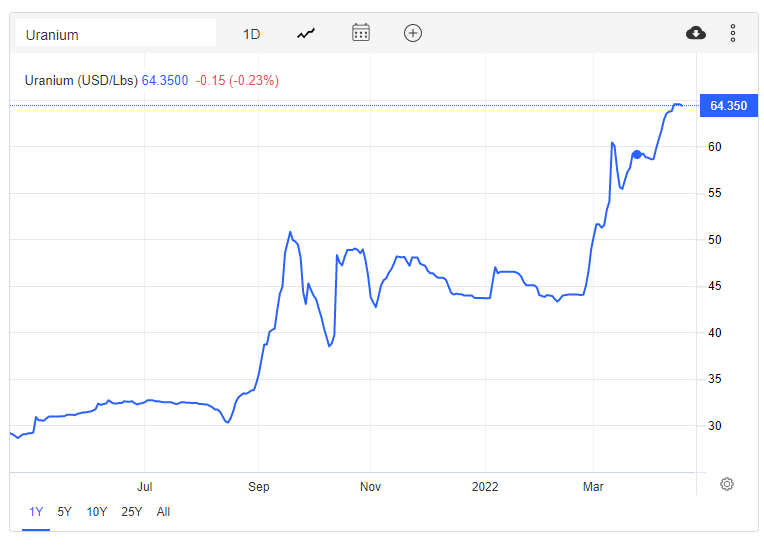

Uranium prices are pulling back after posting new highs for 2022. Is the upwards momentum over? No. Commodities remain the place to be for the inflation trade, and uranium has many other fundamentals backing it that are not only supply chain related.

Energy is going to be a big topic in Europe as nations such as Germany and France attempt to disconnect from Russia. Some are saying these nations will need to reactivate their nuclear power plants, and in fact, invest more in nuclear energy. Somebody might need to tell them that Russia still plays a large part in enriching Uranium and building modern day nuclear power plants. I digress, but you should read Marin Katusa’s “The Colder War” for more details. A lot of the information will be relevant to understand the grasp Russia has on multiple energy and commodity sources.

Earlier this month, I spoke about the resumption of the Uranium uptrend. In that article, I mentioned a few fundamental things which haven’t changed. Nuclear energy being the best clean energy source is still something extremely bullish for spot uranium.

The breakout we were watching for also occurred.

Uranium broke out above $60 printing new highs for 2022 at $64.50. And now, we just expect typical breakout price action. A possible pullback, or retracement, before the resumption of the uptrend. On the daily chart, this pullback could take us down to $60 again which would act as support. Bulls are hoping to see a nice wall of buyers there holding the line.

On the longer term monthly chart, we still have some room to the upside before we test our resistance zone at around $72.50. And remember, we could very well break above this. If so, there is a ton of room to the upside.

The Sprott Uranium Trust (ticker: U.UN) is the chart I bring up on all my uranium articles as it is perhaps the best way to play spot uranium. The chart structure is the same, and right now, we are looking for that retest of the breakout zone, just like spot uranium. Support is never just one number, but a zone. I would be watching for prices to remain above $18.00 in order to resume the uptrend.

Cameco is the major uranium producer in Canada and the chart is also showing signs of a pullback. In fact, many uranium plays both major and minor, are showing the same retest structure. They will move just like spot uranium. For investors, this means acquiring positions in companies to play for the next leg up. Here are a few company set ups I am watching.

enCore Energy (EU.V)

Market Cap ~ $565 million

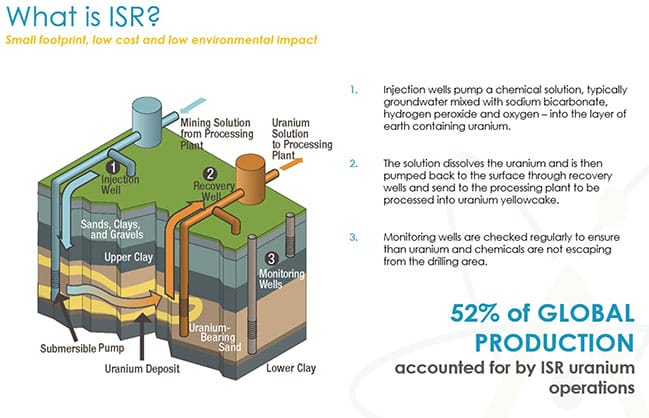

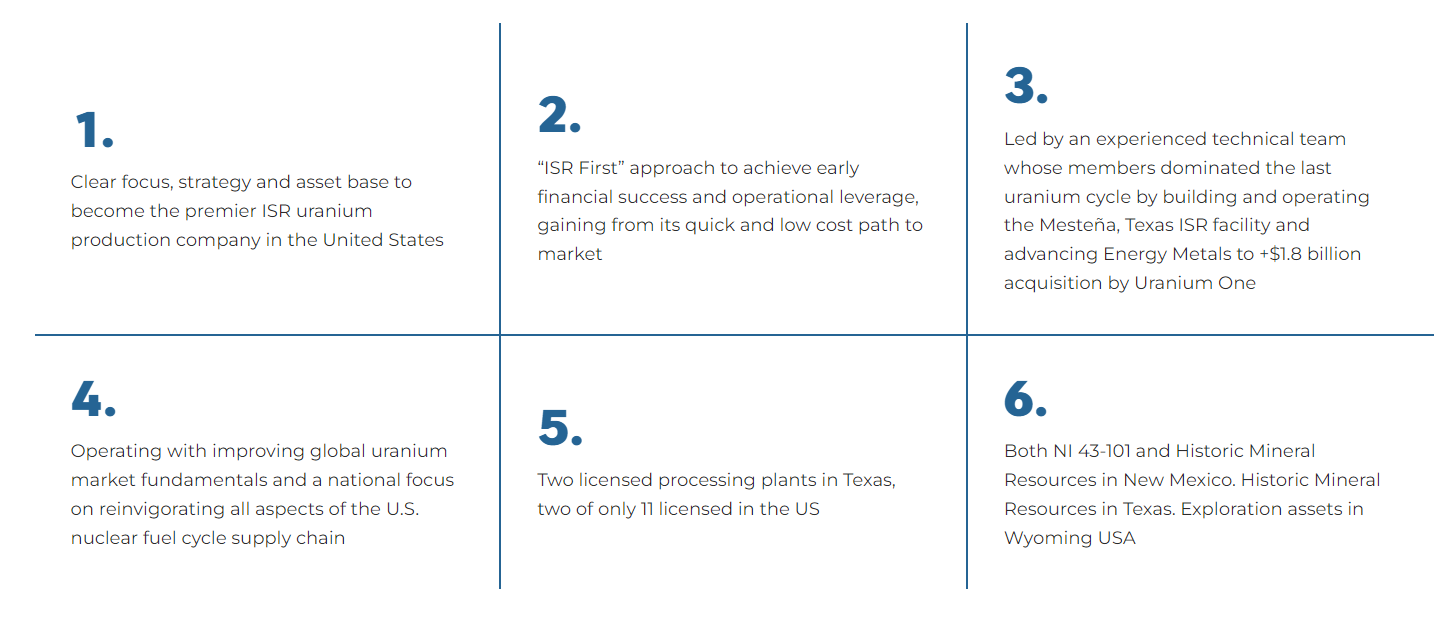

enCore energy is a diversified US domestic uranium developer focused on becoming a leading ISR uranium producer. What the heck is ISR mining you ask? ISR uranium mining stands for ‘in situ recovery’ which is a fancy term to describe a method of uranium extraction. It is one of the two primary extraction methods used to obtain uranium from the ground. ISR facilities recover uranium from low-grade ores where other mining and milling methods may be too expensive or environmentally disruptive.

enCore Energy holds a portfolio of uranium assets located in Texas, New Mexico, Wyoming, Utah and Arizona, USA. The portfolio is highlighted by the Rosita and Kingsville Dome licensed ISR uranium production facilities with combined nameplate capacity of over 1.6 million pounds of U3O8 in South Texas.

The advanced staged Dewey Burdock project in South Dakota and the Gas Hills project in Wyoming add to the large uranium resource endowments in New Mexico creating an outstanding asset base for long term growth and development opportunities with approximately 90 million pounds of U3O8 estimated in the measured and indicated categories and 9 million pounds of U3O8 estimated in the inferred category.

If you are someone who believes there will be a global realignment away from Russia in the nuclear fuel supply chain, start looking at some US based companies. enCore is one to keep on the list with two licensed processing plants in Texas with offtake agreements in place.

And enCore is well on its way to become the next producer of uranium in America. Recent news details the modernization and refurbishment of the 100% owned Rosita ISR processing plant in Texas. The processing plant is 90% complete with a completion date in May 2022. Once the modernization and refurbishment project is complete, enCore will commence commissioning work, expected to take approximately 30 days. Following commissioning work the Plant will be ready to start receiving loaded resin. There are other steps that need to be taken, but the plant will be producing in 2023.

Here is the accompanying short video with the press release:

Chart wise, we recently had a breakout above $1.70. The uptrend channel still holds, and we are in the pullback phase. I expect price to retest the $1.70 zone here which is acting as a major support zone. There is some near term resistance above at $2.10, but if that breaks, we are looking at a move towards $2.20 before printing new record all time highs!

Skyharbour Resources (SYH.V)

Market cap ~ $84 million

Now let’s shift to the Athabasca region.

Skyharbour Resources is a uranium and thorium exploration company that engages in the acquisition, exploration, and evaluation of mineral properties in Saskatchewan, Canada. Its flagship project is the Moore Lake Uranium project covering 35,705 hectare, located on the eastern portion of the Athabasca Basin, where the most high grade uranium is situated.

Recent news has been detailing drilling completion and results with Skyharbour’s multiple partner companies of Azincourt Energy, Medaro Mining, Valor Resources and Basin Uranium Corp.

On April 18th 2022 Skyharbour announced its exploration plan for its phase 1 program at the Mann Lake Uranium project. The Mann Lake project is located 25 km southwest of the McArthur River Mine, the largest high-grade uranium deposit in the world, and 15 km to the northeast along strike of Cameco’s Millennium uranium deposit.

Skyharbour also has notable and strategic shareholders:

2022 is expected to see continued drilling at Moore with exploration funded by partners. Skyharbour will also continue to monitor the market and acquire new projects.

Skyharbour is approaching a major support zone as uranium stocks pullback with spot uranium. I am watching this major $0.60 zone. This zone is worth keeping your eyes on. Back in December 2021, I highlighted this zone being a major weekly support zone. To the upside, we have resistance at $0.80 which needs to break for us to see a resumption of the uptrend and a move to the big $1.00 level. Watch this support test in the upcoming days.

Fission 3.0 (FUU.V)

Market Cap ~ $ 44 million

Fission 3.0 is a uranium project generator and property bank banking on the increased demand for uranium and major producers needing to increase their reserves as they have not spent nearly enough on exploration. Fission 3.0 identifies highly prospective projects and then de-risks them for a potential sale. Fission 3.0 has 16 properties in the Athabasca Basin. Several of these projects are near large uranium discoveries such as the Arrow, Triple R and the Hurricane deposits.

The company has an experienced technical team which has had two major discoveries including the J zone at Waterbury and the Triple R deposit at PLS.

Recent news details Fission 3.0 preparing for drilling at Cree Bay, and the exercise of warrants for $1,096,125. The funds will be used for future exploration work on the company’s multiple projects.

The chart of Fission 3.0 is right at support. Will we be able to bounce just like we did in late March/early April 2022? Seeing signs of buyers so far with the wick on today’s candle. I would want to see some basing here and then a nice bullish green candle. That would be the strongest sign that there indeed is a large group of buyers here.

If we do bounce, then I would be looking for a close above my trendline. Particularly, a close above recent highs at $0.185.

Leave a Reply