Porcupine fault zones of the Abitibi Subprovince of Ontario and Quebec.”

“With Marathon & Matador as neighbours, we are ideally situated between two of the most significant gold deposits in Newfoundland,” added Rayani, “Our next steps are to run a high-resolution magnetic survey which will help map this large territory with braided shear zones which lie proximal to these major fault zones.”

“The newly acquired claims lie within the Valentine Lake Structural Corridor and in an area of very little historical exploration,” stated FG, “Recent structural interpretations of regional scale geophysical surveys led Falcon Gold to the staking of this large land package due numerous interpreted parallel trends and tertiary splay zones which are considered highly prospective for gold mineralization”.

“Central Canada Mines (CCM) operated in the area in the early 1930s and by December 1934 reportedly produced 230,000 ounces of gold with an average grade of 9.9 g/t gold,” reported Equity Guru’s Gaalen Engen on March 14, 2022, “CCM pulled up stakes shortly thereafter due to the untenable economic conditions of the Great Depression”.

“Since then, there have been various drill campaigns by different explorers unearthing intersections including 44.0 g/t gold over seven feet and 30.0 g/t gold over 3.8 feet.

Falcon Gold took up active exploration at the project in 2020, and since its inaugural drill program that year, the company has completed 26 diamond drill holes for a total depth of 4,058 metres.

The junior announced it will commence Phase III this month for three holes totaling approximately 1,000 metres at vertical depths between 200 and 300 metres to extend the gold bearing zones beyond the current drilled depth of 160 metres” – End of Engen.

“We are excited to finally test the historic Central Canada Mine Zone to a new target depth between 300-400m, not previously done by past operators,” stated Rayani.”

In the March 31, 2022 roundtable, four Equity Guru operatives, including EG boss Chris Parry, discuss Falcon Gold’s business objectives.

“Falcon has projects in BC, projects in Ontario, projects in Newfoundland, Argentina, Chile – the focus is definitely on the Central Canada flagship project, which basically ring marks around Agnico Eagle’s property,” stated Parry.

“In the last three months the Falcon share price has gone from five and a half cents, up to nine and a half cents. That’s a double. Well done players,” added Parry at the 16-minute mark of the March 31, 2022 video.

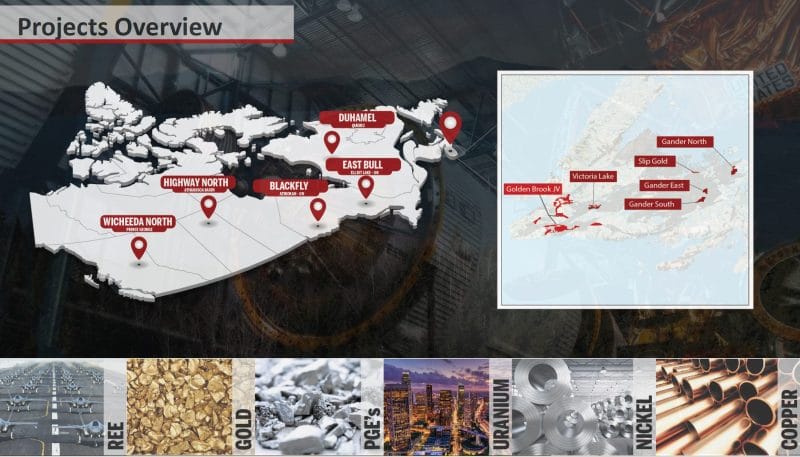

The CEO of Falcon Gold, Karim Rayani, is also the CEO of Marvel Discoveries (MARV.V).

“Marvel presents a slightly different story with its Canadian focus,” reported Gaalen Engen. “Marvel’s hand is varied with gold projects in Newfoundland, a nickel-copper-cobalt/Fe-Ti project in Quebec, precious metals, and rare earth metals projects in Ontario as well as a rare earth metals project in the storied Wicheeda Carbonatite Complex near Wicheeda lake in beautiful British Columbia.”

“The company’s Wicheeda North project is contiguous to Defense Metals Wicheeda REE property located 80 kilometres north of Prince George, BC.

Defense Metals boasts an indicated resource of 4.89 million tonnes at 3.02% light rare earth oxide, 2.1 million tonnes at 2.90% light rare earth oxide, using a cut-off grade of 1.5% total metal.

Marvel sits beside Falcon in Ontario with its Black Fly Gold Property located in the Atikokan gold mining camp. Black Fly also runs contiguous to Agnico Gold. Nine of the 16 holes have been completed in the company’s 2021 Phase 1 drill program at Black Fly intersecting multiple gold domains, including 50.6 g/t gold over 0.5 metres near surface as well as 1.06 g/t gold over 9.3 metres and 1.42 g/t gold over 4.0 metres.

The junior’s East Bull REE project hosts a possible extension of the Folson Intrusive Block. The Pecors Anomaly located to the west of Marvel’s holdings was drilled by International Montoro in 2015 and intersects were reported of 0.224 gpt Pt+Pd+Au over 22.45 metres beneath the overlying sediments.” – End of Engen.

On March 29, 2022 Marvel Discovery announced that it has entered into an option agreement to acquire two large claim groups the (“KLR” and “Walker”) from an arm’s length party.

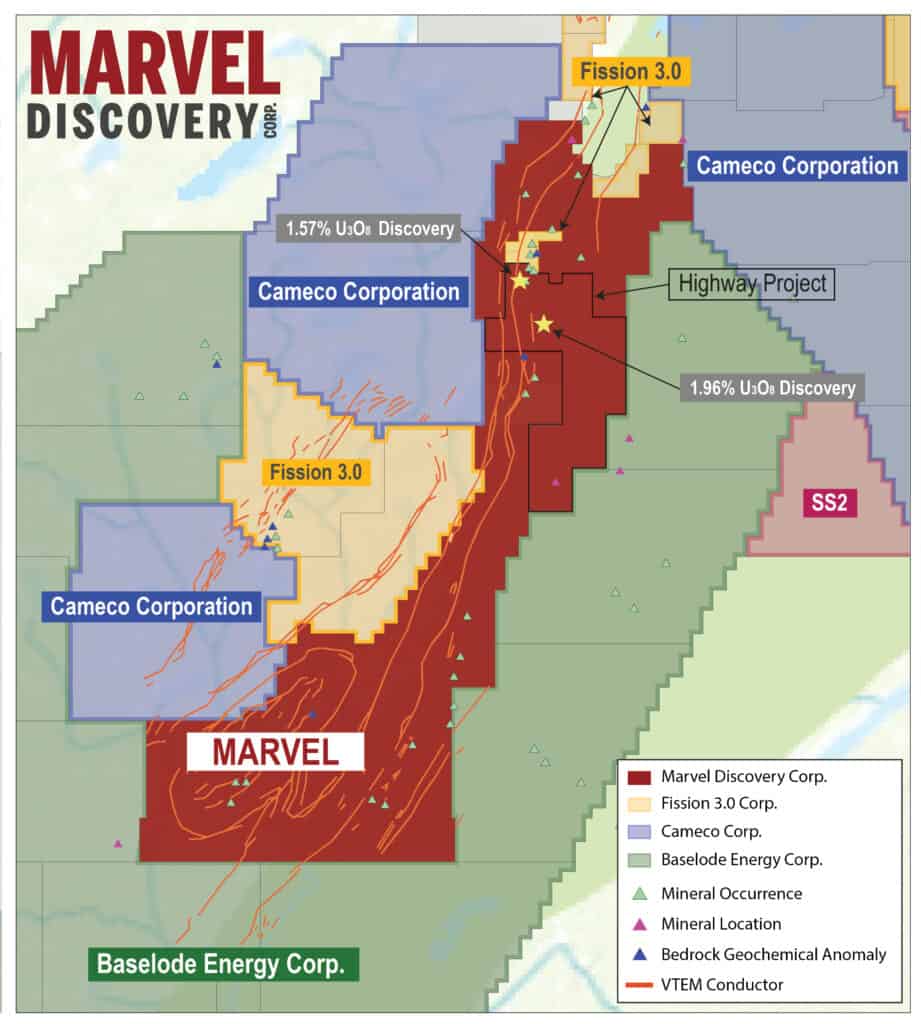

This puts Marvel along the Key Lake fault adjoining both Cameco and Fission’s property boundaries. The two claim groups collectively cover 14,190 hectares along the East, North and Northwestern directions.

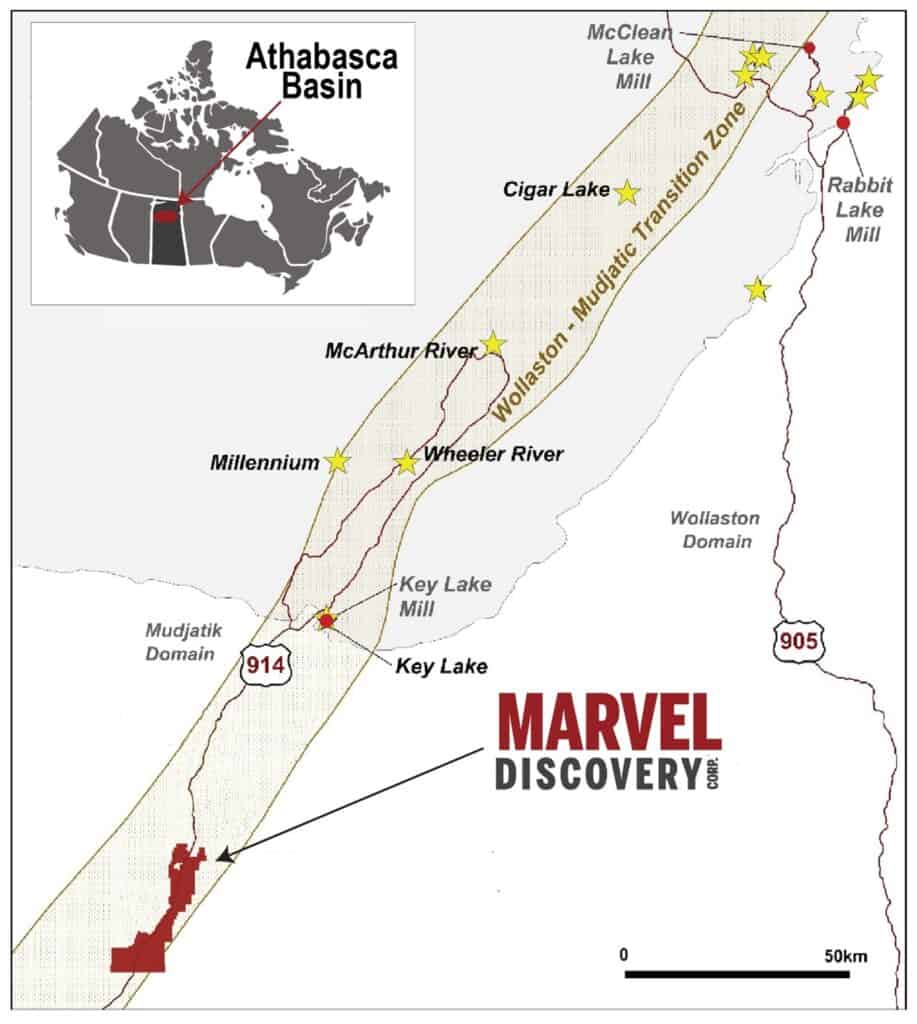

The project lies within the Wollaston-Mudjactic Transition Zone (“WMTZ”) of the eastern Athabasca Basin which is host to the highest-grade uranium mines in the world including:

- Cigar Lake1, 50% owned by Cameco, which hosts 152 million pounds (lbs) of U3O8 at 15.4% U3O8

- McArthur River2, 70% owned by Cameco which hosts 392 million lbs of U3O8 at 6.58% U3O8

- Wheeler Project3, 90% owned by Denison Mines which hosts 109 million lbs of U3O8 in two deposits averaging 11.23% U3O8

The KLR, first claim group consists of 3,595 hectares (ha) and is contiguous to the former producing Key Lake Uranium Mine.

“The Key Lake Deposit consisted of two mineralized zones which historically produced a total of 4.2 million tonnes of product at an average grade of 2.1% U3O8 (Harvey, 1999). The Key Lake Property is now host to the Key Lake Mill, owned, and operated by Cameco which processes ore from the McArthur River uranium deposit,” states Marvel.

“The Walker Property, second claim group covers an area of 10,595 ha and is contiguous to Fission 3.0 Hobo Lake uranium properties. Hosted within WMTZ, the Walker Property lies along the Key Lake Shear Zone and hosts 10 uranium showings and multiple unexplored EM targets. Both properties are easily accessible by highway. Exploration to date on the Properties has been limited.

These 2 claims groups are in addition to Marvel’s recent acquisition of the Highway North Project and are directly tied on to the North and South property boundaries within the same WMTZ corridor which covers an area of 2,573 ha (See Press Release Feb 28, 2022) Marvel now has a controlling interest in the camp totaling 16,763 ha.

“We are extremely fortunate to have acquired the KLR and Walker claim groups being directly tied on to the north and south of our recently acquired Highway North Project,” stated Rayani, “This brings our new total to over 16,000 hectares along a trend that hosts some of the highest-grade uranium mines in the world.”.

“Being next door to the former Key Lake Uranium Mine and Cameco’s Key Lake Mill is highly strategic move as we advanced the project,” stated Rayani, “This corridor along the Key Lake Shear Zone represents tremendous opportunity in mimicking the success of basement-hosted uranium deposits found on the western side of the Athabasca Basin like NexGen Energy’s Arrow Deposit.”

Both Properties straddle the Key Lake Fault Zone, an important corridor for structurally controlled Athabasca Basin type uranium deposits.

The Arrow Deposit, owned by NexGen Energy lies along a similar structural corridor as the Marvel properties. The Arrow Deposit1, which has undergone a Positive Feasibility Study with robust economics contains Probable Reserves of 239.6 million lbs of U3O8 at an average of 2.37% U3O8 and Measured and Indicated Resources of 256.7 million lbs at an average grade of 3.1% U3O8. The Arrow Deposit is the largest undeveloped uranium deposit in Canada.

The Transaction

Marvel has agreed to pay the vendor (the “Optionee”) a total of $550,000 over a 4-year period and incur $1,500,000 in exploration expenditures by the 3rd anniversary date of the signed agreement.

In addition, the Optionee will retain a of a 1.0% net smelter royalty (“NSR”), of which Marvel will have the right to purchase 100% of the NSR for $1,000,000.

Marvel Discovery is currently trading at .15 with a market cap of $13 million. Falcon Gold is trading at .09 with a market cap of $10.

Together – to paraphrase Chris Parry – this baker’s dozen of resource assets, run by Karim Rayani, is valued about the same as a shopping basket of Burnaby condos.

Full Disclosure: Falcon Gold and Marvel Discovery are Equity Guru marketing clients.

Leave a Reply