Jay Garnett from Experion Biotechnologies (VIR.V) has precisely zero f’s to give about building a million square feet of cannabis grow. He’s not buying a hemp farm in the Outer Hebrides, or a license application in Mongolia, or a mega greenhouse near the airport in Nunavut.

He’s got a ten acre property in BC with a beautiful, fully licensed, fully operational grow facility, and it’s putting out clones, which larger licensed producers are paying for. It’s also putting out finished cannabis, which he’s selling to those same LPs when they can’t keep up with demand, and he’s selling his own products through three well received brands.

He has all the Canadian licenses a guy could ask for, which are allowing him to do real clinical trials (for real this time, no six-person fluff studies) and he’s doing deals with German distributors. He’s making oils. He’s finding customers. And he’s happy.

That last bit comes from the feeling you get when a plan comes together.

“We’re in the cannabis space, and I think for a lot of people that that’s very confusing,” says Garnett. “I think there are so many licenses out there and people don’t really understand how the Health Canada’s licensing system works so, if I was going to break it down, I would say that we are a licensed cultivator and seller of cannabis within the industry, and our goal is to ensure that our quality cannabis is vertically integrated from there into our own products, primarily focused in the medical space.”

Not overly complicated. Grow it well, then put it out through a series of pipelines to whomever wants to buy it for a premium.

That doesn’t require tens of millions of dollars raised every few months for ongoing hypey sales letters on Instagram. Just do the work. Right?

“We have just finished an acquisition of a company in Calgary called EFX Labs and they have people running early stage clinical trials for post operative pain management under Health Canada,” says Garnett. “They also had a commercial pill that was able to go to market through that research that we just went to revenue with about four weeks ago, through a partner relationship with Broken Coast, another licensed producer, which is a subsidiary of Aphria.”

Clinical trials was a phrase every licensed producer spoke of early on in the cannabis market, when they were still telling the world that patients were their focus and not enthusiasts.

Today, in the era of full recreational use, clinical trials have been largely forgotten, but there’s a far bigger market in pharmaceuticals and wellness as it relates to cannabis than there is in folks looking to get lit.

And that market lives and dies on clinical research.

“Ensuring that we are creating products for that space, be it, topicals or micro-doses, soft gels in seniors care facilities, or pills in hospitals for post operative pain management – is really important.” says Garnett.

“All the things that are the positive sides of cannabis – medical professionals need the research done so they can know what to prescribe, how much, how it might react with other medicines – they need to be proven out by clinical research, and when you’ve finished that work, it’s a whole new world.”

For Garnett, proving that his product has medicinal effects is more important than having fifteen brands with nice logos. He’s got the one flower brand; Citizen Stash. He has another for his oils, and another for wellness products.

“I think we’re doing important work here to open the eyes of not only the medical community but the mainstream community, on the benefits of cannabis. We don’t have to be #1, we just have to build something real, for the long haul.”

And that’s it. While everyone else is losing tens of millions every quarter chasing shiny lights on the wall, paying crazy money for acquisitions that have no revenue, Garnett and Experion are just advancing what they have every day. A little more planted than yesterday. A little more harvested than yesterday. A new SKU here. A new customer there.

When I point out this difference from the competition, Garnett agrees, to an extent, that some aren’t focused on quality, but explains it as a side effect of a frothy market.

“Its supply and demand. The markets allow that to happen, I think. There are lineups at stores. The stores are out of stock, it takes three weeks to get more, more if you order it online. The attitude right now is, just kinda get me anything. So, the market is kinda supplying them with anything. That’s fine, we have a rec brand ourselves that does very well. We limit our production through the rec brand. Honestly, there’s no production cost difference for us between our rec brand and our medical brand. So, for us, recreational is a low margin business.”

Garnett explains he wants to be in retail stores, mostly, for exposure.

“It’s a great brand positioning spot for us to be, and it helps us get some anecdotal feedback from our consumers, and it does give us the ability to trial things. You know we’re learning from that, from our consumers that will help us hone further on our therapeutic side.”

The potential of the seniors market, to me, has always been one the cannabis industry in Canada has had a blind spot on. If ever a demographic could use a de-coupling from opioids, to me, the gramps are the one.

Garnett sees the opportunity, though few others talk about it.

“We see a huge market there, it’s actually evidenced by the number one demographic of medical customer in the Florida market in the US, which is the 58-year-old female, and it really shows that cannabis is not what a lot of people think it is.”

It’s lit, grandma!

“Obviously you want to produce as much as you can, but it’s also very important to have consistency levels that you can rely on,” says Garnett. “Getting something within two or three percent on a consistent basis is very, very difficult. That’s what we’re working on the most and I think when you using it recreationally, consistency is not as important from one bag to another because maybe you’re not even brand loyal as a recreational user. But I think as a medical user, if you’re a 58-year-old female using it for arthritis pain management, or glaucoma, or one of those things, I do believe to be able to trust your supply that you’re going to get a consistent dose is a very important thing and that’s what we’re focused on.”

Part of that mandate involves experimentation. Experion was not first in the queue for licenses, but was one of the first licensees to develop very small growing facilities to help focus on variable strains, and messing about with how they’re grown in the search for advances the rest of the industry hasn’t seen yet.

It’s no secret certain strains develop in different ways. By giving them different light cycles, different nutrients, and being able to restrict that work to small rooms, allows Experion to have on-going research and development while operating as a commercial facility.

“That’s allowing us to really zero in on how to make sure we’re developing consistent levels, from harvest to harvest, of THC. So, if I could akin that to the wine business, you don’t want to have one year’s vintage, that’s not having a wine that’s 14% alcohol in one bottle and 8% in the next,” he says.

“It’s a consumer packaged goods strategy, which is not unique in the world, but it is unique in this space right now, just because a lot of the energy and the money has gone to cultivation and infrastructure being as large as possible,” he says. “There’s nothing wrong with that, we just chose a little bit of a different of a strategy. We grow too, we do oils too, we have natural health products too, now how do we take those products to the next level in ways others aren’t doing?”

To me, I think there is an investor perception that when the big guys come knocking on the door, when Big Pharma comes along and Big Beverage comes along, looking for things to acquire in the weed market, they’re going to look for size first. My thinking has always been they’re going to be after quality, because they’ll already have size. If you can plug a Vitamin Water into a Coca Cola distributor network and production model, the sky is the limit.

Garnett agrees.

“They can put a product on every shelf,” he says. “Having a consumer audience that is with you every month, that is more important to me than maxing out as much as you can put on your credit line and building as many square feet as possible.”

“I would even take it in a different slant. I think scalability is what they’re going to look for. All we’re saying, let’s just keep it tight and consistent for what we want to develop right now. Let’s work with what the consumer is looking for and then we can scale up. I don’t necessary think that me saying I have a million square under greenhouse is as important as saying I have 20,000 square feet of quality consistent cannabis. I know the market has rewarded size in previous years, but I think the market will get mature and I think the market with get smarter and they’ll be looking for quality and consistency, and its not just us that thinks this.”

Of course, there’s always the threat that, ultimately, when we have cannabis-based beverages and cookies and pills, that quality will be less important. Nobody cares what kind of coffee bean goes into formulating Red Bull, as an example.

“There are massive plantings of cannabis going down in Colombia right now,” says Garnett, “but that doesn’t mean I think that’s the right thing for Canada. Maybe an interim step might be if, kind of like they do in the wine business, where maybe a domestic producer can import juice from Argentina, and through their production facility locally ensure it fits all the standards when it’s bottled. Maybe that can happen, but I don’t know why Health Canada would allow foreign grown cannabis into this market, or other countries would allow Canadian product into their own market. When they’ve got all of these safeguards in place, and put all this expensive infrastructure in place, why commoditize it to the bottom and take out the quality assurances that you put in for human protection?”

Meanwhile, evolving rules and regulations have forced producers to be creative, and invest in development for things they can’t yet sell. Experion has developed 59 formulations for their Kanabé line.

“I doubt that we’ll put more than four or five to market initially,” says Garnett. “Those should adhere to the 80/20 rule, we should go to market with the things people are really interested in.”

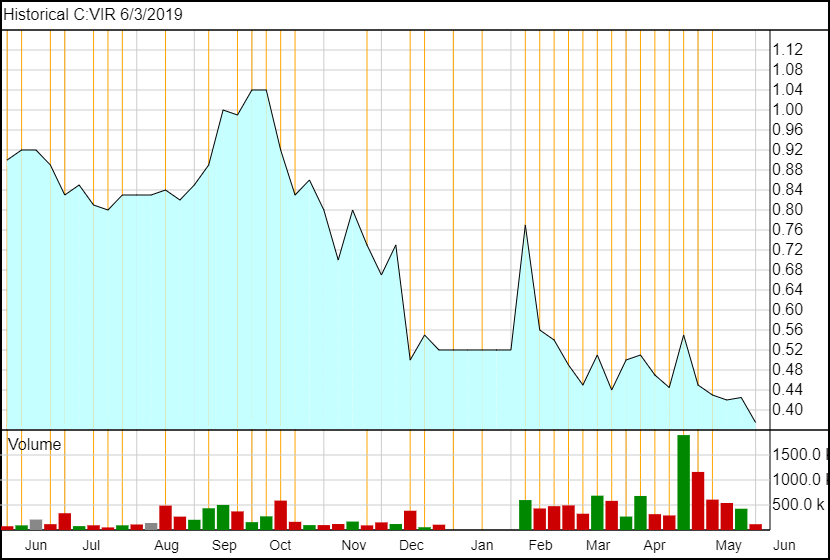

Regarding ‘what people are interested in,’ it must be said, that hasn’t traditionally included ‘buying Experion stock.’ There’s no way to sugarcoat it, the ride has been rough, and mostly downwards.

Garnett wasn’t at the wheel for much of that, but understands what brought it about.

“Six months ago, there was a certain mandate brought in, and that was to fix the missteps of the past,” he says. “I can see why certain things were done and I can see how those trips happen – with that said – what it did was create a whole bunch of churn in directors and management. It created a bunch of energy being put into something that didn’t actually allow the market to understand who and what we were.”

“When I think, in essence, about the backbone we had as a company, the piece just needed to be assembled in the right order and put in front of the market. We’re talking today six months later primarily because there really wasn’t a clarity of strategy, and an ability to talk to the market anytime sooner.”

Since his arrival, however, things have moved quickly.

“We did make that acquisition. That took us a good two to three months of time. Maybe we could’ve been chatting with you sooner, but I do believe we have a better understanding of where the market is right now. We have a good understanding of what our core capabilities are, and I think a lot of people – the big guys – are looking to acquire what they can’t do themselves just because of time. Now, if you’re a really good grower and you’ve got a really good retail product, the big guys are snapping you up, and others are snapping up capacity, whether it’s greenhouses or growing talent. I think that that’s smart, but like in any sector you’re going to have those big three or four guys that gobble things up, but it doesn’t mean you can’t have a great medium-sized business, it just means you go with a slightly different rulebook.”

That’s why Garnett is scope-locked on the medical side.

“I do believe that everything previous management built before I got here led us to be successful in this sector, they just did not deploy the different pieces to be able to make it clear to the market. There were 11 people when I got there and they were all at the facility. Let me tell you, our facility was top notch, but we had nobody in marketing, nobody in IR, we had nobody in finance, we had nobody in modeling. You need those types of things in a company. You don’t need hundreds of people but, six months later, here we are with 26 people and it’s starting to get some momentum. We’re creating a strategy that people can get behind.”

I asked Garnett is he thinks there’ll be consolidation this year, rather than next, and he was eagerly in the affirmative.

“I do. I’ve seen it myself. There are a handful of people who are on their last couple of payrolls. Health Canada is not quick and they are very thorough. If you don’t have your license set in order, then you’re not there. I know people who thought they were going to get it a year ago, and they still don’t have it and they’ve built a $40 million facility and they’re carrying debt and they don’t have any revenue. So that we’re actually in revenue of both of our legal lines right now, and about to be in revenue this fall on our third, I think we’re very well positioned.”

To that, Experion carries no debt and has over $10 million in the bank.

“We’re in revenue so our burn isn’t very high,” says the CEO. “It’s not that acquisitions are forward to our strategy, but partnerships with certain people, I think, will help us grow, and partnerships usually lead to acquisitions, or at least amalgamations or different things. So I don’t think we’re done in our partner, amalgamation, acquisition phase because I think we’ll be stronger together than we will be separate. But I’m not building a company to be purchased and I’m not building a company to roll up a bunch of companies; I’m building a very strong, focused company that when the right pieces are available to us that are accretive to our strategy, we’re going to make those decisions.”

Which all sounds great. But the stock price indicates others haven’t got the memo. Yet.

Experion opened the year with news of the EDX purchase, which catapulted the stock to almost a double, but then came a sell-off. The company has had more good news than bad: they’re selling through Broken Coast, they’re supplying a few other LPs, and Open Fields in Saskatchewan.

But every time there’s been good news it’s been followed with a sell-off, which would tell me that there have probably been a lot of guys who have been sitting, waiting for awhile, to get an exit point. When I asked Garnett if he thinks he’s been hamstrung by that churn, he agrees.

“I do, Chris, and I think you’re very insightful because if you didn’t finish the sentence, it was going to be my first sentence,” he says. “The company has had a lot of people who thought they would put a dollar in one side, and they’d get two or more out the other side in a shorter window, and so every time we do get some momentum and some traction behind us, we do get a bit of of a hit.”

“I do think that our volume is a problem. We doing average around 40,000 shares a day on average and our competition steers to around a million, which makes it really difficult to churn through somebody that maybe wants to step out, even as somebody else wants to step in. I’ve had lots of conversations with people with stories, and they’re like, how do I get $3-$5 million into your company because I’m not going to get to bid for two months. So we have to think about those. I think some people have been around for a long time and their patience has thinned. The run up you mentioned before, after the RTO, I think that was a little bit of promotion, maybe a little bit too much of a promotion that the entire sector was doing. It came back down, harder than it should have. When I look at our three closest peers on licenses, size, revenue, all public so I can see all the same information, they’re five times our market cap, and part of that is volume and part of that is nobody knows who the heck we are. They do a much better job of putting themselves out there but we’re also the only one of that peer-set that doesn’t have debt.”

“I do think we’re getting penalized for being the best little company nobody’s ever heard of, and I think it’s just going to take time for us to get there. If you look at my history, I build things. If you’d like me to build something here, I’m more than willing to do it, but we’re going to go to $0.60 and then we’re going to go to $0.70 and then we’re going to go to $0.80. So we’re going to hold at these thresholds and keep moving forward, not run to $16. Sure we’re undervalued, but there’s a way for us to get to where we should be and we have to be honest, maybe some of those other companies shouldn’t be valued as they are.”

But here’s the thing on that: Some of the biggest spikes on the VIR chart over the last few months took the stock from $0.44 to $0.60 over just a few days, with maybe 300k shares traded and a market cap of just $50 million. To me, what that says is, one good day backed with a little news could get that buying into a respectable place and would catapult this thing in a way that would catch up to sanity quickly.

Maybe even get VIR to that place where they have to tell IIROC why it’s running so hard. Perchance to dream..

Either way, last October, it would have cost you $1.04 to buy a share in VIR.

Today it will cost you $0.375.

That’s a haircut for long term investors, to be sure, but it’s also an opportunity for new buyers especially if you believe, like I do, that this turnaround in progress is more likely to succeed than fail.

— Chris Parry

FULL DISCLOSURE: Experion is an Equity.Guru marketing client.

Leave a Reply