Finning International (FTT.T) is a Canadian infrastructure stock you may want to put on your radar. Sure, it isn’t sexy like most meme-stocks, but it is part of an invisible force that helps drive the structural progress of three continents. A silent soldier that soundlessly expands its business while paying a reliable quarterly 2.44% dividend to shareholders.

The company was founded in 1933 by Earl B. Finning, who had worked as a salesman for Caterpillar Tractor Co. in California and saw greener pastures in developing a new market in British Columbia. After riding out the depression, Finning had it good as British Columbia built itself out in the 50s and 60s.

Today, Finning is an international manufacturer of forestry equipment as well as the world’s largest Caterpillar dealer, selling, renting, and providing parts and service across multiple sectors such as mining, construction, petroleum as well as a wide range of power systems applications.

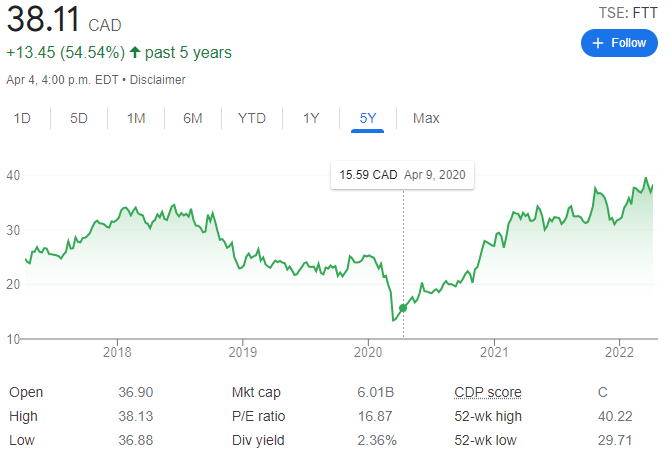

The challenges of the pandemic, lockdowns and supply chain hiccups saw the company’s share price slip more than half of its market cap back in March 2020 to trade at $13.40 CAD per share. However, Finning rose once again and just over a year later as the world continues to open and commodity prices continue to rise, the Canadian infrastructure stock is trading near all time highs.

End of year financials for fiscal 2021 pointed to a happier future as the company reported a 25% increase in revenue from 2020 at $1.1 billion compared to $887 million the year before. Net income increased as well, up 56.9% to $363 million, resulting in an EPS of $2.26 per share.

If you are into stock trading, Finning isn’t your play. This is a retirement Canadian infrastructure stock that pays off in decades rather than days. As such, it has heavily invested in the future announcing on September 3, 2021, that it had purchased a 54.5% controlling interest in ComTech, through its subsidiary, 4Refuel.

ComTech is an early-stage developer of alternative energy infrastructure and proprietary mobile refueling solutions for low-carbon fuels in North America which include CNG, RNG and hydrogen. The final purchase price allocation for ComTech is expected no later than June 30, 2022.

Finning also announced the acquisition of Hydraquip, UK’s second largest hydraulic hose replacement and repair company at the end of March. Hydraquip generated over £26 million in revenue for fiscal 2021. The purchase furthers Finning’s aim of creating a complete ecosystem of product support allowing customers to maximize uptime and reduce operating costs.

As trade disputes with Russia and China stiffen sanctions and increase tariffs for manufactured goods and commodities, Western industries will need to secure relationships with domestic manufacturers and suppliers. Since Finning is relatively agnostic in terms of sectors and businesses, it stands to benefit greatly from this shift.

However, when global relations go into the toilet, there is a good change that the economies involved will also be punished and since Finning survives on society’s growth and prosperity, it too could be impacted negatively. That said, any economic situation that sees a Canadian infrastructure stock take a beating, will most likely adversely affect stocks across the board. Thus, Finning will most probably remain on the strong side of the investment bell curve.

Admittedly as of December 31, 2021, the company was carrying $1.1 billion in long term debt, but it also reported $502 million in cash and cash equivalents, somewhat alleviating the risk of not being able to support its liabilities. Combine this with the fact Finning’s EBITDA to net debt ratio is 1.1 for 2021, and that risk declines even further.

Finning has been making major investments into its operations over the last decade and is reporting a respectable adjusted ROIC of 16.4% as of December 31, 2021, and 20.3% adjusted ROIC for its South American operations. This elevated ROIC performance had the stock returning approximately 49% to shareholders over the last five years.

Looking ahead, the company plans to spend between $240 million and $280 million in net capital expenditures and rental fleet additions during 2022. Finning also plans to continue implementing fixed cost initiatives globally while targeting mid-teen growth EPS growth during the year.

As mentioned earlier, the pandemic knocked the wind out of Finning’s stock value and as such, the company currently trades well beneath its intrinsic value, giving investors a good opportunity for growth.

Insiders have shown confidence in Finning, buying substantial amounts from the start of the year. I would be remiss to not tell you there were a few sell points as well, but the buys remain in the majority. Also, as retail investors own around 50% of the share base, the Canadian infrastructure stock isn’t lacking in liquidity.

Sure, you can pile your money into AMC as it flounders into mineral exploration, or the latest NFT craze, but if you’re looking to retire in comfort without the daily stress of trading flashy tech shares, you need to play the long game.

If you want a technical breakdown of Finning, check out Vishal’s piece!

Please do not forget to do your due diligence and speak with an investment professional before making any changes to your portfolio. Once you’ve done that, pick your winning Canadian infrastructure stock and secure your future. Good luck to all!

–Gaalen Engen

Leave a Reply