Hey millennials.

Quit obsessing over the down market your weed stocks are enduring for a moment and come with me over here.

No, wrong way.

Over here.

Good. We’re going to talk about mining for a second.

Bear with me. It’s going to be okay. You’ll like this.

How many of your weed stocks have run from $0.27 to $0.44 in the last two months?

Not many?

Here’s E3 Metals (ETMC.V):

We like E3 Metals. We’ve liked them for a while because they’ve been putting together real work.

Oh, you don’t like mining because you’re an environmentalist?

Shut up. E3 Metals is targeting lithium, for the next generation of lithium ion batteries and vehicles, which beat fossil fuels a million times over for environmental reasons.

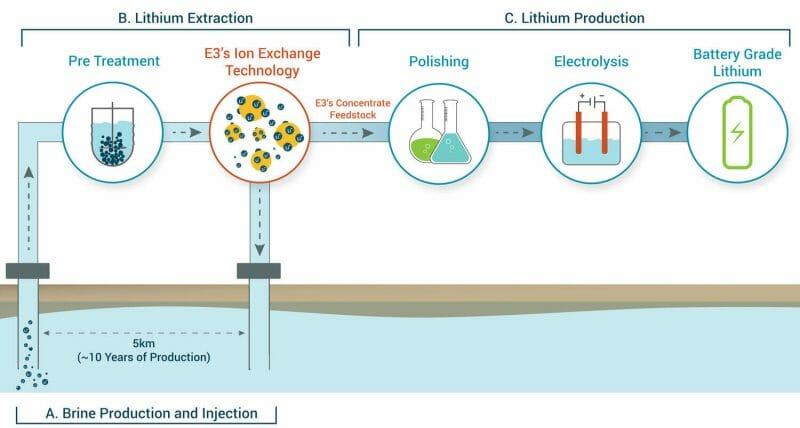

In addition, to get at the lithium, they’re taking dirty water and removing the lithium from it, then putting that water back where it came from.

Environmentally not so foul!

WHY ARE THEY UP?

Because most lithium explorers have little trouble finding lithium, but few have access to water needed to get at it, and fewer still have the technology needed to extract it in the place they found it.

Figuring out the extraction tech is a real issue for most companies.

E3? In December, they did this:

The first set of objectives leading to the pilot plant project was to reproduce and enhance the performance of the initial results of the lithium extraction testing from E3 Metals’ brine. Four recent extraction tests completed on the scaled-up sorbent exceeded previous performance. The tests achieved demonstrated lithium recoveries greater than 99 per cent, averaging 90 per cent and volume reductions up to 20 times while consistently removing 99 per cent of critical metal impurities. The extraction testing produced lithium-enriched brines with up to 1,498 milligrams per litre lithium from an original raw brine concentration of 72 milligrams per litre. The average concentration factor across the four tests was 18 times with an average increase in concentration to 1,308 milligrams per litre.

[..] The next steps planned for the ion-exchange optimization is to test performance at increased concentration factors and repeat cycles. Once the company has demonstrated the performance goals of the ion-exchange material, it will move closer toward the construction of a pilot plant

A few months later, this:

E3 Metals Corp. has achieved a major milestone in the development of its proprietary ion exchange lithium extraction technology. A series of tests was conducted on the sorbent incorporating the most recent enhancements as outlined in the company’s Dec. 4, 2018, news release. These enhancements have enabled E3 to create a more robust sorbent, resulting in higher lithium concentrations of up to 5,367 milligrams per litre lithium, compared with its previous level of 1,498 mg/L. Tests were conducted to demonstrate the performance of the enhanced sorbent by concentrating 50 times and 100 times, with resulting lithium concentrations of 3,142 mg/L and 5,367 mg/L, respectively.

[..] To reach the target for battery grade lithium hydroxide (LiOH H2O), lithium is refined, and impurities removed, to reach a 99.5-per-cent or greater purity of LiOH H2O. Removing impurities and concentrating the lithium in a single step is critical to the overall production flow sheet. If these concentration levels can be consistently achieved under full cycle process flow conditions and in larger field-based pilot plant testing, the company believes the most significant development hurdle will have been achieved.

Progress, bois.

And if you’re not sure what all this means, the company laid out a full explanation of the path to a pilot plant back in September of last year.

What I really like about this crew is they raise money as they need it, but in small doses, because they only need small injections of funds to move things along. They’re not raising $20m at a low share price, they’re picking up $100k in a financing here, another $100k in grants from the government over there, they’ll toss out some shares for debt to protect cash… this is a grown up team doing grown up things that protect your money.

And, not for nothing, but they have an inferred resource that would peg this thing as being close to the largest lithium resource in the world, if fleshed out – good enough for them to produce lithium for 70 years. The only remaining question for them is, can they do that in an economic way?

That question will be answered in short time. Meanwhile, a just closed financing saw them handed $400k more than the million they were looking for, so those in the know are keen to get aboard.

All that and it’s just a $9 million market cap, even after the last few months run.

E3 has been a client of ours for some time, and themarket hasn’t always been eager for what they’re offering, what with lithium as a sector having been through a tough year. But they’re zipping right now, and we’re right in there behind them.

You want more lithium? Look at Cypress Development Corp (CYP.V).

Money appears to be flowing back into the battery metals space after a serious rout. It’s not an across-the-board lift off the lows, only quality is benefiting.

We speculated recently that Cypress Development was due for a significant re-rating after the company hit yet another milestone at its Clayton Valley Project in Nevada. Good Metallurgy is what the market needed to see – good metallurgy is what the market got.

A couple of years back, there was a real run on lithium projects in Nevada’s Clayton Valley. They all blew up, then blew apart as the realities of getting water rights in the desert became real, and those holding on for a ‘me too’ share price bump wandered off.

Cypress Development Corp stuck about, and did work. Where E3 Metals is based in Alberta and extracting lithium from petro holes, Cypress is in the Clayton, snuggled up right next to Albermarle, which is the biggest dog in the region and has produced for a long time.

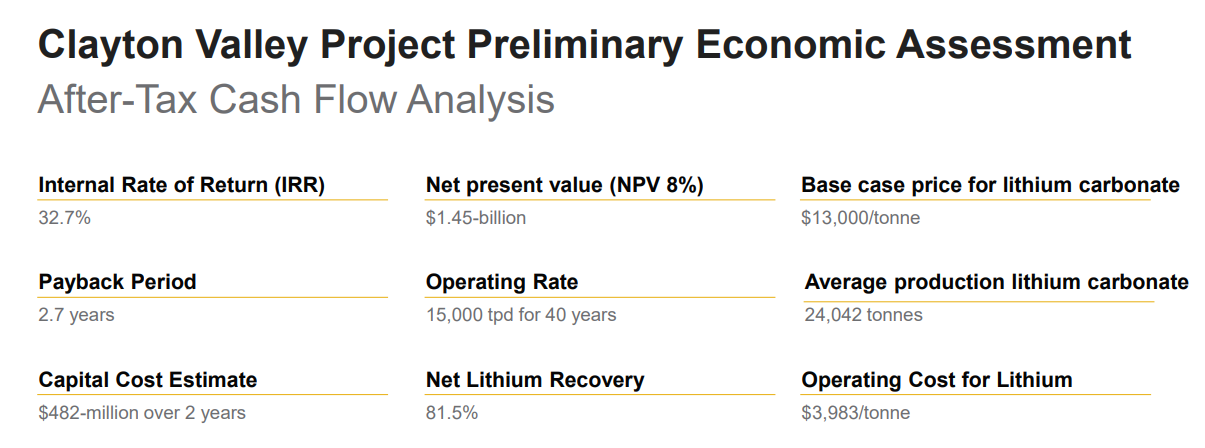

While E3 is early but moving fast, Cypress has elevated to the next level by moving towards a Preliminary Economic Assessment (PEA), which tells you what sort of return and cost you’d be dealing with if you actually build a production facility there.

So let’s get some terminology out of the way here for you newbies to the mining scene.

Net Present Value is “the projected earnings generated by a project or investment – in present dollars – exceeds the anticipated costs, also in present dollars,” according to Investopedia. So this project is a $1.45 billion play, potentially.

Generally speaking, the higher a project’s internal rate of return, the more desirable it is to undertake. [..] Assuming the costs of investment are equal among the various projects, the project with the highest IRR would probably be considered the best and be undertaken first.

And payback period:

The payback period is the cost of the investment divided by the annual cash flow. The shorter the payback, the more desirable the investment.

So Cypress has a project that will cost $482 million to put in play, but should pay for itself in 2.7 years on its way to being a 40 year project that puts out 24k tonnes of lithium carbonate annually on average.

That’s not terrible. And early testing on the property has brought similar results to the E3 successes.

Do not hate.

It’s important to note that unlike salt lake extraction (salars) lithium projects, where production levels are difficult to predict due to a host of variables (rain, snow, etc), Clayton Valley is a sedimentary hosted lithium deposit, which is easier to scale and production rates can be tabled with much greater predictability and confidence. This is a key differentiator. The market is catching onto this as well.

Keep an eye on this one’s newsflow:

Cypress Development Completes Drilling at Clayton Valley Lithium Project in Nevada

KEEP AN EYE ON LITHIUM.

And while you’re at it, gold is no slouch.

ABEN RESOURCES (ABN.V) is gearing up.

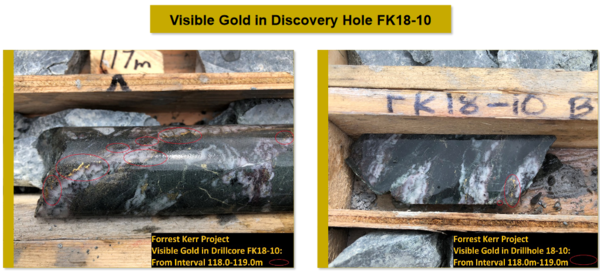

Investors aren’t waiting for the snow to leave BC’s Golden Triangle where Aben Resources is planning an aggressive follow-up drilling campaign at its 23,000-hectare Forrest Kerr Gold project.

On the subject of snow, the pack is not as deep in the Triangle this year. It’s possible that the company will get on the property sooner opening the door to a longer exploration season.

While the younger investors have traditionally steered clear of metals mining, there’s a new investor block that is figuring out the potential in recent months.

Well-researched investors are positioning themselves early in Aben specifically, not wanting to miss out on what could turn into a nice high elevation ride if the company is able to continue successfully stepping out from last summers discovery hole at their North Boundary zone (38.7 g/t gold over 10.0 meters including an uber high-grade interval of 62.4 g/t gold over 6.0 meters).

If the data above is a mystery to you, we got you. Exploration companies pull the nicest parts of their drill cores, where the most gold shows up, to suggest there may be a lot more. If there’s a lot of gold per ton over a wide area, that would suggest a future mine that would be cheap to operate.

5 grams per ton is nice. 62.4 is monster. That said, what’s more important than the highlights are the averages, so Aben has more work to do to flesh out exactly how much ore may be under their ground.

Going into this field season, the company has a much better sense of North Boundary’s structural controls, which gives them an idea of where to drill next. To backstop those efforts, the company plans a geophysical survey over the entire area, and this added bit of intel should help their crew home in on some of the areas higher grade structures with greater confidence and accuracy.

The market is sensing Aben is onto something, perhaps something big. But North Boundary represents only the first high-priorty target at Forrest Kerr – there are over a dozen. Plenty of highly prospective ground remains untested, which makes this your classic Gldn-Tri speculation play.

Don’t forget the Justin Project, 18,314 acres of strategic ground that ties in directly with Golden Predator’s (GPY.V) 3 Aces project in the southeast Yukon. Aben plans to put boots to the ground on this Orogenic setting this month, giving investors a full two-month jump on what could turn into significant exploration newsflow.

BLUE SKIES ARE A-COMIN’.

Blue Sky Uranium (BSK.V) is another junior ExplorerCo that has tacked on significant market cap in recent sessions, its flagship project, Amarillo Grande, finally attracting the market’s attention.

Located in the Patagonia region of central Rio Negro province, Argentina, the company’s Ivana deposit – a resource of some 22.7 million pounds of uranium oxide and 11.5 million pounds of vanadium oxide – represents the largest uranium discovery in that country in over 50 years.

It’s important to understand that Ivana’s geological setting is surficial. As the name suggests, it’s close to the surface and due to the host rocks crumbly nature, the uranium and vanadium are easy to extract.

There are a number of reasons for BSK’s recent share price lift. A late Feb, 2019 scoping study shows an after-tax NPV of $135.2 million and an IRR of 29.3% (payback period = 2.4 years) with a pre-production CapEx of $128.05 million.

Translation: good numbers, especially for a resource that is expected to grow markedly.

On the subject of growth, and this might be considered one of the better catalysts going forward, Blue Sky boasts heaps of (exploration) blue sky – numerous high priority targets are slated for a proper probing with the drill bit in the coming months.

Nikolaos Cacos, Blue Sky president & CEO:

“This PEA demonstrates that the Ivana deposit is a leading new low-cost uranium-vanadium development project. With the expansion upside at Ivana and the discovery potential for new uranium and vanadium resources throughout the district-scale property, we expect Amarillo Grande to continue to improve its value proposition.”

Even after its recent 65% share price tear, the company’s market cap sits at an extremely modest $23 million.

Another catalyst for the company, one that could create significant upward pressure on the co’s common: the price of uranium itself.

There is a mad rush to build nuclear reactors around the globe right now, with China setting the pace. If the uranium price, having bottomed a few years back at < $18.00 per lb, successfully takes out the $30.00 resistance level, it could be off to the races for this company, and others.

Demand is picking up. Large sources of uranium – a number of important mines – are nearing the end of their production life-cycles. The elements all appear to be lining up for a solid push higher, though the sector has applauded similar moves in advance of them happening – or not happening – before.

I’ve witnessed a uranium bull market. There really is nothing like it. Here’s hoping we see another soon.

— Chris Parry

Additional research provided by Greg Nolan aka Dirk Diggler.

FULL DISCLOSURE: The four companies featured above are Equity.Guru marketing clients, and we may own stock of them at any given time.

Leave a Reply