Publicly-traded cannabis companies that are not run by nutbars, piglets or hype-merchants, currently have good access to capital.

If you’re selling weed, hemp or vape pens – it’s just not that hard to find institutional money.

A fast-growing cannabis company like 1933 Industries (TGIF.C) with 2018 revenues of $12.6 million – can snap its fingers – and have a container of cash dropped onto to nearest helipad an hour later.

Two months ago, 1933 closed a non-brokered private placement (PP) raising $4.5 million (10 million shares at .45). The PP was fully taken down entrepreneur Paul Rosen, who sits on the boards of iAnthus (IAN.V), Hill Street Beverages (BEER.V) and High Tide Ventures (HITI.C).

“1933’s business model incorporates cultivation, extraction, processing, manufacturing, branding, distribution, and ancillary services,” stated Rosen, “There are only a handful of companies that have been able to accomplish this in a short period of time.”

Complete 1933 Industries Fiscal 2018 Highlights

- Revenues of $12.6 million for the year

- Gross margins of 49%

- Total assets increased to $41 million

- Product offering expanded to over 120 SKU’s

- Retail footprint of 600 stores

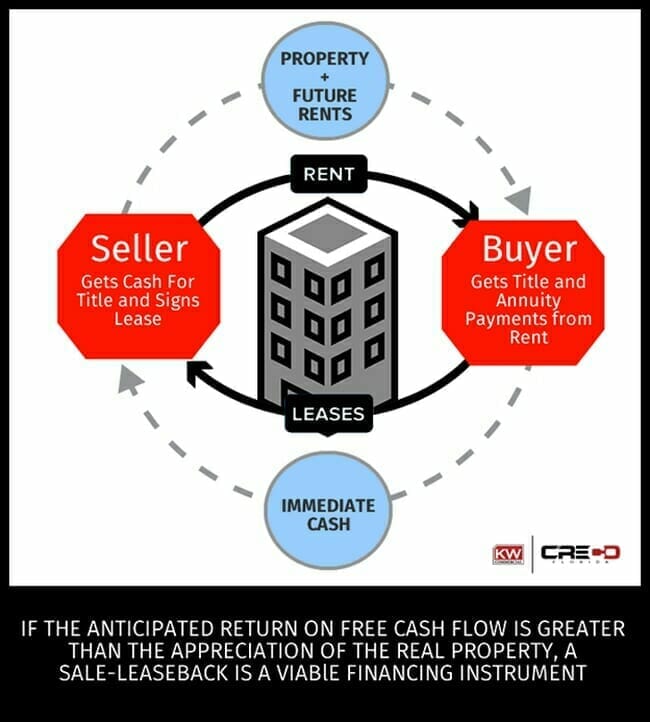

One way or another, publicly traded companies – like regular folks – have to pay for the money they borrow – through interest, finders-fees or stock dilution.

As shareholders, one of the things we need to watch – with a critical eye – is how the company allocates its finances.

When does it borrow?

How much does it borrow?

What is the cost of the loan?

What are the plans for the money?

On May 15, 2019, 1933 Industries announced that its subsidiary, Alternative Medicine Association (AMA), has completed a sale and lease back for its brand new cannabis cultivation facility in Las Vegas, Nevada.

This “sale & leaseback” generates about $14 million Canadian dollars to the 1933 coffers with no “Interest, finders-fees or stock dilution.”

It also means 1933 no longer owns that chunk of commercial Nevada real-estate, and will have to pay leasing charges which are presumably higher than land taxes and property upkeep.

Deal Highlights:

Purchase price of USD $10,450,000

Hold-back of USD $500,000 contingent on permanent occupancy permits

Hold-back of USD $250,000 contingent on state and local permitting.

AMA anticipates receipt of all permits and approvals within 45 days.

Transaction includes cultivation facility & the 1.39 acres of land it sits on.

The transaction is a 10-year lease-back agreement, with the option to extend the lease term for two more periods of 5 years each, ensuring manufacturing stability for 1933.

“We funded the purchase of the land and construction of the facility without incurring any debt,” stated Brayden Sutton, President & CEO of 1933, “So the full sale proceeds are available for working capital and to fund acquisitions in key cannabis markets.”

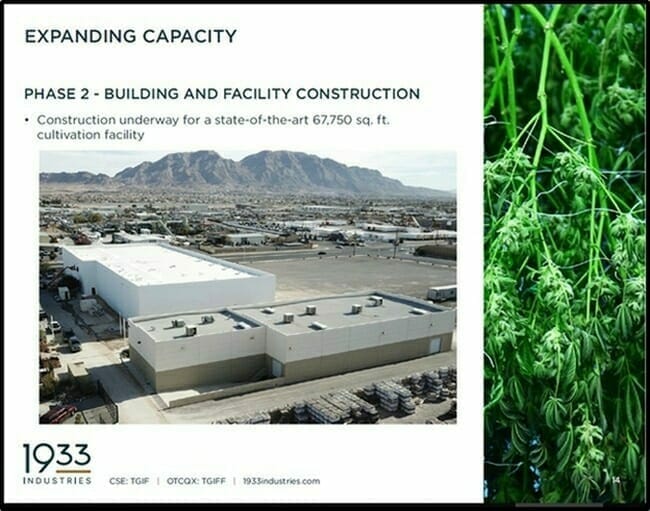

AMA’s 12,160 sq. ft. building adjacent to the cultivation facility, will be utilized for cannabis production, processing and extraction – increasing the size of the current facility by 600%.

AMA is one of Nevada’s largest wholesalers of cannabis products, including branded flower, wholesale distillate for vape products, and a broad range of concentrates with distribution channels in place throughout Nevada.

The purpose-built 67,750 sq. ft. cultivation facility has been developed as a two-story building on 1.39 acres and zoned M-1 (Light Manufacturing) by the Clark County Zoning Department.

The structure includes:

- fully automated irrigation and fertigation system

- small vegetation/cultivation rooms for better crop management

- packaging areas

- supporting offices

- climate-controlled rooms catered to each phase of plant production

- benching system will maximize growing space

- advanced data tracking system

- vault

Fully operational, the newly constructed facility will deliver a substantial 10-fold infrastructure expansion and significantly increase AMA’s flower cultivation output.

“Our adherence to efficient capital allocation and sound operational practices has led us to maintain a strong financial position,” stated 1933 CEO Sutton about the sale & leaseback transaction. “This will propel us into our next growth stage”.

Full Disclosure: 1933 Industries is an Equity Guru marketing client, and we own the stock.

Leave a Reply