On November 25, 2020 Fremont Gold (FRE.V) announced that it has permits-in-hand to launch its maiden drill program at the North Carlin gold project, located at the northern end of Nevada’s prolific Carlin Trend.

Fremont has permitted 14 drill sites at North Carlin and plans to drill a minimum of three holes, totalling 1,500 metres, in a reverse circulation drill program. The fully funded drill program will begin shortly after FRE selects a drill contractor.

The Carlin Trend is an 80-kilometer northwest alignment of sedimentary rock-hosted gold deposits in north-central Nevada.

Forty oxide and refractory gold deposits have been discovered along the Carlin Trend, while 27 open pit and underground mines have been developed.

Since the discovery of micron-size, disseminated gold mineralization in 1961, 84 million ounces of gold have been produced from the Carlin Trend.

Reserves on the Carlin Trend are 30 million ounces of gold (Barrick, 2016).

At today’s spot price of USD $1,800 – that puts the total value of the reserves (measured & indicated) at $54 billion.

The Carlin Trend is the North American gold Mecca.

It’s where aggressive gold explorers come to stake, survey, drill – or just to press their hungry faces against the window and drool.

North Carlin highlights:

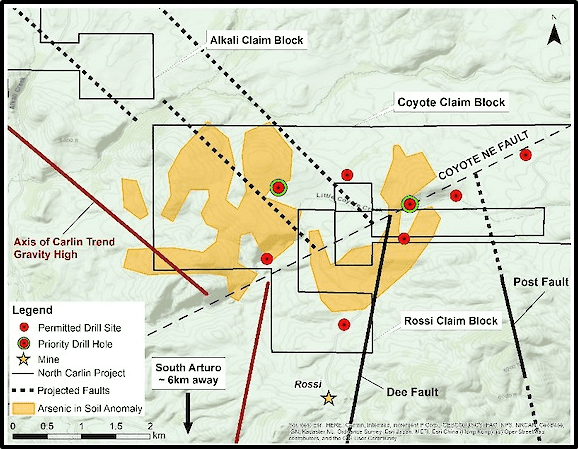

- North Carlin is over 42 km2 in size and is comprised of three claim groups (Alkali, Coyote, and Rossi) located at the northern end of Nevada’s prolific Carlin Trend.

- North Carlin is approximately 6 km north of and on-strike of Nevada Gold Mines/Premier Gold Mines’ South Arturo mine, where recent drilling intersected 39.6 metres of 17.11 g/t gold3, and 12 km north of Nevada Gold Mines’ Goldstrike mine, which hosts 11.1 million ounces gold in the measured and indicated category2. The western edge of the Project is approximately 6 km east of Hecla Mining Company’s Hollister mine.

- Situated in the right geological setting for the discovery of a major gold deposit, Fremont has developed several drill targets based on soil geochemistry, gravity and geomagnetic surveys, and the projection of key faults that control gold mineralization in the Carlin Trend.

Of course, drilling ground pregnant-with-gold is ultimately pointless if your asset is situated in a hostile political environment.

“According to the esteemed Fraser Institute, in its most recent investment attractiveness survey, Nevada continues to roll out the welcome mat,” reports Equity Guru’s Greg Nolan on October 21, 2020, “It’s ranked in the top three mining jurisdictions worldwide”.

“Fremont controls four gold projects along Nevada’s Carlin, Cortez, and Independence Trends,” continued Nolan.

- “The North Carlin project is located on the Carlin Trend. The company is targeting a Carlin-style gold deposit and/or low-sulfidation epithermal mineralization.

- The Cobb Creek project is located on the Independence Trend—the target is a Carlin-style gold deposit.

- The Griffon project is located on the Cortez Trend—the target is Carlin-style gold.

- The Hurricane project is located on the Cortez Trend—the target is a Silica replacement-type gold deposit.

The North Carlin Project now bears flagship status.

The 42-square kilometer North Carlin Project is located at the very northern end of the Carlin Trend and is comprised of 3 claim blocks—Alkali, Coyote, and Rossi.

North Carlin’s southern boundary is located only 6 kilometers north of and on-strike with the South Arturo mine operated by Nevada Gold Mines (NGM)) and Premier Gold (PG.T). The deposits comprising the South Arturo package have produced roughly 2.3 million ounces of gold to date (NGM is a joint venture among mining giants Barrick and Newmont).

Recent drilling at South Arturo tagged an exceptionally fat 39.6 meters of 17.11 g/t gold.

A further 6 clicks to the south is NGM’s Goldstrike mine which hosts 11.1 million ounces of gold in the Measured and Indicated category.

Hecla’s (HL.NYSE) high-grade Hollister mine is located 6 kilometers from North Carlin’s western border.” – End of Nolan.

North Carlin drill targets

There are two types of targets at Alkali:

- a Carlin-type deposit in the southwest

- a low-sulfidation epithermal deposit in the northeast.

“The Carlin-type target is based on favorable soil geochemistry and projected Carlin Trend faults,” explains FRE, “The low-sulfidation epithermal target is associated with a possible intrusive body and significant soil geochemical anomalies.” The geochemical anomalies occur on the flank of the possible intrusive body near the intersection of a projected Carlin Trend fault and a northeast-trending fault.

At Coyote and Rossi, the target is a Carlin-type deposit in lower plate units. The same type of units that host gold mineralization a few kilometres to the south in the Devonian Rodeo Creek Formation, the Devonian Popovich Formation and the Silurian Roberts Mountains Formation.

North Carlin – Alkali

Alkali is located at the intersection of projected Carlin Trend faults and the Alkali NE fault, a northeast-trending structural corridor that hosts Hollister to the southwest and Tuscarora and Jarbidge to the northeast.

The Alkali NE fault cuts through a 1,500 metre by 2,000 metre magnetic high and coincident gold and mercury soil anomalies that occur on the eastern flank of the magnetic high. Together, the data suggests the presence of gold mineralization beneath alluvial cover.

Alkali claim block

The magnetic high at Alkali may indicate an intrusive body at depth. Magnetic highs representing intrusive bodies coincident with Carlin-type deposits can be found at Gold Standard Venture Corp.’s Railroad-Pinion project at the southern end of the Carlin Trend. They are also known to be associated with epithermal deposits at Hollister and Tuscarora.

North Carlin – Coyote

Coyote is located at the intersection of projected Carlin Trend faults and the Coyote NE Fault (see Figure 4). Surface geology is upper-plate Ordovician Vining Formation, which is likely underlain by the Roberts Mountain thrust and lower plate Paleozoic carbonate rocks – common hosts of Carlin-type deposits.

Figure 4: Coyote claim block

Fremont has identified broad areas of chalcedonic breccias and siliceous alteration on surface at Coyote, frequently associated with concealed gold mineralization in the Carlin Trend, and sampling has defined a large arsenic-in-soil anomaly. Arsenic is the most important pathfinder for gold in Carlin-type deposits”.

“Let’s face it, management is everything in the junior exploration arena (okay, nearly everything),” explains Nolan, “You can have a great, company-maker of a project in the friendliest jurisdiction, but without the right team in place—a combination of gifted rock kickers and enterprising business types— things can fly apart at the seams.

Operational inefficiencies often create a processional effect that can lead to an erosion in shareholder value via reckless spending and an endless cycle of heavily dilutive raises (PPs).

“This a team with heaps of Carlin experience,” continues Nolan, “Example: Andy Wallace (aka Mr. Nevada) is on the Advisory Board (if a world-class deposit is indeed lurking somewhere in the subsurface layers at Carlin North, this crew will undoubtedly tap it).

This team also has a solid track record of creating shareholder value.

Looking at CEO Monaghan’s resume, the man was aboard True Gold Mining (acquired by Endeavour Mining in 2016), Canplats Resources (acquired by Goldcorp in 2010), Western Prospector Group (acquired by a subsidiary of China Nuclear National in 2009), Nu Energy Uranium (acquired by Mega Uranium in 2007) and Wheaton River Minerals (which merged with Goldcorp in 2005).

Impressive.

Skin in the game? Fremont management owns 17% of the shares outstanding—values are aligned.” – End of Nolan.

There’s an old cliché in the capital markets: “if you own the stock, you can sell it”.

Pfizer’s (PFE.NYSE) CEO off-loaded $5.6 million in stock the same day PFE announced promising vaccine news.

Maybe Pfizer’s CEO needed the money for his wife’s controversial cancer treatment.

May he wanted to cut a cheque to save a venerable opera company.

Or maybe he didn’t believe in the company he was leading.

It’s really no-one’s business.

But he reality is, it’s never a good look when insiders jump ship.

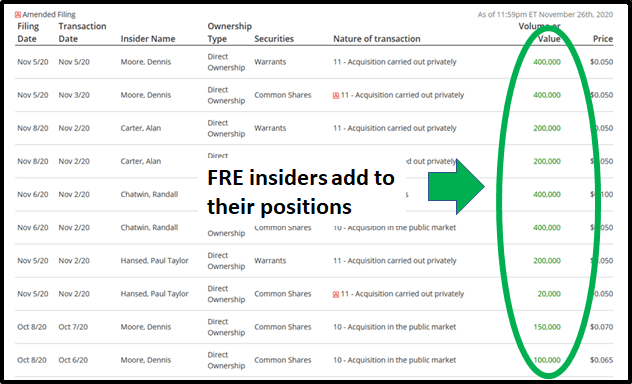

In contrast to the PFE embarrassment, insiders at Freemont (Dennis Moore – President; Alan Carter – Chairman; Randall Chatwin – Independent Director) are adding aggressively to their positions.

In the last 10 weeks, gold has dropped USD $240, from $2,040 to $1,800.

That’s been annoying, especially while some investors booked profits on buckets of steam Bitcoin.

“The U.S. government owes about $23 trillion itself (a lot of it to China), and is plunging another $1 trillion in debt every year,” we wrote a year ago.

Since then, the U.S. government has borrowed another $4 trillion.

Combined U.S. national & consumer debt are more than the entire property value of the U.S.

To be 100% clear: the U.S. has zero chance of ever paying this money back.

On the global stage, the U.S. is the illiterate Great Uncle who drives a lime-green Corvette, lives off his credit cards, and spouts off about “Mexican rapists” at Thanksgiving.

We believe money-printing will eventually lead to a destruction of fiat currency (paper money) – which will trigger a spike in gold investment.

Typically, if there is a flight to gold, the gold juniors (GDXJ.NYSE) will out perform bullion and big-cap miners.

Fremont Gold – with a market cap of $7.8 million – committed management – and four gold projects along Nevada’s Carlin, Cortez, and Independence Trends – is one to watch.

- Lukas Kane

Full Disclosure: Fremont Gold is an Equity Guru marketing client

Leave a Reply