Dig up rocks all day, commute home for dinner.

Fill trucks with rocks to mill, have the trucks back later that day.

Mill your ore, have it arrive in downtown Vancouver before the end of your shift.

This sort of mining scenario isn’t one that we hear about a lot in Canada. Usually, if you do find a puddle of sparkly rainwater in some distant gravel mound, and can track where it originally came from, you’re helicoptering in drills and laying power lines and clearing trees and leveling dirt roads and hoping there’s a workforce within a few hours snowmobiling so you can build a camp that keeps the bears out. You may or may not have to bring in giant heaters to thaw snowpack for part of the year, or build a mill out of pig iron and coconut shells, and once you’ve raised the money to do all that, THEN you hope to find something.

But what if you don’t have to do any of that – AND you’ve found something?

What if your risk isn’t ‘will there be gold’ but rather ‘where is it mostly gathered?’

What if your project has been crawled over before, if you have a shed full of cores and prior drilling data, and the path to production isn’t over ten years but.. one?

Welcome to GOLD MOUNTAIN MINING (GMTN.V), a mineral exploration play by name only because, let’s be honest, digging around in a shoebox for a pair of shoes isn’t exactly digging, it’s more ‘locating.’

For those who deal in resource data, here’s the tale of the tape. If it’s all jibberish to you, meet me downstairs in a bit for the layman’s version.

- Measured & Indicated Resource: 454,000 oz @ 5.33 g/t AuEq

- Inferred Resource: 95,000 oz @ 6.57 g/t AuEq

- Located 2 km off an all season highway and the Elkhart Lodge, located between Kelowna and Merritt, British Columbia.

- 53,000 ounces at 93g/t weighted average grade mined throughout its history

- 16,716 Hectare land package with nine identified high grade zones

- 127,069m of historic drilling, extensive geochemistry and geophysics programs

- $2M drill program across 4 zones to delineate further resources and add to exploration targets

- Exploration targets up to 638,000 ounces with grades between 2.13 g/t and 4.26 g/t*

- Small Mining permit submitted and under review

Okay, let’s lay this out in a fashion a 15-year-old could understand.

- Measured & Indicated Resource: 454,000 oz @ 5.33 g/t AuEq

- Inferred Resource: 95,000 oz @ 6.57 g/t AuEq

Mining 101: A mineral resource is a document where a Qualified Person has signed off that, based on the drill data that has been collected, we’re pretty sure there’s X number of ounces of ore in a given project, and a certain number of ounces in every ton of rock or soil or 400-year-old raccoon carcasses or rusty bike parts you’d have to sift through to get at it.

You want a LOT of ounces, and a LOT of grams per ton because it costs money to shake a ton of waste off an ounce of the good stuff.

Now, let’s be very clear: That measured and indicated number above isn’t what most mining guys would call a ‘LOT’ – usually you want millions of ounces to get a fully fledged mine going, not 454k, but that grade of 5.33 grams per ton is pretty decent (comparables at the same stage across Canada, such as Skeena, Radisson, and Maritime Resources, show the same or less), and having a good idea there are 454k ounces (at least) to be had is certainly enough to start digging in if you didn’t have to spend tens of millions building an entire infrastructure around the joint, and you had a mill nearby you could utilize on the cheap.

Which brings us to the next item:

- Located 2 km off an all season highway and the Elkhart Lodge, located between Kelowna and Merritt, British Columbia.

Thankfully, Gold Mountain Mining has a mill nearby, and all the infrastructure in place that it needs to get moving quickly. Hell, there’s a highway literally two minutes down the road, and Kelowna is a half-hour commute away so, if they wanted, they could order their employees pizza for lunch.

- 53,000 ounces at 93g/t weighted average grade mined throughout its history

A lot of mining explorers are plumbing the depths of virgin ground, which means they’re really going in with educated guesses as to where their targets might be. But Gold Mountain is going in after others have already trodden their ground – and produced gold. 53k ounces of it, in fact. Hence all that infrastructure.

- 127,069m of historic drilling, extensive geochemistry and geophysics programs

If you can’t get some good targets out of 127 kilometres of ground drilling, you’re not trying.

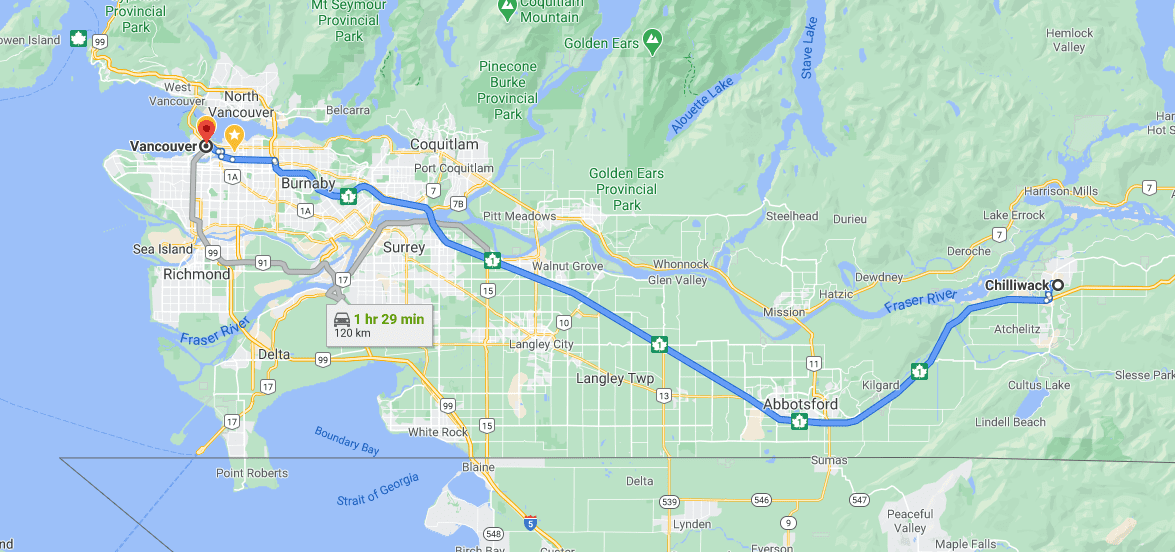

To put that in perspective, if you were to lay a drill along Highway 1 from downtown Vancouver BC all the way out to Chilliwack, and took a scenic route through Richmond along the way, you’d still have 7 kms of drill to go to match the length of drilling that’s been done on the property Gold Mountain has under its control.

In essence, they’ve drilled enough distance to make it 1/4 of the way from my office to the mine.

Yoinks.

So, obviously, this:

- 16,716 Hectare land package with nine identified high grade zones

That’s a decent amount of land to drill on, and drill they will, but before they get out into the weeds, the existing resource has plenty to like. Which is why…

- $2M drill program across 4 zones to delineate further resources and add to exploration targets

- Exploration targets up to 638,000 ounces with grades between 2.13 g/t and 4.26 g/t

If they spend that $2 million (and they’ve been raising $10m, so that shouldn’t be tough) and they find what existing evidence suggests they might find, that 638k ounces would double their existing resource, which would mean this is more than a good little earner, it would start looking like a BFD.

(I’ll let you figure out what BFD stands for because some folks don’t like me swearing when I’m describing a big deal..)

Now, all of this is decent stuff with some promise, but remember back at the beginning of all this, we talked about not waiting around to build a monster resource estimate but, rather, going in small?

This is a strategy that is increasingly being utilized by companies that don’t want to spend years raising money and drilling and raising more money and drilling – especially when they can walk around and kick up sparkly dust already.

Where there’s enough data and existing infrastructure to make it reasonable to just start digging for gold, in a small and focused area where the previous drilling done has shown some promise and already made previous owners money, and then expand that digging outwards as you see where the veins lead, why not?

If you’re trying to build a massive mine and need all the bits around it to be built, that strategy doesn’t work because no bank will give you the money you need to make that sort of investment without a lot more paperwork than a ‘nice little’ resource estimate.

But if all you needed to move forward to production was, pretty much, permission… well then there’s no reason to not ask for it.

Which makes this important:

- Small Mining permit submitted and under review

In its investor presentation, Gold Mountain is projecting they’ll update their resource estimate in Q1 of 2021, and hope to start digging in Q3 of 2021. That’s outrageous when compared to most decade-long mining explorer business plans.

If you do go through the Gold Mountain investor deck, two things will become clear.

- It was written by guys who live, breathe, eat, and if it’s possible, engage in sexual relations with mining.

- They’re not farting about. This property isn’t a roulette spin, it’s blackjack.

Of course, there’s always a chance they’ll miss with a drill bit or a local commune will claim land rights or a comet lands next door and dumps a million tons of gravel on top of everything. But the things that usually screw up a mining exploration deal – ignorance, corruption, or dumb luck – aren’t in evidence here at first glance.

- The executive team have runs on the board.

- The bank balance is heavy.

- The data is deep and the targets many.

- There’s precious little that needs building.

- They’ve wasted no time doing the work to this point.

Now, one thing before you run out and claim your piece of Gold Mountain – you can’t just yet. The company is going through an RTO with the private Bayshore Minerals and the capital pool company, Freeform Capital (FRM.P.V). The ticker will be GMTN.

Soon.

— Chris Parry

FULL DISCLOSURE: Gold Mountain is an Equity.Guru marketing client.

Leave a Reply