On November 24, 2020 Brigadier Gold (BRG.V) announced good assay results for the first three diamond drill holes at its Picachos Property, El Rosario, Sinaloa Mexico.

We’ll get into those results in a minute.

Today was not a perfect day to release gold results.

On Tuesday morning, the spot price of gold fell to the $1800 level – close to the 200-day Exponential Moving Average (EMA) – a technical chart indicator that gives more weighting to recent price data.

In the last 10 weeks, gold has dropped USD $240, from $2,040 to $1,800.

The Bitcoin crowd is crowing.

“Gold delivers financial freedom via horse, buggy, & stagecoach,” stated one Twitter user, “Bitcoin is a crypto-powered warp drive. When the monetary mass transit system of the modern state breaks down, we might go back to an economy powered by horses, donkeys & mules, but I doubt it”.

God bless all Bitcoin investors – we applaud their recent gains – but gold does have one advantage over crypto-currency.

It’s a thing.

You know, it exists.

In the same way that mountains, rain-puddles and llamas exist.

Of course, Gold Bugs are also not known for any excess of rational thought.

We often express blind devotion to the yellow metal.

Brigadier’s Picachos asset contains four mining concessions, covering 3,954 hectares of land. That’s about 80 X the size of Vancouver’s Stanley Park.

In the southeastern region of Sinaloa state, Mexico, the Picachos mine workings are accessed by approximately 20 km of roads internal to the property.

The drill program is planned for a minimum 5,000 metres in approximately 40 holes targeting four high-grade gold-silver veins.

Drill Targets:

- San Agustin mine: underground channel sampling by prior operator returned average grade of 81.22 grams per ton (g/t) gold and 73.36 g/t silver across 1.2 meters (June 1997).

- Values of 185 g/t gold were cut across the bottom of a production shaft.

- Mochomos vein: historic rock chip-channel yielded a result of 18.5 g/t gold and 570 g/t silver across half a meter.

- Los Tejones vein with values of 28.6 g/t gold, and 114 g/t silver across approximately a meter.

- Fermin vein with values of 268 ppm silver and 0.3 g/t gold across 1 meter.

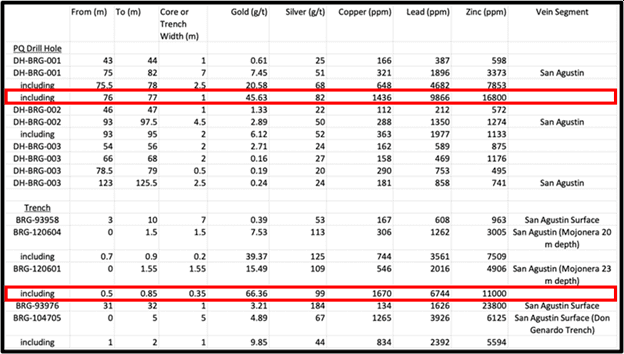

The assay results from the first three diamond drill holes (DH-BRG-001, 002 and 003) were released on November 24, 2020.

“The drill program is currently active on hole number 18 having completed approximately 2158 total metres,” stated BRG, “The first 14 holes of the program tested approximately 225 meters of strike length in the San Agustin vein.”

Holes 15 -18 are now testing Los Tejones, approximately 1 kilometre northeast of San Agustin on the same regional east-northeast trending Cocolmeca shear zone.

A steady flow of samples continues to be shipped to SGS Labs in Durango with additional assays expected imminently.

“I’m pleased that the vision I had when assembling this project over many years is starting to take shape,” stated Michelle Robinson, Picachos Chief Geologist.

Robinson – an Engineering Geologist – speaks fluent Spanish and English, has authored 20 technical reports and is a Qualified Person as defined by NI 43-101.

The combination of geological expertise and cultural knowledge makes her a shining asset for Brigadier Gold.

“As good as the assays were in BRG-001,” continued Robinson, “the drill appears to have cut through old underground workings reducing the potential reported overall width of mineralized material.”

At a certain point, the drill bit punched through a rock wall and carried on through open space (where Mexican miners used to walk) until it hit rock again.

“With 40-holes and 5000 metres of drilling in this program, I’m confident we will continue to add significant value to the project,” said Robinson.

The 3,954 hectare Picachos Gold-Silver Property is centered over the historic “Viva Zapata” National Mineral Reserve, Sinaloa, Mexico, approximately 4 hours by road from the city of Mazatlan.

Picachos features over 160 historic mines and workings, and at least 46 veins including San Agustin.

“We are very encouraged with the early success of the inaugural diamond drill program at Picachos,” stated Ranjeet Sunder, President and CEO of Brigadier Gold. “To confirm high grade gold mineralization in a vein system totaling 8 kilometres in length, within a property that hosts multiple of these systems is exciting and points to further discovery potential within the project.”

“Given Michelle’s intimate knowledge of Picachos, combined with a robust historical data set,” continued Sunder, “We are confident that the prospective targets we have chosen will continue to yield strong results”.

In addition, assays have been received for surface rock-chip channel samples (trenches) across the San Agustin Vein.

Values of 3.21 g/t Au and 184 g/t Ag across 1 metre were assayed for BRG-93976, located 150 metres northeast of BRG-93958.

Underground, approximately 15 metres north of BRG-93958, chip-channel sample line BRG-120604 was cut 20 metres below surface from a historically mined surface shaft (Pozo Mojonera) and contains 7.53 g/t Au and 113 g/t Ag across 1.5 metres.

A second underground sample line, BRG-120601, was cut from 23 metres below surface. This result was 15.49 g/t Au and 109 g/t Ag across 1.55 metres.

The central portion of this sample line contained the most gold, with values of 66.36 g/t Au and 99 g/t Ag across the central 0.35 metres.

Finally, approximately 220 metres northeast of Pozo Mojonera, there is a surface trench that follows the San Agustin Vein for approximately 20 metres.

A series of 1 metre wide chip-channel samples across the face of the trench yielded an average result of 4.89 g/t gold and 67 g/t Ag across 5 metres in trench BRG-104705.

Today, it was more profitable to own Bitcoin than gold.

I have asked Bitcoin Bugs point-blank if digital coins have any utility. The answer is always the same: “yes, they will be worth more later.” That’s called a bubble, my little bunnies.

Looked at another way, I would be concerned an army of co-investors were declaring themselves – without irony – to be financial geniuses on twitter.

We believe, when the dust settles, gold will be a treasured asset.

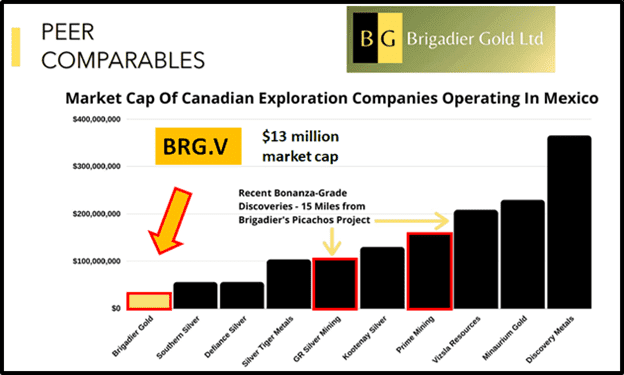

Typically, if there is a flight to gold, the gold juniors (GDXJ.NYSE) will out perform bullion and big-cap miners.

Inside that galaxy of gold juniors, Brigadier Gold is one to watch.

- Lukas Kane

Full Disclosure: Brigadier Gold is an Equity Guru marketing client.

Leave a Reply